spot.ETHQID ( vs ). Exchange rate and online charts.

Currency converter

15 Aug 2025 18:34

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

See Also

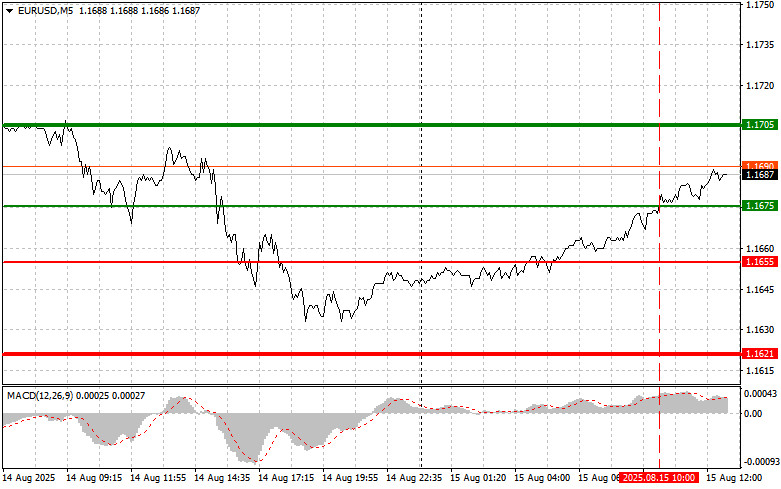

- EUR/USD: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)

Author: Jakub Novak

13:33 2025-08-15 UTC+2

1183

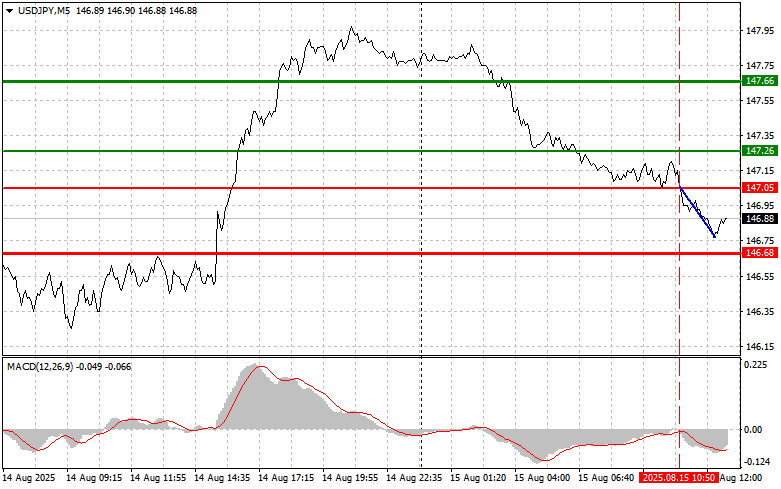

USD/JPY: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)Author: Jakub Novak

13:42 2025-08-15 UTC+2

1018

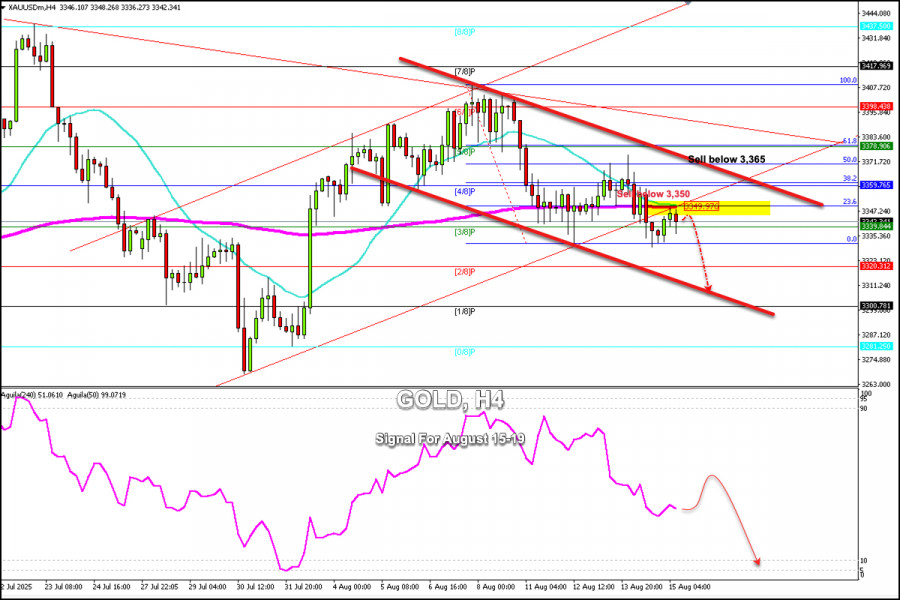

Technical analysisTrading Signals for GOLD for August 15-19, 2025: sell below $3,365 (200 EMA - 21 SMA)

If gold consolidates below the 200EMA at 3,350 in the coming hours, any technical rebound will be seen as a signal to sell, with targets at 2/8 of the Murray at 3,320, and could even reach 0/8 of the Murray around 3,281.Author: Dimitrios Zappas

14:54 2025-08-15 UTC+2

988

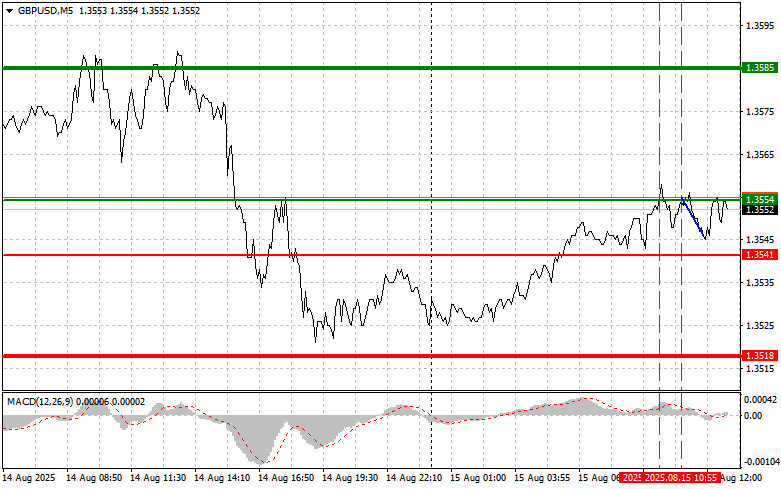

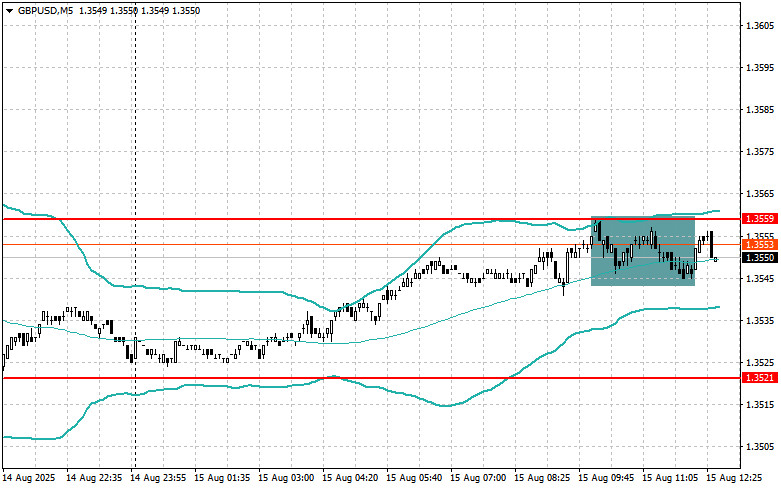

- GBP/USD: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)

Author: Jakub Novak

13:39 2025-08-15 UTC+2

988

Technical analysisTrading Signals for BITCOIN for August 15-19, 2025: sell below $120,000 (6/8 Murray - 21 SMA)

If Bitcoin consolidates above the 6/8 Murray level at 118,750, which has now become key support, in the coming hours, we could expect it to reach $120,000, a level that coincides with the 21-SMA and could be seen as a signal to sell.Author: Dimitrios Zappas

14:52 2025-08-15 UTC+2

973

On Thursday, the pair moved downward, tested the 85.4% retracement level at 1.3522 (red dotted line), and closed the daily candle at 1.3526. Today, the pair may start moving upward. Significant calendar news is expected.Author: Stefan Doll

11:33 2025-08-15 UTC+2

958

- Adjustment of Levels and Targets for the U.S. Session on August 15th

Author: Miroslaw Bawulski

13:18 2025-08-15 UTC+2

943

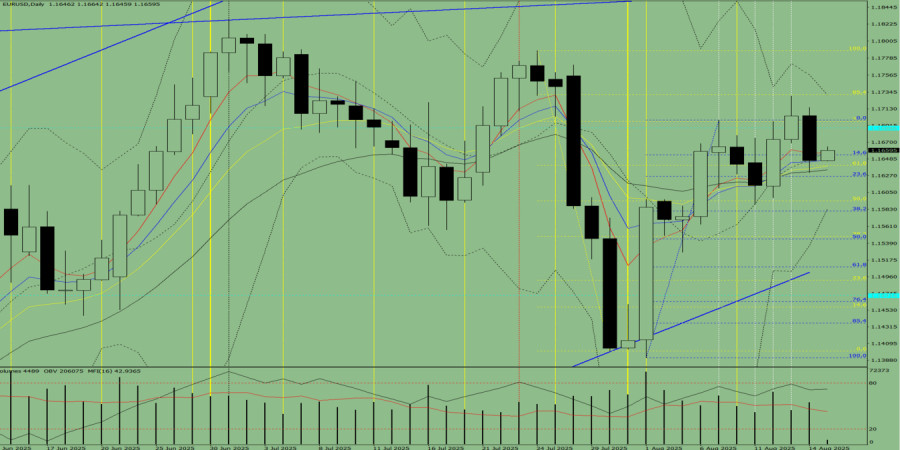

On Thursday, the pair moved down, tested the 21-period EMA at 1.1632 (thin black line), and then moved upward, closing the daily candle at 1.1646. Today, the pair may begin an upward move. Significant calendar news is expected.Author: Stefan Doll

11:25 2025-08-15 UTC+2

913

USD/JPY. Analysis, Forecast, and Current Market SituationAuthor: Irina Yanina

13:55 2025-08-15 UTC+2

898

- EUR/USD: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)

Author: Jakub Novak

13:33 2025-08-15 UTC+2

1183

- USD/JPY: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)

Author: Jakub Novak

13:42 2025-08-15 UTC+2

1018

- Technical analysis

Trading Signals for GOLD for August 15-19, 2025: sell below $3,365 (200 EMA - 21 SMA)

If gold consolidates below the 200EMA at 3,350 in the coming hours, any technical rebound will be seen as a signal to sell, with targets at 2/8 of the Murray at 3,320, and could even reach 0/8 of the Murray around 3,281.Author: Dimitrios Zappas

14:54 2025-08-15 UTC+2

988

- GBP/USD: Simple Trading Tips for Beginner Traders for August 15th (U.S. Session)

Author: Jakub Novak

13:39 2025-08-15 UTC+2

988

- Technical analysis

Trading Signals for BITCOIN for August 15-19, 2025: sell below $120,000 (6/8 Murray - 21 SMA)

If Bitcoin consolidates above the 6/8 Murray level at 118,750, which has now become key support, in the coming hours, we could expect it to reach $120,000, a level that coincides with the 21-SMA and could be seen as a signal to sell.Author: Dimitrios Zappas

14:52 2025-08-15 UTC+2

973

- On Thursday, the pair moved downward, tested the 85.4% retracement level at 1.3522 (red dotted line), and closed the daily candle at 1.3526. Today, the pair may start moving upward. Significant calendar news is expected.

Author: Stefan Doll

11:33 2025-08-15 UTC+2

958

- Adjustment of Levels and Targets for the U.S. Session on August 15th

Author: Miroslaw Bawulski

13:18 2025-08-15 UTC+2

943

- On Thursday, the pair moved down, tested the 21-period EMA at 1.1632 (thin black line), and then moved upward, closing the daily candle at 1.1646. Today, the pair may begin an upward move. Significant calendar news is expected.

Author: Stefan Doll

11:25 2025-08-15 UTC+2

913

- USD/JPY. Analysis, Forecast, and Current Market Situation

Author: Irina Yanina

13:55 2025-08-15 UTC+2

898