Veja também

26.05.2025 03:18 PM

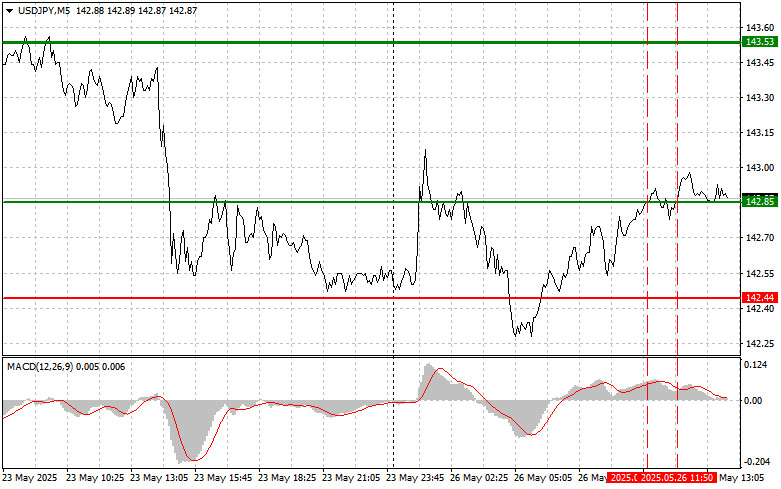

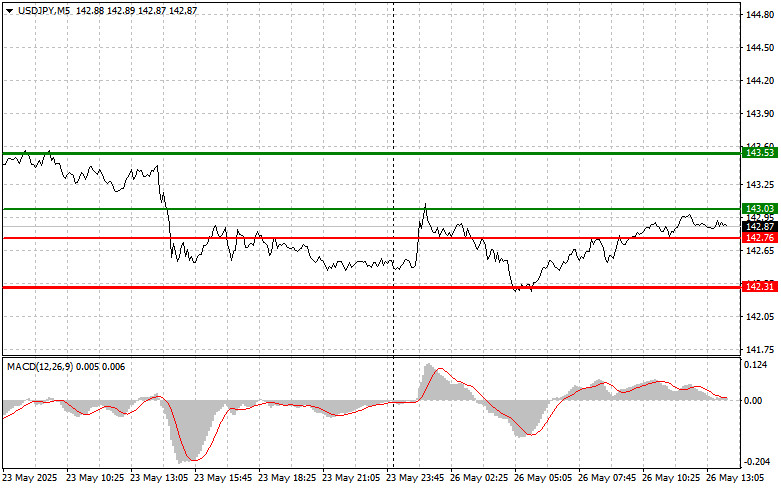

26.05.2025 03:18 PMThe test of the 142.85 level occurred when the MACD indicator had already moved far above the zero line, limiting the pair's upward potential. For this reason, I did not buy the dollar. A second test of 142.85 shortly afterward triggered Scenario #2 for a short position, but no meaningful drop followed.

The positive data on Japan's Leading Economic Index quickly lost momentum, which negatively affected the yen's bullish trend against the dollar. Investors, briefly encouraged by the prospects of a stronger Japanese currency, were once again faced with the reality of Japan's macroeconomic uncertainty. The initial optimism fueled by expectations of a more aggressive monetary stance from the Bank of Japan faded amid persistent doubts about the durability of Japan's economic growth. Short-term spikes in positive data, like the released index, were not enough to support the yen's upward movement.

Today, with no major U.S. statistics scheduled during the U.S. session, the focus will shift to Trump's statements and potential speeches from FOMC members, although none are currently on the calendar. Therefore, strong volatility in USD/JPY is unlikely.

For today's intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY upon reaching the entry point at 143.03 (green line on the chart) with a target of 143.53 (thicker green line on the chart). At 143.53, I will exit long positions and open short positions in the opposite direction (anticipating a 30–35 point pullback). A strong upward movement in the pair is unlikely today.Important: Before entering a long position, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 142.76 level while the MACD is in the oversold zone. This should limit the downward potential and lead to a reversal upward. Expect a move toward 143.03 and 143.53.

Sell Signal

Scenario #1: I plan to sell USD/JPY once the price breaks below 142.76 (red line on the chart), expecting a quick drop. The key target will be 142.31, where I'll exit shorts and possibly reverse into longs (expecting a 20–25 point bounce). However, significant downward pressure is unlikely today. Important: Before selling, ensure the MACD is below the zero line and just beginning to fall.

Scenario #2: I also plan to sell USD/JPY in case of two consecutive tests of 143.03, while MACD is in the overbought zone. This setup will likely trigger a reversal downward. Expect a move toward 142.76 and 142.31.

Chart Key:

Important Note for Beginners:

New Forex traders should exercise caution when entering the market. It's best to stay out of the market ahead of major economic releases to avoid sharp price swings. If you decide to trade during such periods, always use stop-loss orders to minimize losses. Trading without stop-losses can quickly deplete your account, especially if you're not practicing money management and trading with large volumes.

Remember: For successful trading, it is essential to have a clear and structured trading plan, like the one outlined above. Spontaneous trading decisions based on current market fluctuations are inherently a losing strategy for intraday traders.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das operações e recomendações para negociar o euro O teste do nível 1,1713 ocorreu quando o indicador MACD já havia se movido de forma significativa acima da linha zero

Análise comercial e dicas de negociação para o euro O teste de preço em 1,1690 ocorreu justamente quando o indicador MACD começava a subir a partir da linha zero, confirmando

Análise das negociações e dicas para negciar a libra esterlina Um teste de preço em 1,3608 na primeira metade do dia coincidiu com o indicador MACD já tendo se movido

Análise das operações e orientações para negociar o iene japonês Um teste de preço em 144,97 ocorreu quando o MACD já estava muito acima da linha zero, o que impediu

Análise das operações e dicas para negociar o iene japonês Devido à baixa volatilidade, os níveis que indiquei não foram testados na primeira metade do dia. Dados os dados

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.