Lihat juga

27.06.2025 11:58 AM

27.06.2025 11:58 AMThe S&P 500 rose by 0.80%, while the Nasdaq 100 added 0.97%. The Dow Jones Industrial Average climbed by 0.84%.

Stocks gained amid talks that the US is getting closer to trade agreements with China and other major trading partners, including India. Expectations of interest rate cuts by the Federal Reserve this year also increased, especially after yesterday's weak US GDP report.

Europe's Stoxx Europe 600 index rose 0.6% after Friday's data showed that French inflation remained significantly below the European Central Bank's 2% target. S&P 500 futures grew 0.3% after the index hit a new all-time high.

Market euphoria is fueled by hopes of a swift resolution to trade disputes that have weighed on the global economy in recent months. Reaching agreements with China and other key partners could boost international trade, strengthen supply chains, and improve business confidence. At the same time, weak macroeconomic data from the US, especially the disappointing GDP report, has led investors to expect a more dovish monetary policy from the Federal Reserve. Interest rate cuts typically support equities by making borrowing cheaper for companies and increasing the appeal of risk assets.

However, it's important to remember that trade negotiations are complex and unpredictable. Similarly, a decision to cut rates rests solely with the Federal Reserve and will depend on further economic data. Investors should remain cautious and consider both positive and negative potential scenarios.

US Commerce Secretary Howard Lutnick stated that the US and China have reached an agreement, though no details have been provided yet.

This week, a series of Fed officials made it clear that they would need a few more months to gain confidence that tariff-driven price increases won't lead to sustained inflation. Economists believe that today's core Personal Consumption Expenditures (PCE) index — which excludes food and energy — will show the lowest reading in the past three months. Clearly, the market is in a state of euphoria, hoping that inflation is cooling and that the Fed will be able to begin cutting rates soon. A soft PCE reading could reinforce those expectations.

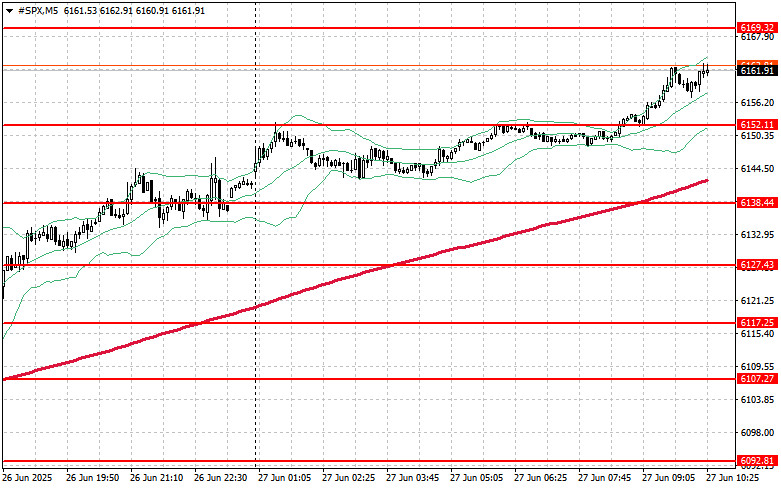

Technical outlook for S&P 500

Today, the key task for buyers will be to break through the nearest resistance level at 6,169. Achieving this would support further gains and open the path to a move toward 6,185.

Equally important for the bulls is to establish control above the 6,200 level, which would further strengthen the buyers' position.

If the market moves lower due to a decline in risk appetite, buyers must step in around the 6,152 area. A break below this level would quickly push the instrument back to 6,138 and potentially open the door to a decline toward 6,127.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.