See also

03.06.2025 07:09 PM

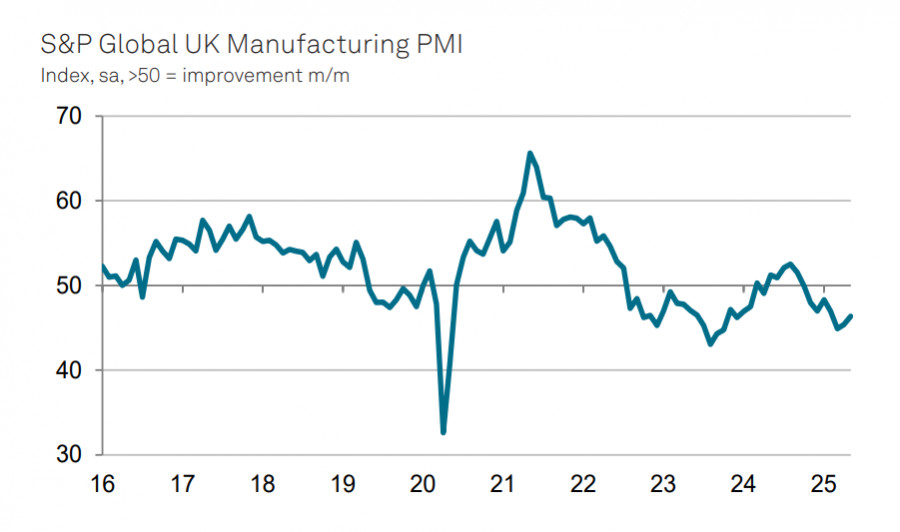

03.06.2025 07:09 PMOverall, the PMI index does not have a significant impact on exchange rates but offers insight into trends. Next week will be much more informative: on Tuesday, the labor market report will be released, showing trends in average wage growth — one of the key factors sustaining high inflation levels. On Thursday, we'll see a batch of data on industrial production and GDP growth rates. The Bank of England needs to be convinced that the slowdown in inflation is proceeding according to plan, although, frankly, the figures so far suggest the opposite.

BoE officials are trying to demonstrate that the situation is under control. On Tuesday, several members of the Monetary Policy Committee commented on price developments, which at first glance, could seem to be getting out of control. Dhingra stated that the disinflation process is ongoing, Breeden said he had "gained confidence" and also believes disinflation is in full swing, and Mann explained that she voted to keep rates unchanged in May because the labor market had not weakened as much as she had expected in February (thus clarifying her actions without directly mentioning rising inflation). In contrast, BoE Governor Bailey said that the labor market has softened and wage growth, while high, is lower than it was expected to be in February.

It seems that the Bank of England is eager to ensure the market perceives the rise in inflation as a temporary factor, not a sign of instability — essentially, that everything is proceeding according to plan and there is no need for a reaction. We'll wait for next week and new data. For now, the pound is reacting as it should — by rising, benefiting also from the clear weakness of the dollar.

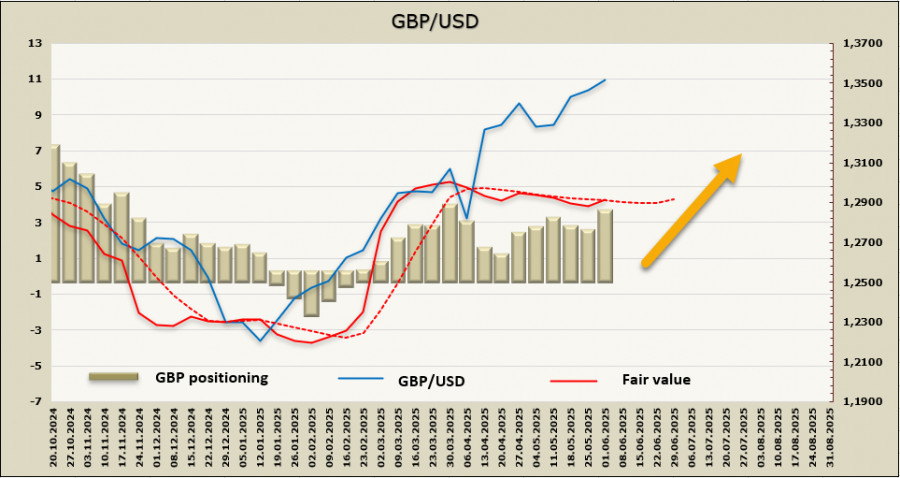

The net long position on GBP increased by $978 million over the reporting week to $2.99 billion. Positioning remains bullish, although the advantage is not yet very substantial. The estimated price appears ready to resume growth.

Last week, we noted that the chances for a bullish impulse had noticeably increased; the pound managed to hold above the 1.3443 support, targeting 1.3650. The pound's rise is largely due not so much to the strength of the British economy as to the weakness of the dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.