Vea también

05.06.2025 12:38 AM

05.06.2025 12:38 AMWhen there is no unity among allies, things don't go smoothly. Following mutual accusations between the U.S. and China, Donald Trump commented that Xi Jinping is a very tough man and it is difficult to strike a deal. The trade war between the world's two largest economies is about to return to center stage — the very trade war that sent EUR/USD soaring in late April to its highest level since autumn 2021.

One reason for the escalating tension is a mutual misunderstanding of the terms of the Swiss-brokered agreement. Another is China's resilience to tariffs. Trump sees China as his main adversary and expects tariffs to significantly slow the rival's GDP growth—especially since the blow is being delivered not only by the U.S. but also by persuading other countries to act.

One of Washington's demands in trade negotiations with other countries is to jointly oppose China. For instance, the European Union plans to restrict China's access to its medical equipment procurement market.

Brussels is yielding on some issues but refuses to do so on others. The EU has expressed outrage over Trump's decision to double tariffs on steel and aluminum from 25% to 50%. According to the EU, this will be a serious obstacle to reaching a final agreement.

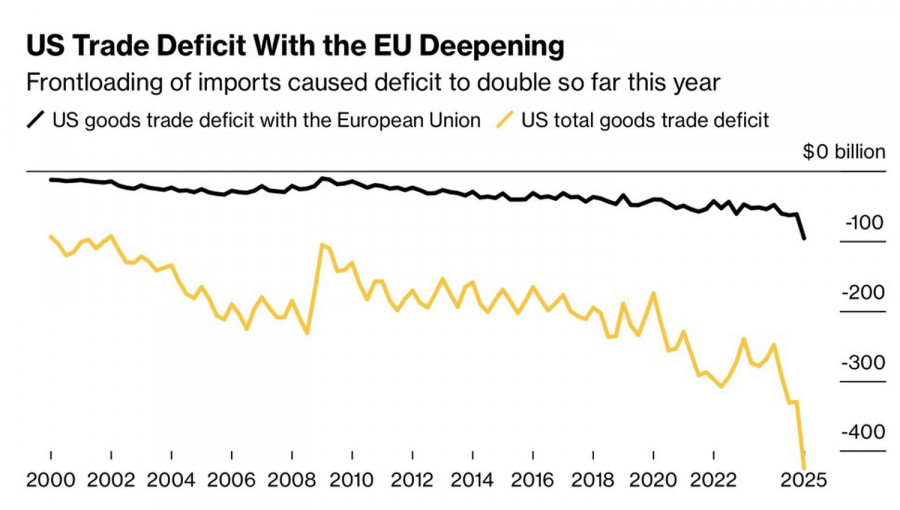

It seems the U.S. will have to wage a trade war against two powerful adversaries simultaneously — plus its own legal system. It's no wonder investors are fleeing the U.S. swiftly, creating pressure on the dollar.

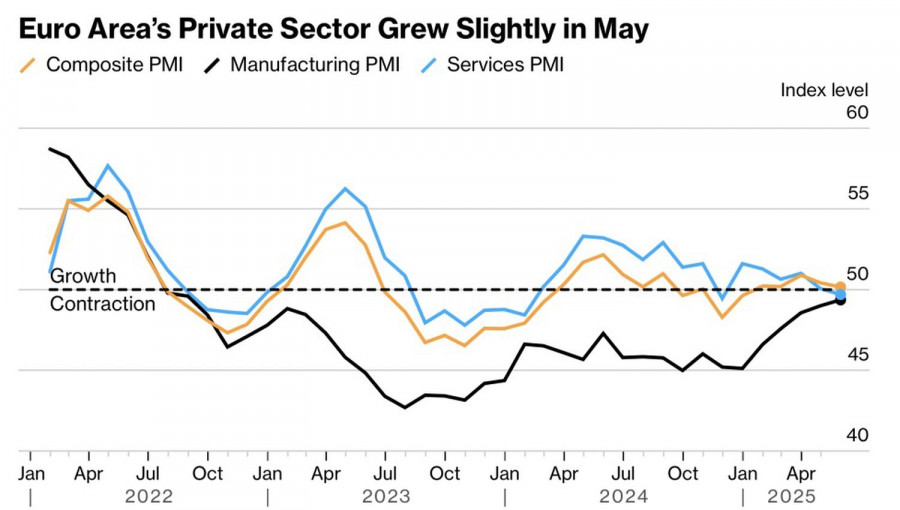

Meanwhile, Europe shows resilience to tariffs. Final readings showed that the eurozone composite PMI for May stayed above the critical 50 mark. GDP will likely continue expanding, which is good news for EUR/USD.

There are challenges ahead, notably the political crisis in the Netherlands and the slowdown of European inflation, which has fallen below the 2% target. Consumer price dynamics will be a strong argument for the "doves" at the European Central Bank's June meeting. The deposit rate is expected to fall to 2%. Slower CPI growth could prompt Christine Lagarde to signal the continuation of monetary expansion soon.

Nevertheless, when monetary and fiscal stimuli are seen as lifebuoys for economies drowning in the ocean of trade wars, monetary policy easing no longer leads to panic in EUR/USD. The more significant event on the economic calendar for the euro-dollar pair appears to be the U.S. nonfarm payrolls report for May.

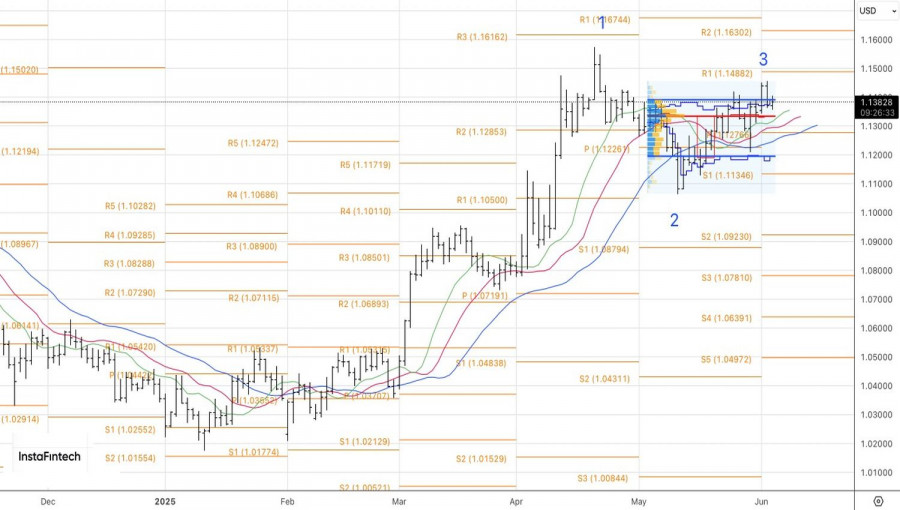

On the daily chart, EUR/USD bulls are trying to push the pair beyond the fair value range of 1.119–1.1395. If they succeed, the chances of a renewed uptrend will increase. Long positions formed from the 1.12–1.122 area could be expanded.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.