यह भी देखें

29.09.2025 09:07 AM

29.09.2025 09:07 AMGold prices have climbed to a new all-time high of around $3,800 per ounce amid dollar weakness, as investors grew nervous about the potential shutdown of the U.S. government.

Bullion rose 1.4% to an all-time high of $3,814 per ounce, surpassing last Tuesday's record after six consecutive weeks of gains. Silver jumped 2.4%, while platinum and palladium also posted significant increases, supported by persistent market tensions and inflows into exchange-traded funds backed by these metals.

Strong physical demand from central banks — particularly in emerging markets — has also been an important factor behind gold's rally. Diversification of foreign reserves into gold is seen as a safeguard against fluctuations in the dollar and other currency risks, helping to sustain elevated gold prices despite broader market volatility.

The dollar fell as investors anticipated negative developments ahead of a scheduled Monday meeting between senior U.S. congressional leaders and President Donald Trump — just one day before federal government funding is set to expire. Failure to reach a deal on a short-term spending bill could trigger a shutdown, threatening the release of key economic data, including Friday's closely watched employment report, which economists expect will show weak job growth in September. A weaker dollar typically makes precious metals cheaper for international buyers.

Disappointing labor market data would further strengthen the case for another Fed rate cut at its October policy meeting — a scenario that would make gold even more attractive. However, uncertainty remains high regarding the Fed's rate-cutting cycle, as policymakers last week voiced diverging views on monetary policy.

As Barclays Plc recently noted, precious metals do not appear overvalued relative to the dollar and U.S. Treasuries, which should reflect some degree of Fed-related risk premium, especially given the potential threat to the central bank's independence.

Gold has surged 45% this year, reaching record levels driven by strong demand from central banks and renewed expectations of Fed rate cuts. Prices are now on track to complete a third consecutive quarterly gain. Inflows into precious metals-backed ETFs have already reached their highest level since 2022. Major banks, including Goldman Sachs Group Inc. and Deutsche Bank AG, have stated they expect the rally to continue.

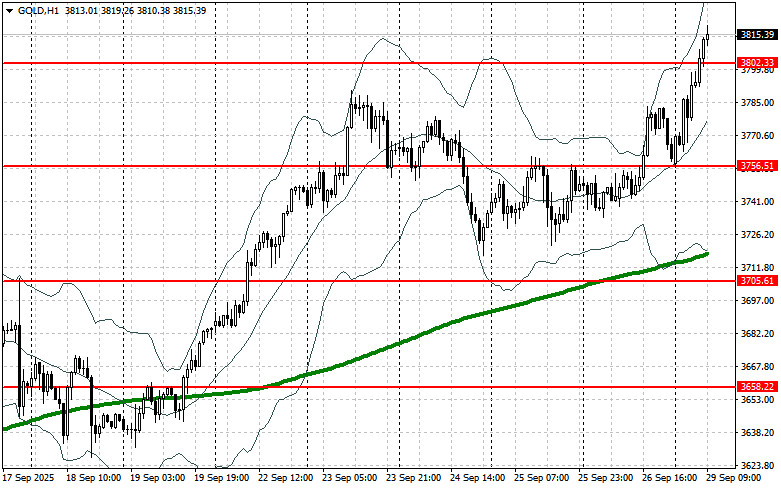

For buyers, the immediate resistance lies at $3,802. A breakout above this level would open the way toward $3,849, though overcoming it could prove challenging. The furthest bullish target is seen at $3,906.

In case of a pullback, bears will attempt to regain control at $3,756. A break below this level could deal a serious blow to bullish positions and pull gold down toward $3,705, with the potential to extend losses to $3,658.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |