यह भी देखें

10.11.2025 12:06 PM

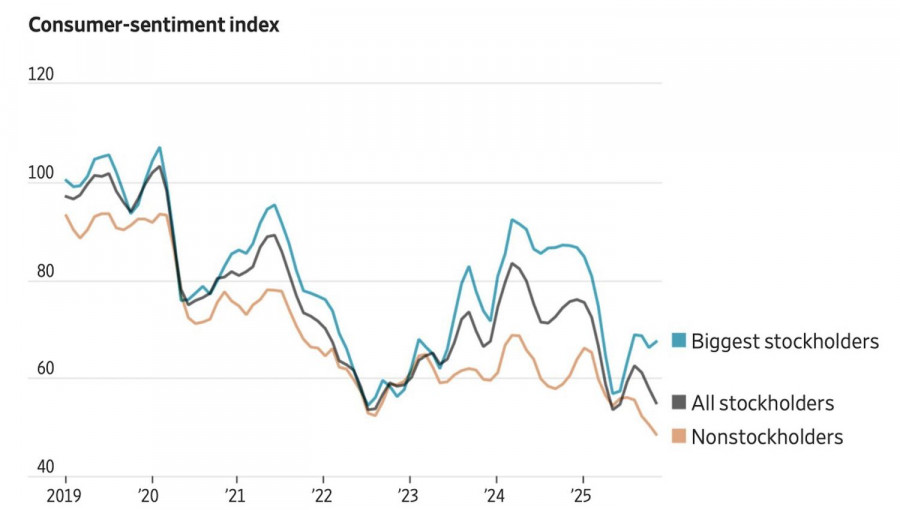

10.11.2025 12:06 PMThe wealth effect. When the stock market rises, Americans who own equities feel great. They spend more, stimulating the economy. Conversely, a drop in the S&P 500 dampens investor sentiment. Spending goes down, GDP growth slows. In this regard, the broad stock index's break from its three-week winning streak is a troubling sign.

Consumer sentiment is shifting The US stock market has reached a turning point. While Goldman Sachs insists that the balance of risks still favors the "bulls," the Federal Reserve's expected monetary easing, the cyclical upswing in US GDP growth, and the boom in artificial intelligence investment remain powerful drivers of the S&P 500 rally. The bank's confidence is admirable, yet one worrying signal cannot be ignored.

Previously, the broad market index shrugged off negative news, and even the slightest bit of good news was enough to push it higher. Now, the opposite is true. The largest wave of layoffs since 2003 sent the S&P 500 tumbling, while private-sector job growth reported by ADP was ignored. Investors are now paying more attention to the Fed's "hawks" than its "doves."

The same applies to the corporate earnings season. Of the 446 companies that reported third-quarter results, 80% beat earnings estimates — the best performance since spring 2021. However, instead of extending its rally, the S&P 500 slipped into a correction. Some analysts believe that, as the first results came in, forecasts for the rest of the companies were revised upward. As a result, actual earnings came close to the adjusted expectations, triggering the classic "buy the rumor, sell the news" reaction.

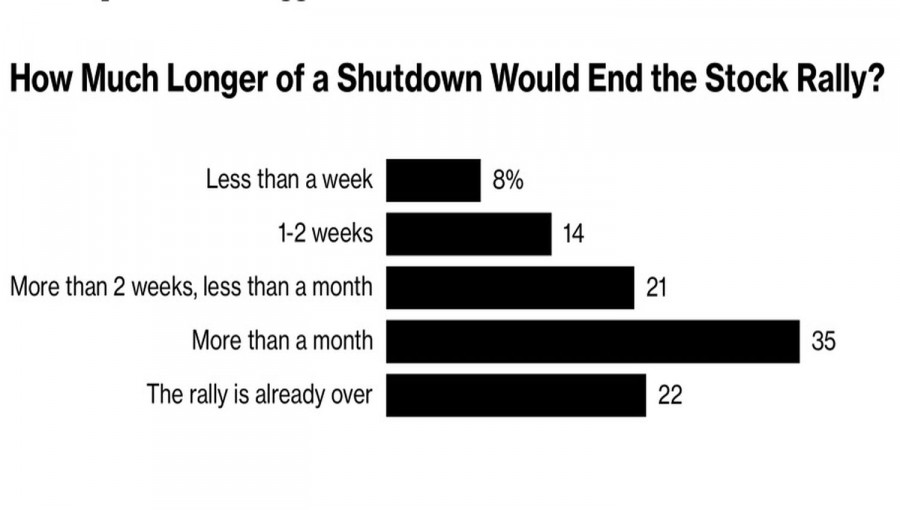

The shutdown factor The government shutdown also contributed to the S&P 500's decline. According to presidential economic adviser Kevin Hassett, a shutdown could cut fourth-quarter GDP growth in half, from the expected 3% to 1.5%. In a Markets Pulse survey, 14% of 121 investors said that if the government doesn't reopen within a week, the S&P 500's record streak will end; 22% believe it already has.

The S&P 500 is expected to end its rally amid the shutdown

Thus, the US economy and stock market are closely intertwined. The S&P 500's pullback reflects investor doubts about America's bright future. Conversely, slower GDP growth — partly due to the shutdown — reinforces the case for a correction in the broad stock index.

In this context, positive news from Congress could breathe new life into US equities. The Senate voted 60 to 40 to end the government shutdown. Now, the decision rests with the House of Representatives.

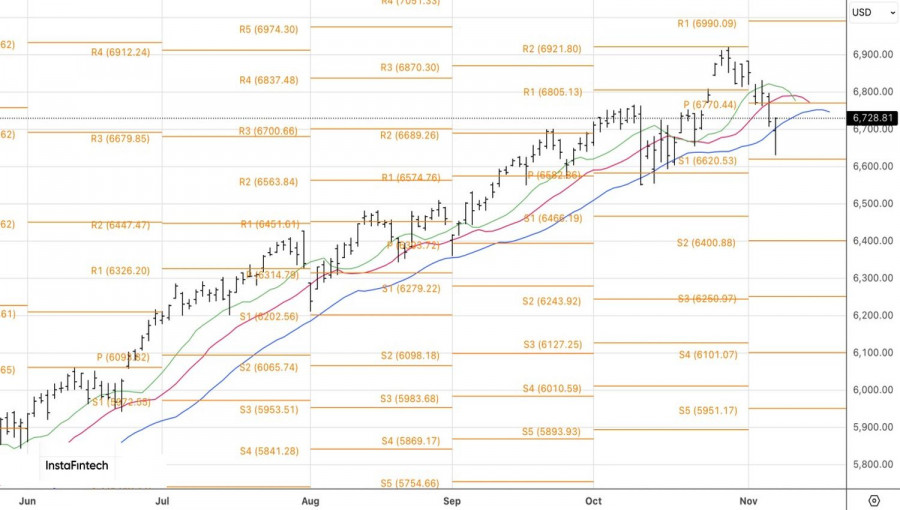

Technical outlook On the daily chart, the S&P 500 has formed a candlestick with a long lower shadow — a sign of weakening bearish momentum. A breakout and consolidation above 6,731 would provide a signal to buy the broad stock index.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |