আরও দেখুন

06.11.2025 12:51 AM

06.11.2025 12:51 AMAfter the Bank of Canada (BoC) cut the interest rate by a quarter point and expectations for the Federal Reserve's rate policy became more hawkish, a further weakening of the Canadian dollar became nearly certain. The accompanying statement from the BoC indicated that the Bank is satisfied with the current interest rate level, which reduces the likelihood of further cuts.

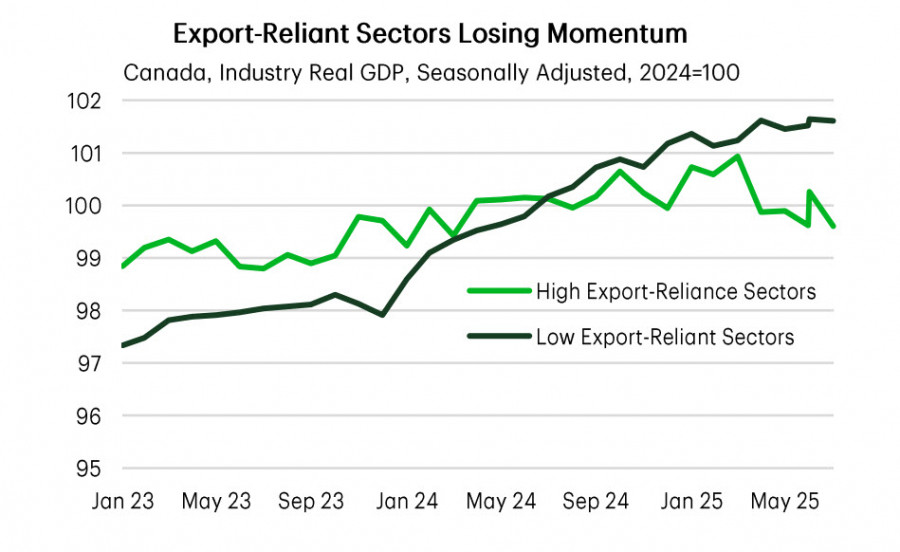

Now all attention is focused on how the government under Prime Minister Carney intends to lead the country out of the structural crisis. The long-awaited budget has been published in its first reading, and its direction looks far from optimistic for the Canadian dollar. Hundreds of revenue-boosting measures scattered across various sectors and demographics have disappeared, replaced instead by a focus on management efficiency and a reduction in operational spending on infrastructure, defense, and housing construction, while simultaneously supporting business investments. All of this is being done out of necessity, as the realignment of trade with the U.S. has led to structural issues in the economy, heavily reliant on access to the U.S. market, causing sectors to lose momentum while competing with those oriented toward the domestic market.

The budget deficit for this year is at its highest level since 1996, except for the 2008/09 period and the COVID-19 period. A total of nearly $141 billion in new spending is included in the budget, indicating that the deficit will continue to grow, which will require an increase in government debt even after some subsidizing programs are cut.

Forecasts indicate that real GDP growth in 2025/26 will be lower, the deficit will be higher, all amid a trade war. While it is currently unclear how successful Carney's government will be in implementing its program, one thing is clear: GDP will be lower, and government debt will grow faster. The economy will go through a challenging phase, which means interest rates will likely be lower rather than higher. Consequently, yields will likely be lower rather than higher, and the Canadian dollar's exchange rate is expected to be lower rather than higher.

The market reacted accordingly to the budget publication, and there are no reasons to think that anything will change in the near term. The Canadian dollar faces additional pressure, which will push USD/CAD upward.

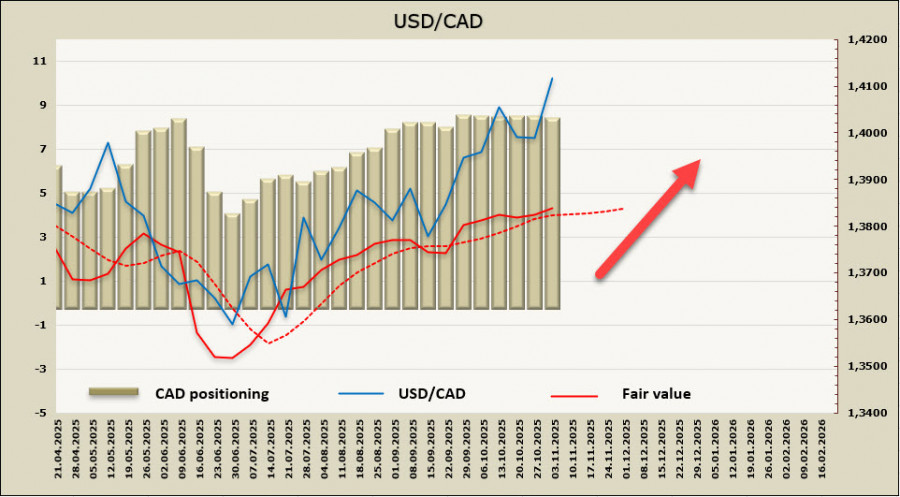

The calculated price remains above the long-term average, with no signs of a downward reversal.

Just a week ago, we predicted a slow rise to the 1.4077 resistance level, and the rapid strengthening of the dollar allowed USD/CAD to consolidate above it. Moreover, the growth has accelerated. The 1.4077 level has now turned into the nearest support, and we do not expect a decline back to it; growth will likely continue. The closest target is 1.4150/70, and we anticipate that the pair will move higher towards 1.4311.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।