See also

25.08.2025 01:31 PM

25.08.2025 01:31 PMMarkets shoot first and ask questions later. Following the seemingly "dovish" comments from Jerome Powell at Jackson Hole, the cryptocurrency market was the first to come down from its euphoria. Risk asset enthusiasts seized on the Fed chairman's remarks about adjusting monetary policy. However, the data dependency and the Fed's meeting-to-meeting approach remain in place. As the market reassessed, BTC/USD rode a rollercoaster.

Bitcoin, which not so long ago hit the mainstream, is going through a maturation phase. Token volatility has dropped from 200% to 38%. Investors now perceive this asset more as a store of value due to its natural scarcity. The "risk asset" label is now more appropriate for the second-largest cryptocurrency by market cap—Ethereum. Its volatility remains significantly higher, around 60%.

Volatility trends of Bitcoin and Ether

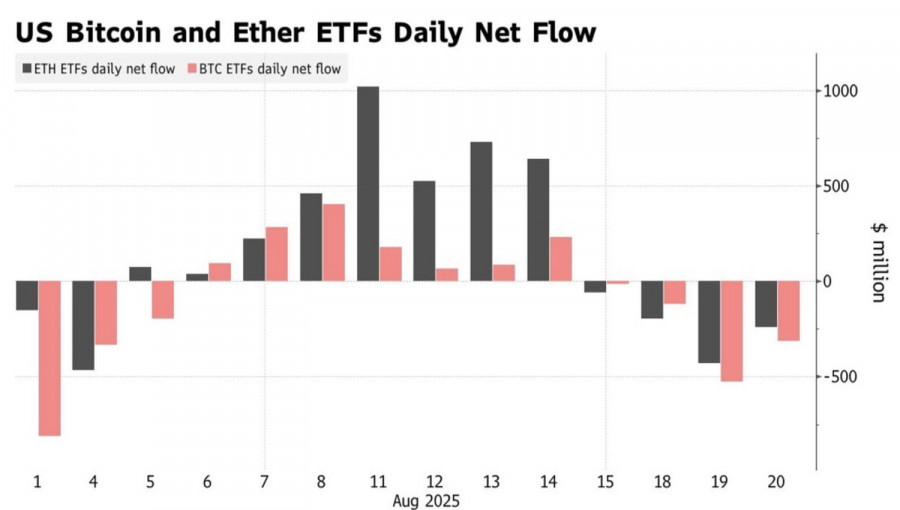

ETH/USD market quotes reached a record high for the first time in four years, driven by demand for the Ethereum blockchain. Its native token Ether is outperforming Bitcoin in 2025, thanks to Congress' passing of the stablecoin act and their mass implementation. In August alone, specialized ETFs focused on Ether saw $2.5 billion in capital inflows. In the same period, Bitcoin ETFs lost $1.3 billion.

This divergent capital flow dynamic shifted ahead of Jackson Hole. Both cryptocurrencies saw outflows from specialized ETFs totaling $1.9 billion during the five days leading up to Jerome Powell's speech to central bankers. All this occurred alongside a similar-duration decline in the S&P 500, amid a worsening global risk appetite. Investors feared hawkish rhetoric from the Fed chairman.

Capital flow trends into Bitcoin and Ether ETFs

In reality, the outcome was even better than the most bullish optimists had expected. The Fed chief not only hinted at monetary policy adjustments in September but also presented a new perspective. Further cooling of the labor market will slow inflation, offsetting the price increases caused by tariffs. In such a scenario, the Fed gets the opportunity to cut rates with its eyes closed. Stock indexes soared, the Dow Jones hit its first record in 2025, and global risk appetite improved—a seeming paradise for Bitcoin.

Unfortunately, the leader of the crypto sector now risks plunging straight into hell. At this stage of digital asset maturity, capital is likely to flow into better-performing assets such as gold, the S&P 500, and even Ether. Portfolio rebalancing becomes a powerful driver for BTC/USD's decline, and helps explain the fund outflows from Bitcoin ETFs.

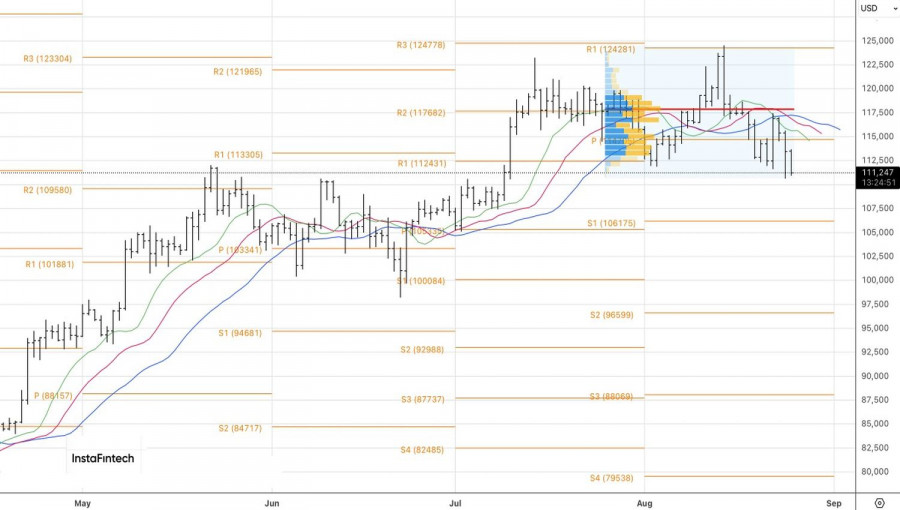

Technically, on the daily BTC/USD chart, a correction to the uptrend is underway, triggered by the realization of a Double Top pattern. Quotes managed to cross the EMA from above—a sign of strong bears, validating the shorts positions opened from 114,750.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.