Vea también

05.05.2025 12:51 AM

05.05.2025 12:51 AMThe hit parade of American news and events will continue. I still believe that the most significant factor in the market is Donald Trump's decisions. It's enough to compare the price movements of both instruments during periods when Trump actively imposed tariffs versus periods when he remained silent to understand just how important this news is for the market. Last week only reinforced this observation, as all the key U.S. reports triggered completely inconsistent reactions. This leads to the conclusion that there was effectively no reaction at all — the market was trading in accordance with Trump's silence. The U.S. dollar slightly improved its position, but not significantly.

In the new week, the U.S. will see the release of the ISM Services PMI and the Federal Reserve meeting. The FOMC, led by Jerome Powell, still awaits tangible economic changes. One such change was seen this week — GDP growth slowed by 0.3% in Q1 on a quarterly basis, a result not expected even by pessimists. However, I believe this won't prompt the Fed to act quickly, as the labor market has shown reasonably strong results, and the unemployment rate in April did not rise. Therefore, the Fed's only "headache" at this stage is economic growth — which is now absent.

I believe that monetary policy easing will only resume if unemployment begins to rise and Nonfarm Payrolls decline. The faster these two developments occur, the greater the likelihood of rate cuts. But inflation should not be forgotten either. If inflation continues to rise alongside those two trends, the Fed may remain silent. Practically, no one expects a rate cut next week. Therefore, while the overall situation won't worsen for the dollar, that offers little comfort under current conditions.

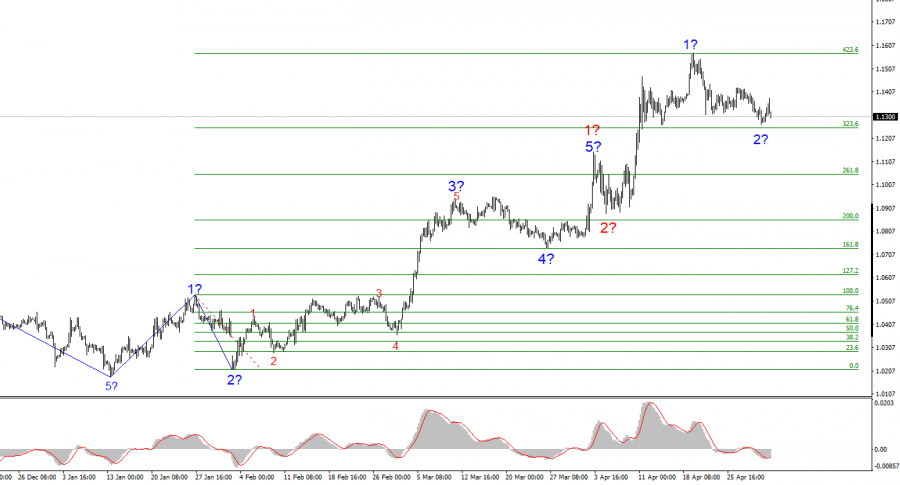

Based on my analysis of EUR/USD, I conclude that the pair is continuing to build a new bullish wave segment. Soon, the wave count will depend entirely on the stance and actions of the U.S. President. This must always be kept in mind. From a purely wave-based perspective, I had expected a three-wave correction within wave 2. However, wave 2 has already ended in a single-wave form. Wave 3 of the upward trend has begun, and its targets could extend to the 1.25 area. Reaching these levels will depend entirely on Trump. A corrective wave may form at the moment, but growth is expected to resume once it is complete.

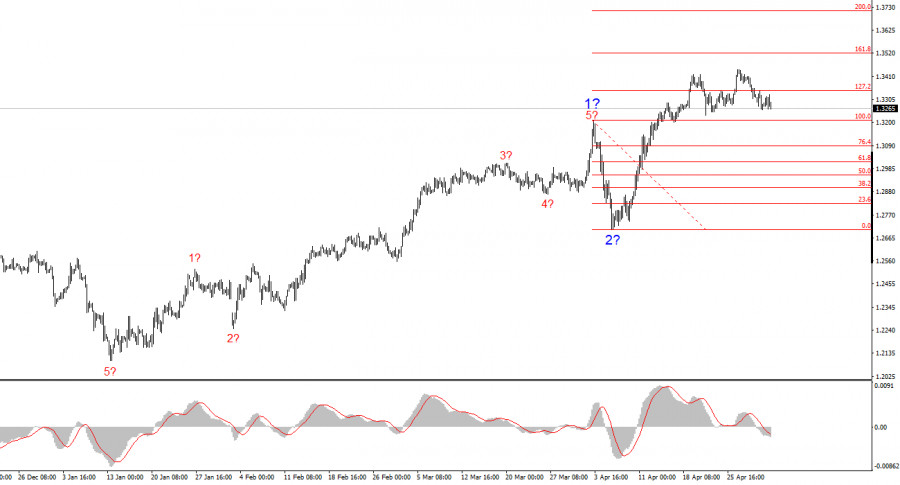

The wave structure of GBP/USD has shifted. We are now dealing with a bullish, impulsive trend segment. Unfortunately, under Donald Trump, markets may experience numerous shocks and reversals that defy wave theory and any other form of technical analysis. The presumed wave 2 has been completed, as the price has moved beyond the peak of wave 1. Therefore, we should expect the formation of bullish wave 3, with short-term targets at 1.3541 and 1.3714. It would be helpful to see a corrective wave 2 within wave 3, but the dollar would need to strengthen. And for that to happen, someone would have to start buying it.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Indicador de

patrones gráficos.

¡Note cosas

que nunca notará!

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.