See also

11.06.2025 10:56 AM

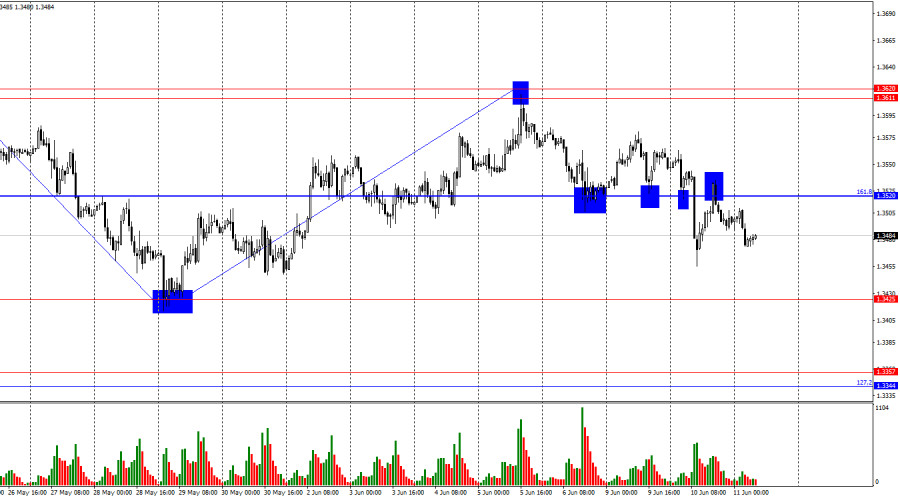

11.06.2025 10:56 AMOn the hourly chart, the GBP/USD pair continued its decline on Tuesday, consolidated below the 161.8% Fibonacci level at 1.3520, and rebounded from it from below. Thus, the decline may continue today toward the next level at 1.3425. A consolidation above 1.3520 would favor the British currency and a resumption of growth toward the resistance zone of 1.3611–1.3620.

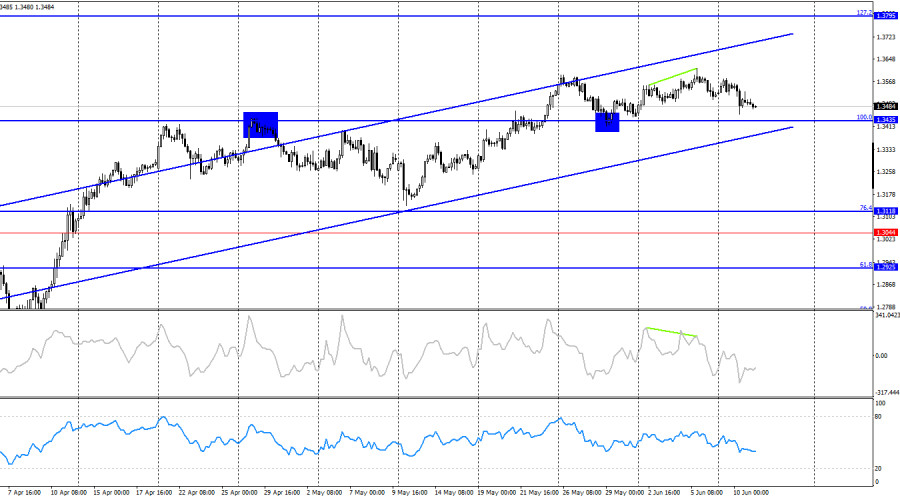

The wave structure clearly indicates that the "bullish" trend remains intact. The last upward wave broke the peak of the previous wave, and the last downward wave did not break the previous low. Bulls will find it difficult to count on further growth without new statements from Donald Trump regarding increased or new import tariffs. However, the U.S. president is ready to raise tariffs, battle immigration, and exert pressure on China. Therefore, bulls do have grounds for new offensives, but new catalysts are needed. A "bearish" trend will only be confirmed if the pair closes below the 1.3425 level.

On Tuesday, the news background supported the bears—something that has been rare in recent months. However, this time, three UK reports simultaneously pointed to selling pressure on the British pound. The unemployment rate rose to 4.6% (in line with traders' expectations), the number of newly unemployed increased by 33,100, and average wages declined. Today, traders await the U.S. inflation report, making it difficult to predict the pair's movement throughout the day—especially in the second half. Everything will depend on the May Consumer Price Index, which traders expect to increase slightly to 2.9% y/y. If inflation rises more sharply, it would validate Jerome Powell's recent warnings about the strong impact of tariffs on the CPI. In that case, the Fed may extend its pause in monetary easing indefinitely. For the dollar, this news may be of little importance since the Fed has not lowered rates at all in 2025, yet traders still avoid buying the U.S. currency.

On the 4-hour chart, the pair consolidated above the 100.0% Fibonacci level at 1.3435 and then rebounded from it from above. The upward movement may resume toward the next Fibonacci level of 127.2% at 1.3795 if there is another rebound from 1.3435. The bullish trend is still unquestioned, but a close below 1.3435 would open the path toward the 76.4% Fibonacci level at 1.3118. A bearish divergence has formed on the CCI indicator, prompting a return to 1.3435. I still do not expect a sharp drop in the pair.

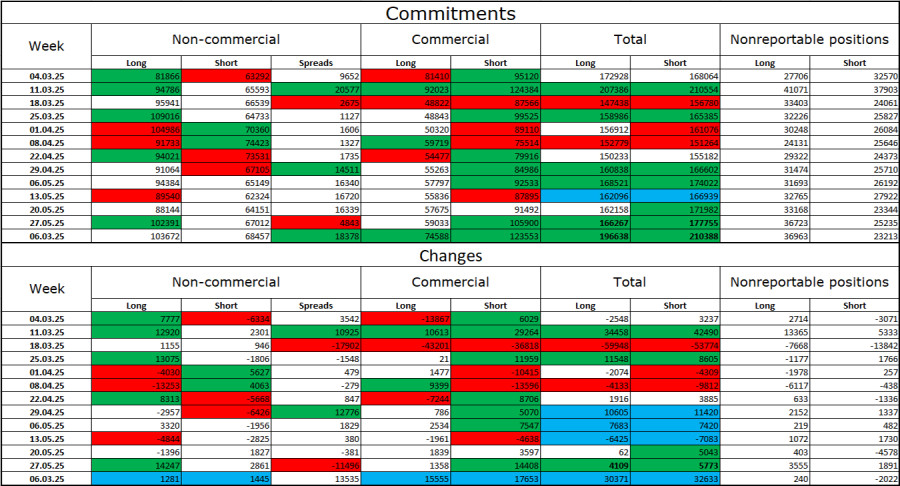

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category did not change over the last reporting week. The number of long positions held by speculators increased by 1,281, while short positions rose by 1,445. Bears have long lost their advantage in the market. The gap between long and short positions stands at 35,000 in favor of the bulls: 103,000 vs. 68,000.

In my view, the pound still has downward potential, but recent developments have shifted the market outlook in the long term. Over the last 3 months, the number of long positions has risen from 65,000 to 103,000, while short positions have declined from 76,000 to 68,000. Under Donald Trump, faith in the dollar has weakened, and COT reports show that traders have little appetite to buy the U.S. currency. Therefore, no matter how the news background appears, the dollar continues to decline amid the ongoing developments surrounding Trump.

Economic Calendar for the U.S. and UK:

On Wednesday, the economic calendar contains only one but significant event. News impact may influence trader sentiment in the second half of the day.

GBP/USD Forecast and Trading Advice:

Selling the pair was possible after a rebound from the 1.3611–1.3620 resistance zone on the hourly chart, with a target at 1.3520. This target has been reached. New short positions were possible after the close below 1.3520, targeting 1.3425 and 1.3357. These trades can currently be held. Buying opportunities will arise upon a rebound from the 1.3425 level or the 1.3357–1.3344 zone.

The Fibonacci grids are constructed from 1.3205–1.2695 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Early in the American session, the XAU/USD is trading around 3,370, below the 21 SMA under bearish pressure. We believe a technical rebound could occur in the coming hours

The outlook remains negative for the euro, as rising oil prices could pressure the European currency. In turn, we could expect EUR/USD to reach the 6/8 Murray level at 1.1230

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

With the movement of the EUR/GBP price on its 4-hour chart moving above the WMA (21) which has a slope that is going upwards and the appearance of convergence between

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.