Vea también

02.05.2025 09:14 AM

02.05.2025 09:14 AMOnly a few macroeconomic events are scheduled for Friday, but some are quite significant. Naturally, the focus is on the U.S. NonFarm Payrolls and unemployment rate, yet it's also important to note that all previous U.S. reports this week have disappointed.

Therefore, two conclusions follow:

The Consumer Price Index will be published in the Eurozone, but it carries virtually no market significance. First, it's only the second estimate for April. Second, inflation in the EU is near the target level, so it no longer has much influence on market sentiment.

There is nothing of fundamental importance to discuss besides Trump's trade war, although that war appears to be on pause for now. The dollar's decline can continue for as long as Trump introduces new tariffs or raises existing ones. Any escalation could trigger a new leg down for the dollar. Any de-escalation would support the dollar.

The U.S. president has softened his tone toward China, but that has not yet de-escalated the situation. And knowing Trump, we wouldn't be surprised if he raises tariffs again soon.

Trump is well aware that further tariff hikes could cripple the U.S. economy, so in the near term, we probably won't see another escalation. At the same time, there are no trade deal talks with China, meaning the "145%–125%" tariff range remains in effect. We already saw on Wednesday how the U.S. economy is reacting to Trump's trade policy.

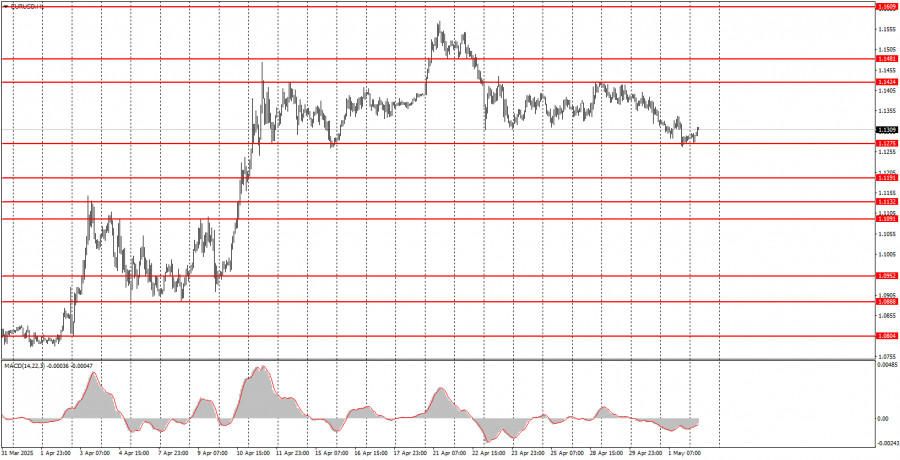

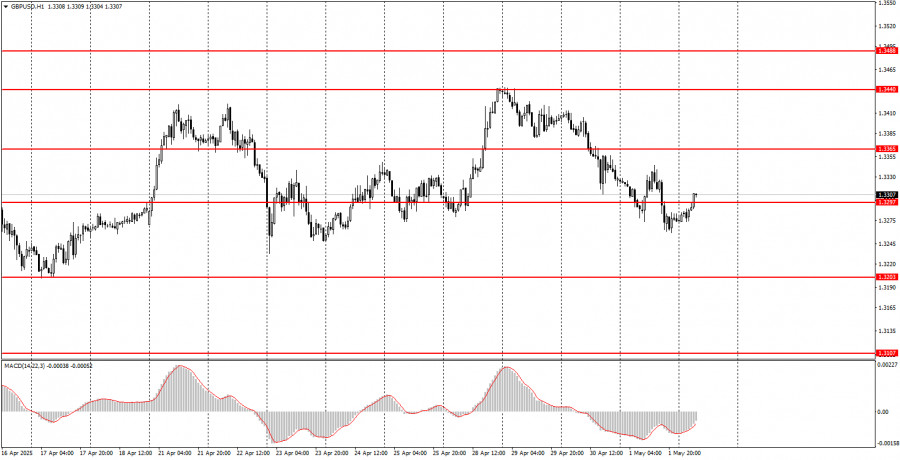

On the week's final trading day, both currency pairs may move in either direction. The euro may remain range-bound, so a rebound from the 1.1275 level could trigger a new upward wave. The British pound still shows much more willingness to rise, although it has declined for three days in a row.

With a 90% probability, the macroeconomic backdrop will not impact trader sentiment. However, if traders decide to react to today's data, the likelihood of a dollar sell-off is very high.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Note for Beginner Forex Traders: Not every trade can be profitable. Developing a clear strategy and sound money management is key to long-term success in trading.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.