Vea también

14.05.2025 06:11 AM

14.05.2025 06:11 AMOn Tuesday, the GBP/USD pair experienced significant growth, despite no clear catalyst behind it. On Monday, the dollar rose on specific grounds, but on Tuesday it fell for no apparent reason, simply because it's the dollar. As it turned out, even a reduction in global trade tensions is not enough to support the U.S. currency, despite earlier expectations for further dollar strengthening. The U.S. inflation report, showing a 2.3% increase instead of the forecasted 2.4%, ultimately pushed the dollar down.

Now, the market expects the Federal Reserve to resume its monetary easing cycle, despite Jerome Powell stating last week that the Fed should wait until at least summer to assess the impact of Trump's tariffs on the economy. Powell also noted that inflation could accelerate in 2025, so any rate cuts should be approached cautiously to avoid having to raise them again later. We tend to agree with Powell. However, the market has its own opinion.

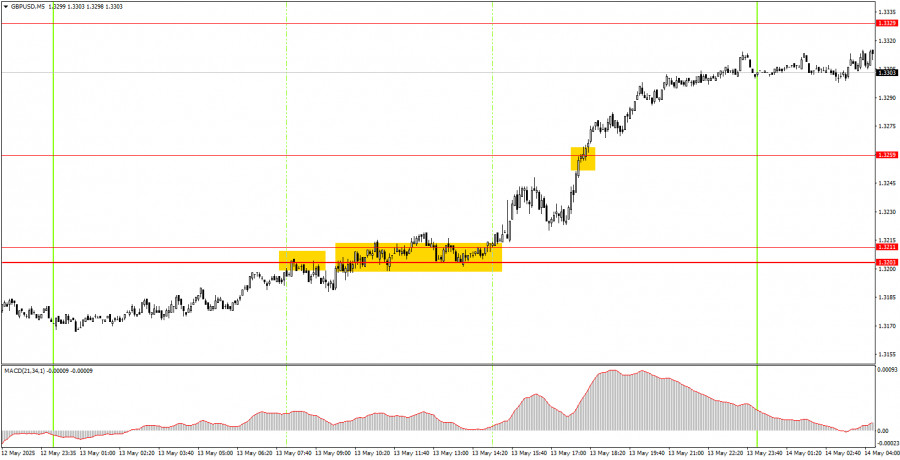

Three trading signals were formed on Tuesday on the 5-minute timeframe. Initially, the pair bounced off the 1.3203–1.3211 area, but that sell signal was false. Later, the price broke through this area, allowing for long positions to be opened. During the U.S. session, the 1.3259 level was also broken, and the price moved up another 40 pips. In summary, Thursday's dollar decline was understandable, but the market had consistently overlooked dollar-positive macroeconomic data before this event.

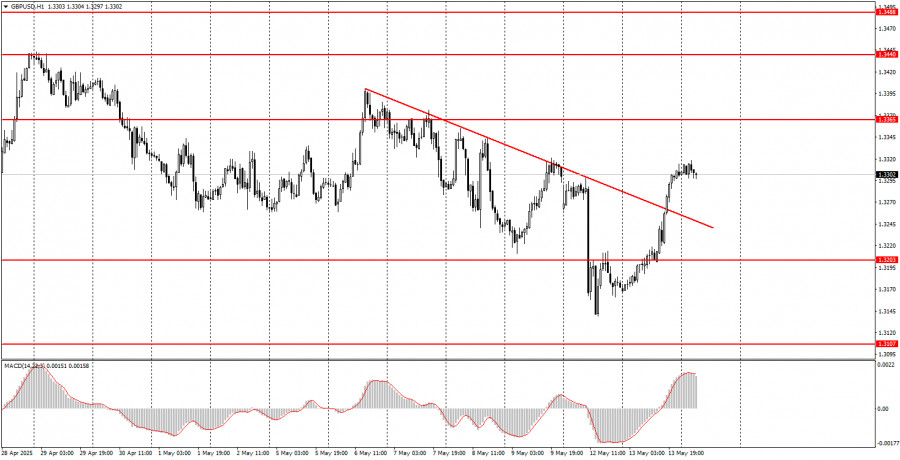

On the hourly timeframe, GBP/USD continues to react primarily to news involving Donald Trump and remains skeptical of his policies. Even the signing of a trade deal between the U.S. and the UK benefits the dollar, not the pound, as the dollar fell in response to any tariff or sanction-related news. Theoretically, the dollar should now be recovering on any news of de-escalation in the trade war, but we still see the market reluctant to support the greenback.

On Wednesday, the GBP/USD pair is projected to trade on technical factors, indicating that it may move in either direction.

On the 5-minute TF, it is now possible to trade at 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3203-1.3211, 1.3259, 1.3329, 1.3365, 1.3421-1.3440, 1.3488, 1.3537, 1.3580-1.3598. No important events and reports are scheduled for Wednesday in the UK and US, so the movements today are likely to be non-trending and not strong.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

GBP/USD: plan para la sesión europea del 9 de mayo. Informes COT (Commitment of Traders, análisis de las operaciones de ayer). La libra se desplomó tras la bajada de tasas

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.1269

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel 1.3335

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel 1.1379

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.3282

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.1320

GBP/USD: plan para la sesión europea del 30 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra se prepara para un nuevo salto, pero

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió allí. En mi pronóstico de a mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.3342

Ayer no se formaron puntos de entrada al mercado. Propongo echar un vistazo al gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico matutino, presté atención

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.