See also

25.07.2025 11:15 AM

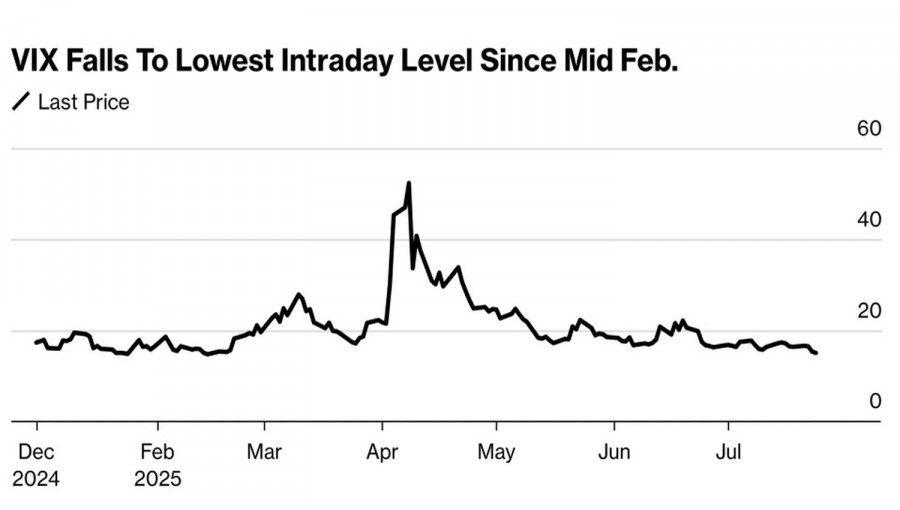

25.07.2025 11:15 AMThe U.S. stock market has shaken off its fears completely. The VIX volatility index has plunged to its lowest level since early February, while the S&P 500 has hit yet another record high — the tenth in the past 19 trading days. This happened despite the European Union approving a list of retaliatory measures worth €100 billion if no deal with the U.S. is reached by August 1, and despite Donald Trump renewing his threats toward Jerome Powell.

According to J.P. Morgan, the S&P 500 rally is expected to continue, driven by positive economic data, progress in trade negotiations, and an increase in merger and acquisition activity. Indeed, optimism stemming from a sixth consecutive week of declining unemployment claims and robust business activity in the U.S. has lent strong support to the broad stock index.

Even more impactful were President Trump's statements that he does not intend to block Tesla and other Elon Musk companies from receiving government funding, as well as strong corporate earnings from Alphabet. Google's parent company reported a surge in revenue in Q2 and plans to increase capital investment in artificial intelligence technologies. This theme fueled the S&P 500 in 2023–2024 and continues to do so in 2025. Approximately 83% of S&P 500 companies that have reported earnings have exceeded forecasts, compared to a 10-year average of 75%.

As for the White House's renewed threats toward Jerome Powell, they should be viewed with a certain degree of skepticism. Trump remarked that he would fire any manager who overspent on a construction project — a clear jab at the Federal Reserve Chair, who allegedly underestimated the cost of renovating the central bank's building.

In reality, the president wants the Fed Chair to cut interest rates. His attacks on Powell are a win-win strategy: either the Fed loosens monetary policy, allowing the White House to claim victory, or Powell becomes the scapegoat if the U.S. economy eventually cools. There's also a third scenario: a future Fed "traitor" might pursue aggressive monetary expansion.

For now, the Fed is holding its ground firmly, having previously been criticized for missing the inflation surge after the pandemic. It doesn't want to repeat past mistakes. Nevertheless, the Fed's missteps provide the White House with ample reason for criticism. Clearly, a 300-basis-point rate cut, as demanded by Trump, would fuel inflation — but any form of monetary easing would be great news for the U.S. stock market.

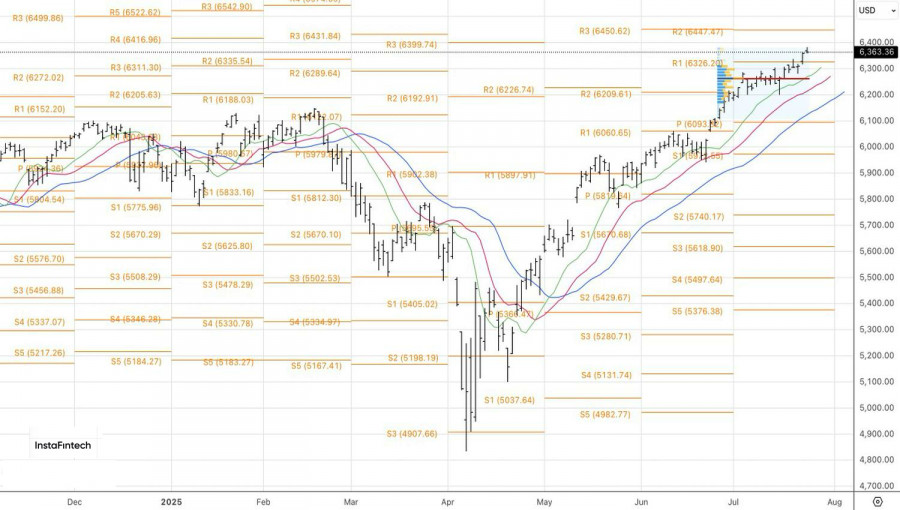

On the daily S&P 500 chart, the index continues to climb steadily toward the previously mentioned long position target of 6450. As long as it trades above the pivot support at 6325, a buy strategy remains appropriate.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.