আরও দেখুন

09.09.2025 10:04 AM

09.09.2025 10:04 AMThe US dollar is under heavy pressure, as yet another set of extremely weak labor market data has led to a revision of Fed rate forecasts—now, it's expected that the rate will be cut three times before year-end. There are also growing concerns about whether the Fed can maintain its independence, as Trump is actively trying to reshape the Board of Governors to secure decisions from the Fed that align with his new economic policy.

It goes without saying that if the Fed starts doing what Trump wants, this would automatically mean a sharp rise in the risk of losing control over inflation. The Fed is attempting to preserve financial stability even in the face of a looming recession, while Trump is seeking to accelerate economic growth despite the threat of inflation. Clearly, these are fundamentally opposing goals, and the fate of the dollar will largely be determined by who prevails in this standoff.

In this regard, special attention will be paid to Thursday's US consumer inflation data for August, which will ultimately establish expectations for the Fed rate and send the dollar either up or down.

The pound has few reasons to rise against the dollar. The UK is preparing for the review of the autumn budget; the NIESR forecast is disappointing— the government needs to proceed under the assumption that GDP growth in the coming years will be lower than the budget office projects, while inflation and unemployment will be higher. Accordingly, more spending on social programs will be needed, leading to increased borrowing. The autumn budget will require both tax increases and simultaneous spending cuts to restore fiscal discipline. In such conditions, an influx of investment and stock market growth will be difficult, which will negatively affect demand for the pound.

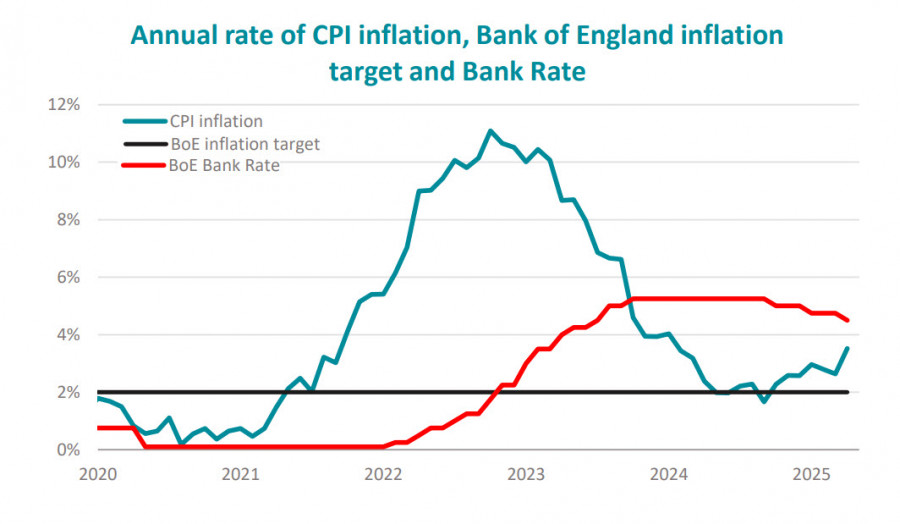

Inflation will remain above target for a long time, so the Bank of England will most likely keep the rate unchanged until year-end or cut it by no more than 25 basis points. A high rate gives the pound a certain yield advantage, but will restrain GDP growth and thus growth of the budget's revenue side.

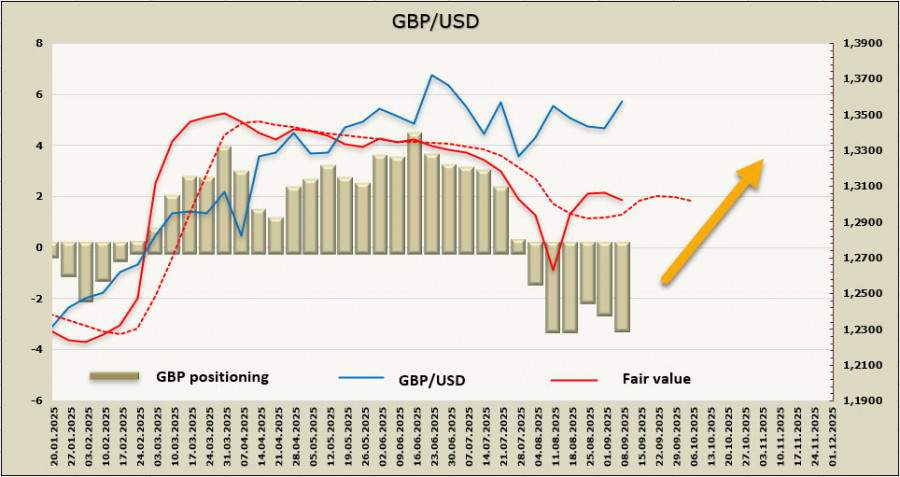

The net short position on the pound increased by $133 million over the reporting week to -$2.77 billion. Positioning is bearish, the fair price is above the long-term average, and the short-term impulse is bullish.

In the previous review, we assumed the pound's consolidation would end with a test of support at 1.3310/30, but due to the apparent weakness of the dollar, this forecast did not pan out. The nearest resistance is 1.3580/95; if it does not hold, the pound will try to develop further success toward 1.3787. Support has shifted to 1.3370/90, but something very unexpected would have to occur for investors to return to buying dollars. The sharp rise in gold prices suggests a surge in panic about the robustness of the entire dollar-based financial system.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।