Vea también

14.08.2025 09:40 AM

14.08.2025 09:40 AMGold prices rose for the third straight day as expectations for Federal Reserve interest rate cuts increased after Treasury Secretary Scott Bessent urged the U.S. central bank to lower borrowing costs.

The rally in gold, traditionally viewed as a safe-haven asset, is a natural investor reaction to growing uncertainty over the outlook for the global economy. Yesterday's call by the Treasury Secretary for lower interest rates further fueled such sentiment, reinforcing expectations of a more accommodative monetary policy from the Fed. The arguments in favor of a rate cut are likely based on concerns about slowing economic growth. Lower interest rates can stimulate investment and consumer spending, supporting economic activity. However, they may also lead to higher inflation and a weaker national currency, creating a dilemma for the Fed.

The Fed's decision on the future course of monetary policy will have a significant impact on gold. If the central bank does indeed move to cut rates, gold is likely to continue climbing as investors seek alternative assets to protect against inflation and currency depreciation. Conversely, if the Fed opts to keep rates unchanged, gold prices could face a downward correction.

Gold reached around 3,370 dollars per ounce after Treasury yields fell on Wednesday. Scott Bessent suggested that the Fed's benchmark rate should be at least 1.5 percentage points lower than its current level.

The rise in bets on monetary easing marks a shift from last month, when markets at one point priced the probability of a September rate cut at less than 50%. The current consensus forecast calls for a quarter-point cut next month, with some expecting a more substantial reduction.

This year, gold has gained 28%, with most of that growth occurring in the first four months. The rally has been driven by increased geopolitical and trade tensions, which boosted demand for safe-haven assets, while central bank purchases also contributed to its strengthening.

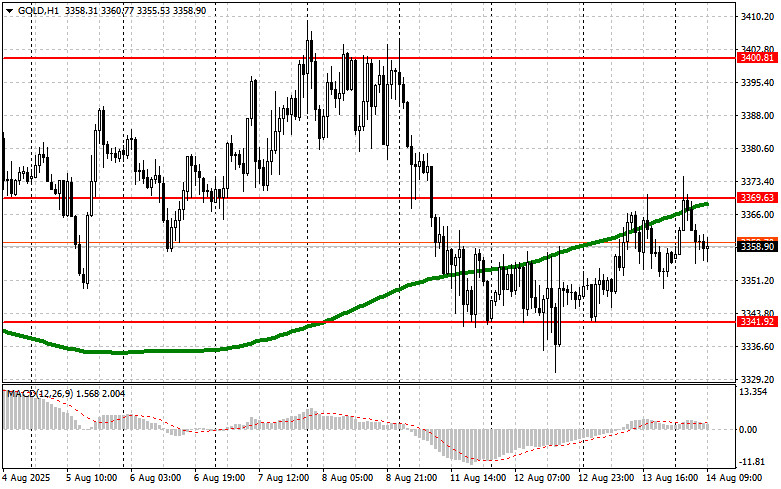

Current Gold Technical Outlook Buyers need to reclaim the nearest resistance at 3,370. This would allow them to target 3,400, a level that will be challenging to surpass. The most distant target stands at the 3,440 level. In the event of a decline, bears will attempt to regain control over 3,341. If successful, a break below this range would deal a serious blow to bullish positions and push gold down to the 3,313 low, with the potential to reach 3,291.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.