আরও দেখুন

30.07.2025 01:14 AM

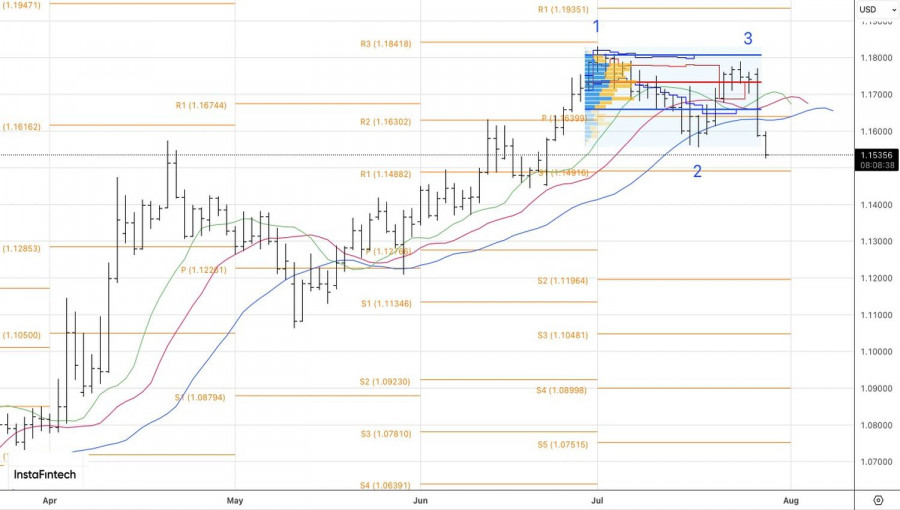

30.07.2025 01:14 AMTo be or to appear? The sharp EUR/USD rally to nearly four-year highs in early July may have looked like the eurozone's confidence in a bright future. A strong economy means a strong currency—this principle of fundamental analysis remains valid. Not even a trade war with the U.S. seemed to scare euro bulls. Yes, the EU has a significant surplus in goods trade, but a deficit in services trade placed both sides on more equal footing. In reality, Brussels suffered a resounding defeat at the hands of Washington, and the regional currency collapsed. It turned out to be a colossus with feet of clay.

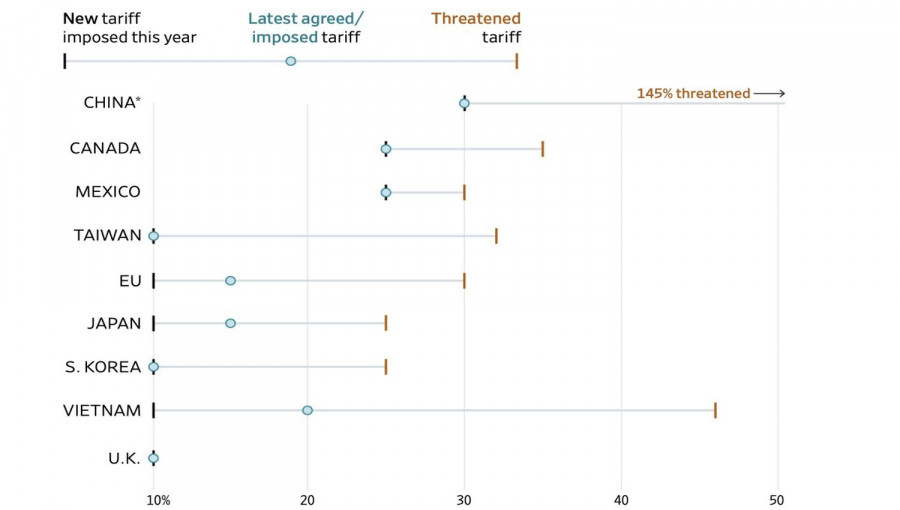

While Germany and France speak of an unequivocal defeat following the White House's imposition of 15% tariffs against the EU, other countries argue otherwise—claiming Brussels had no choice and that the situation could have been much worse. A large-scale trade war would have brought not just a recession. The eurozone, heavily reliant on U.S. LNG supplies, would have had no alternative sources. The EU could have found itself without U.S. military support. Much was at stake. Now the euro is paying the price through the collapse of EUR/USD.

According to Credit Agricole, the U.S.–EU trade deal could have given short-term support to EUR/USD by reducing uncertainty and bolstering eurozone exports, expecting tariff relief. However, the medium- and long-term outlooks favor the U.S. dollar more than the euro. Lower tariffs reduce the risk of imported inflation in the U.S. The inflow of foreign direct investment increases demand for the greenback. Finally, the improvement in net exports could reverse the contraction in U.S. GDP seen in the first quarter.

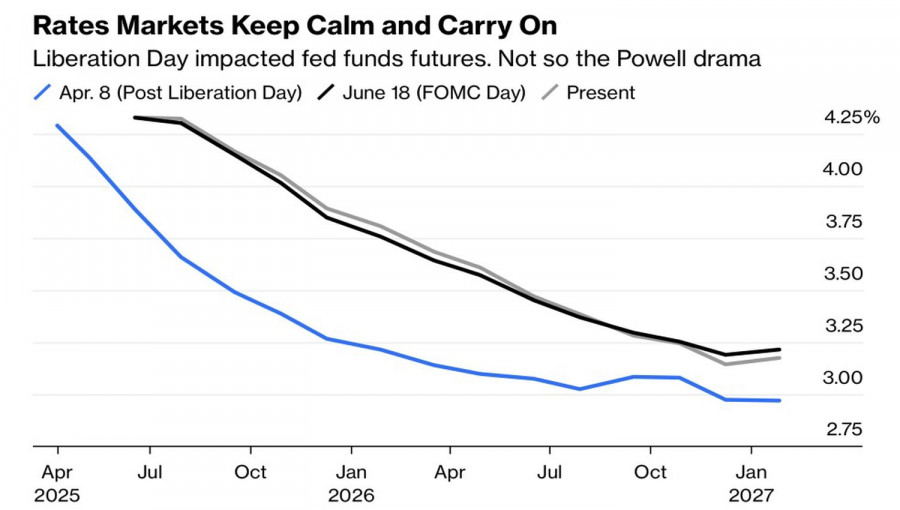

Indeed, in June, the U.S. goods trade deficit fell by 10.8% to $86 billion. This was primarily due to a 4.2% drop in imports to $264.2 billion. Exports declined only 0.6%. The U.S. external trade balance is stabilizing—exactly what Donald Trump and his team have been aiming for. Luck is on the side of the U.S. administration. The only thing left is to push the Federal Reserve to lower interest rates—and that's proving to be a major hurdle.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।