Lihat juga

05.11.2025 12:48 AM

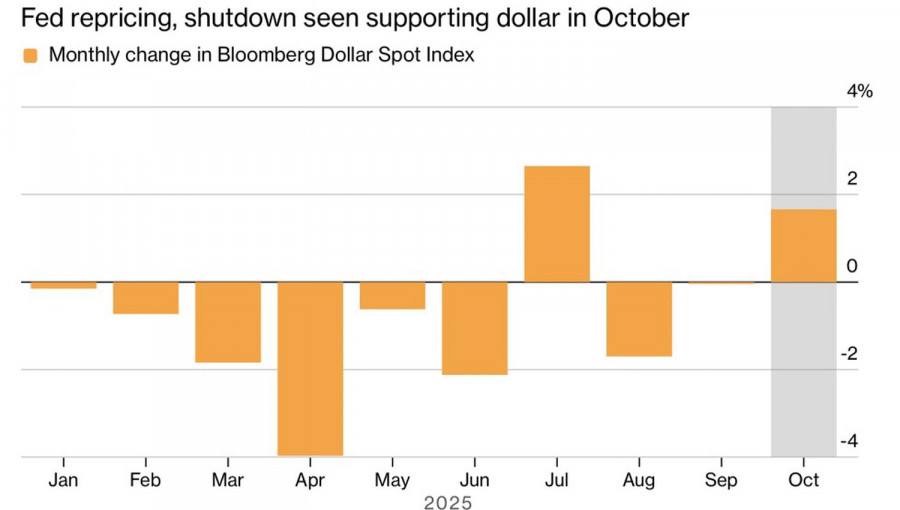

05.11.2025 12:48 AMRarely but significantly. The US dollar has risen in only two months of the year out of ten—July and October. However, this has been enough to recover a substantial portion of losses against major global currencies since the beginning of the year. Many of the advantages for EUR/USD have already been priced in, and by the end of 2025, the euro is likely to hinder rather than help, as it did previously.

The three main drivers of the USD index's decline in 2025 are expectations of a rate cut in federal funds, undermining of confidence in the US dollar due to Donald Trump's criticisms of the Fed, and hedging currency risks by non-residents investing in US securities.

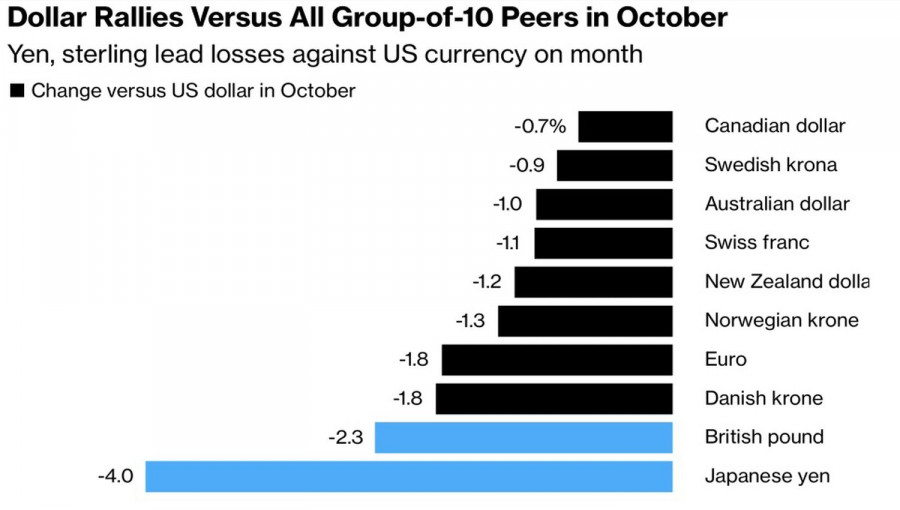

Nevertheless, Credit Agricole notes a rise in liquidity premiums in the US money market. This increases demand for the dollar. At the same time, hedging costs are rising. Foreign investors are foregoing currency risk insurance. The greenback is strengthening, often simultaneously with US stock indices. Interest in it has surged amid declining demand for the yen and the euro, which seems logical given the change in leadership in Japan and the political crisis in France.

The yen has become the absolute underperformer among G10 currencies, as fiscal dominance has shifted from the United States to Japan. While Donald Trump demanded that the Fed lower the federal funds rate to 1% in the first half of the year, by the end of 2025, everything had changed. The US president has other problems. His visit to Asia diverted attention from the Fed.

Conversely, "Takaichi trading" is thriving in Japan. The new Prime Minister has previously stated that raising the overnight rate under current conditions is foolish. Even though the head of government now asks to forget those words, there is no smoke without fire. Investors are shedding the yen, driving USD/JPY values upwards rapidly.

Politics also plays a role in Europe. In France, socialists dominate. They first forced the president and prime minister duo to postpone pension reform, then demanded an increase in the tax on the wealthy. Finally, they are now dictating the budget composition. One can't help but recall the story of the fisherman and the fish. Is it too much to ask for?

In any case, the political landscape makes the yen and euro vulnerable. Investors have few alternatives under such conditions. The pound is falling amid concerns that the Treasury won't close the budget gap, and the Australian dollar is declining amid the Reserve Bank's reluctance to signal an end to the monetary easing cycle.

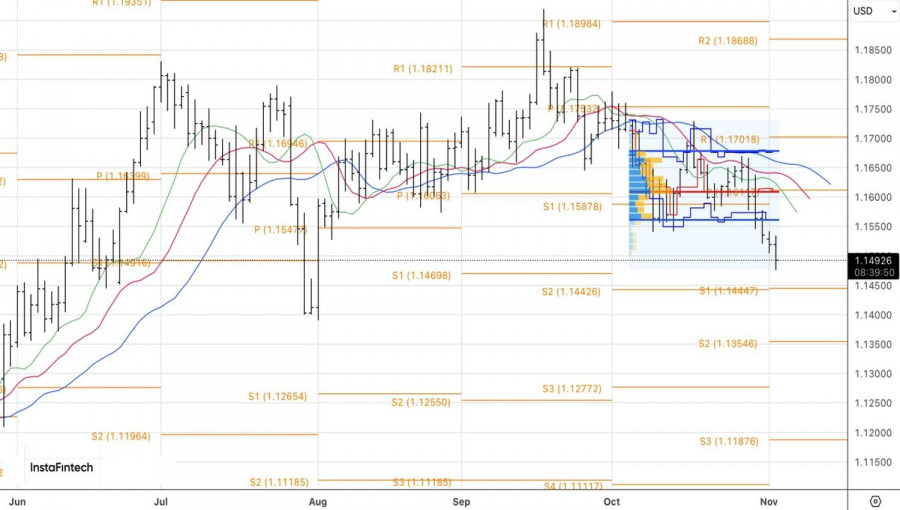

Technically, the daily chart of EUR/USD continues its corrective movement toward the upward trend. Short positions on the euro against the US dollar formed on the bounce from 1.1615 should be held and periodically increased. Target marks include 1.1350 and 1.1270.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.