See also

12.08.2025 10:42 AM

12.08.2025 10:42 AMThe British pound has recovered all of yesterday's losses against the US dollar, maintaining the potential for the bullish trend observed last week to continue.

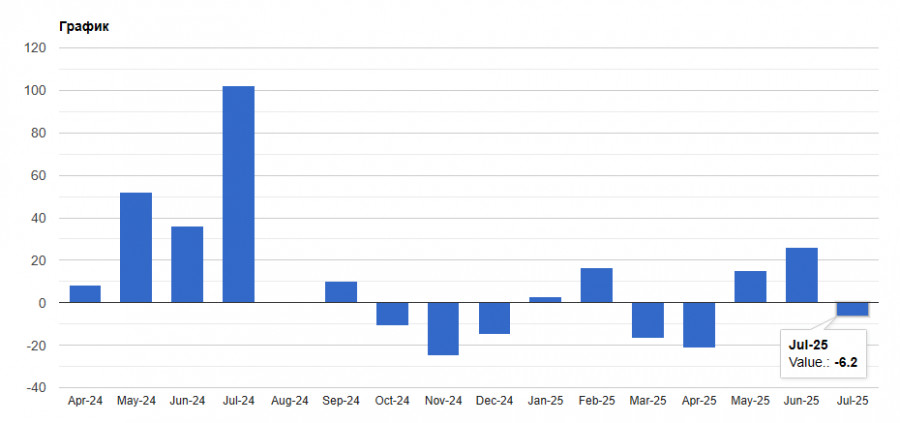

According to the latest data, the worst phase in the UK labor market appears to be over: last month saw a smaller-than-expected decline in employment, suggesting the Bank of England may proceed with rate cuts more actively.

Data from the Office for National Statistics showed that the July reduction of 8,353 employees was the smallest drop since January this year, offering some relief to Chancellor of the Exchequer Rachel Reeves. The July decline was far less than economists' forecast for a 20,000 drop, and previous months' job losses were also revised lower.

The Bank of England is currently weighing whether to prioritize the recent flare-up in inflation or the signs of economic slowdown. The milder labor market deterioration complicates that decision. Upcoming data on Thursday is expected to show a sharp slowdown in second-quarter growth, with GDP rising only 0.1%, which could add further pressure on the central bank.

In its latest report, the Bank of England highlighted labor market weakness and cut rates by a quarter point in a dramatic meeting that required an unprecedented number of votes to reach a decision.

As mentioned earlier, the pound sterling recovered slightly after the data release, climbing to 1.3455. Rate expectations have barely shifted, with traders putting the odds of a November cut at less than 50/50.

As for the unemployment rate, ONS data shows that for the three months to June it remained at a four-year high of 4.7%, while private-sector wage growth excluding bonuses slowed slightly from 4.9% to 4.8%.

Several economists note that substantial revisions to wage data in recent months have shown that Labour's policies have had less impact than initially thought. The report suggested that early indications point to a possible slowdown in the pace of labor market easing, noting that any signs of improvement could shift the balance toward the Bank of England maintaining its current policy in 2025.

From a technical standpoint, buyers of the pound need to break the nearest resistance at 1.3470. Only then will they be able to target 1.3502, above which gains will be more difficult to secure. The furthest upside target is 1.3540. In case of a decline, bears will aim to reclaim control over 1.3400. A break below this range would deal a serious blow to bullish positions and push GBP/USD toward the 1.3375 low, with scope to extend to 1.3350.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.