Lihat juga

30.05.2025 01:49 PM

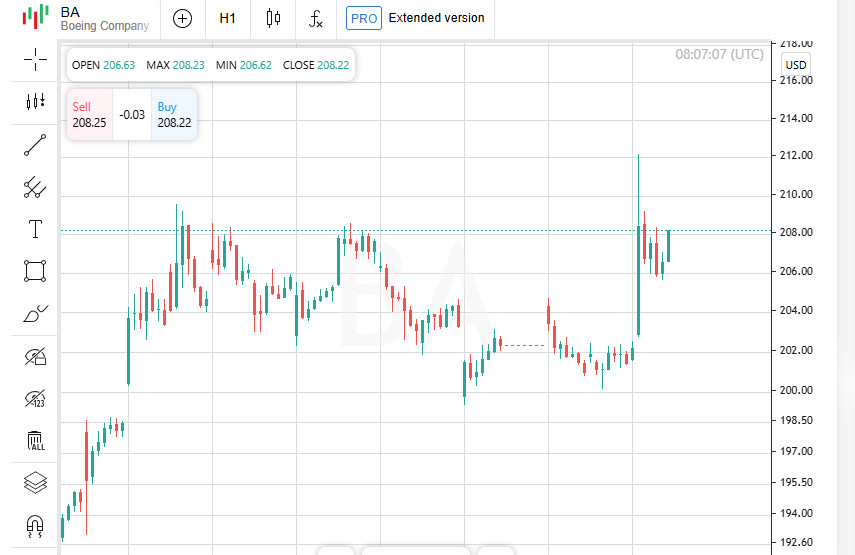

30.05.2025 01:49 PMBest Buy shares fell after the company cut its full-year sales and earnings forecasts. Boeing, on the other hand, gained ground as its CEO announced plans to ramp up production of the 737 MAX. Meanwhile, Japan's Nikkei lagged as the yen strengthened on safe-haven demand.

Index performance: The Dow rose 0.3%, the S&P 500 added 0.4%, and the Nasdaq climbed 0.4%.

.

US equity indices advanced on Thursday, boosted by a sharp rally in Nvidia shares following a robust quarterly earnings report. Against this backdrop, investors also digested a surprise court ruling that reinstated key tariffs imposed by former President Donald Trump.

An appellate court overturned a recent trade court decision that would have suspended the tariffs immediately. The ruling caused volatility throughout the session. Despite early strength, major indices closed well below their intraday highs.

Shares of enterprise software firm Salesforce dropped 3.3%, even after the company raised its revenue and earnings guidance. The decline suggests that positive expectations were already priced in, or that other elements of the report acted as red flags for investors.

Nvidia shares rose 3.2% after the company reported strong demand for its artificial intelligence chips, with buyers racing to place orders ahead of new export restrictions on shipments to China. However, Nvidia warned that those restrictions could result in a sales decline of up to $8 billion this quarter.

With Nvidia's results, the so-called "Magnificent Seven," the leading high-cap tech giants, have now all reported quarterly earnings. Despite the broadly upbeat tone, Nvidia shares are up only 3.6% year-to-date.

US stock indices ended Thursday's session in positive territory, continuing to show resilience despite mixed signals from both the economic and political front.

Trading session recap:

Rising trade tensions, triggered by Donald Trump's April 2 statement announcing plans to impose universal import tariffs, have placed noticeable pressure on markets. Still, the S&P 500 managed to recover following its April correction, supported by easing tensions and unexpectedly strong corporate earnings reports.

The index remains below its February peak, but it is up 0.5% year-to-date, an indication of a cautious return of investor confidence.

Boeing shares climbed 3.3% after CEO Kelly Ortberg announced plans to ramp up production of 737 MAX jets. The company aims to reach a monthly output of 42 planes in the coming months and expand to 47 per month by early 2026. Investors welcomed the update as a sign of stabilization and production growth.

Shares of electronics retailer Best Buy fell 7.3% after the company lowered its full-year guidance. Management warned that new US tariffs could weaken consumer appetite for big-ticket items, a trend already reflected in same-store sales and earnings expectations.

Asian equity markets came under pressure on Friday as investors locked in profits after a volatile week marked by abrupt legal swings in US trade policy. The sell-off coincided with a rally in the Japanese yen, a classic safe-haven asset, dealing a sharp blow to the export-heavy Nikkei 225, which pulled back after nearly a 2% gain the previous day.

Japan's Nikkei fell 1.1% in response to the yen's rapid appreciation. The currency climbed 2% from recent lows, reaching 143.45 per dollar. A stronger yen erodes exporters' competitiveness and diminishes the value of overseas revenues, triggering the index's retreat.

On Friday, losses extended across other Asian markets:

S&P 500 futures dipped 0.1%, following Thursday's rally driven by Nvidia's strong earnings report, a reaction already priced in across Asia. Eurozone STOXX 50 futures also posted modest losses.

The US 10-year Treasury yield held steady at 4.42%, after falling 5.5 basis points the day before.

Global oil prices slipped slightly:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Harga minyak mentah turun, mundur dari level tertinggi beberapa bulan setelah Iran membalas Saham Wall Street ditutup lebih tinggi, saham Eropa jatuh Dolar naik terhadap yen, turun terhadap franc; euro

S&P 500 dan indeks acuan lainnya memulai minggu perdagangan baru dengan momentum positif, didukung oleh indikator teknikal. Kenaikan ini mengikuti sinyal kuat dari Marlin oscillator, memperkuat ekspektasi bahwa indeks akan

Serangan AS terhadap Iran menimbulkan kekhawatiran tentang minyak dan pembalasan S&P 500 mendekati level tertinggi Februari tetapi menunjukkan tanda-tanda stagnasi Kenaikan harga minyak menimbulkan kekhawatiran tentang inflasi, kebijakan Fed Investor

Para investor tetap berhati-hati di tengah meningkatnya ketegangan di Timur Tengah, menunggu kemungkinan pembalasan dari Iran. Meskipun reaksi pasar sejauh ini masih tenang, eskalasi konflik lebih lanjut dapat memicu lonjakan

Pasar Saham Asia Menguat pada Jumat Harga minyak mendekati puncak 4,5 bulan akibat kekhawatiran gangguan pasokan Dolar tetap menguat berkat permintaan aset safe haven meskipun sinyal dari The Fed beragam

Ketegangan di pasar saham AS meningkat seiring dengan intensifikasi konflik antara Israel dan Iran. Para analis memperingatkan bahwa potensi perang skala penuh dapat memicu penurunan 20% pada S&P 500. Skenario

Saat ini, cryptocurrency unggulan Bitcoin sedang berusaha untuk mencapai titik tertinggi baru, tetapi masih menghadapi berbagai hambatan di sepanjang jalan. Tantangan terbaru datang dari pertempuran yang sedang berlangsung antara bull

Indeks ekuitas AS mengakhiri sesi Jumat dengan penurunan karena ketegangan yang meningkat antara Israel dan Iran mendorong harga minyak lebih tinggi dan memicu ketidakpastian pasar. S&P 500 turun sebesar 1,13%

Terlepas dari kenaikan S&P 500 yang sedang berlangsung, investor tetap tertarik pada saham, sebagian besar mengabaikan risiko yang meningkat dan ketidakstabilan dalam ekonomi global. Kepercayaan ini didorong oleh harapan akan

Pasar saham AS mengakhiri sesi dengan lebih rendah setelah AS dan Tiongkok menyepakati perjanjian dagang yang sangat dinantikan. Meskipun ada latar belakang berita positif, para investor mulai mengunci keuntungan dari

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.