See also

01.08.2025 12:32 AM

01.08.2025 12:32 AMThe good old days are returning to Forex! The international currency market is gradually getting used to Donald Trump's threats and trade deals, and once again turns its full attention to central banks — despite the U.S. president's attempts to shift the spotlight to himself. He imposed 15% tariffs on South Korea and 25% on India. The White House is unhappy with Delhi's close ties with Moscow. However, EUR/USD is more concerned with monetary policy.

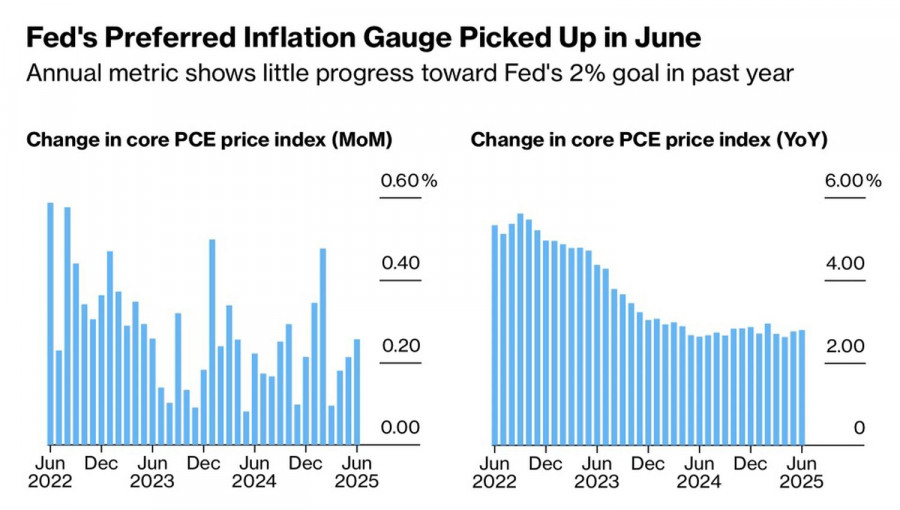

The Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred inflation gauge, accelerated to 2.6% in July, while the core PCE also rose to 2.6% year-over-year. Both figures exceeded Bloomberg analysts' forecasts. As a result, the futures market now expects only one Fed rate cut in 2025. This allowed EUR/USD bears to extend their offensive.

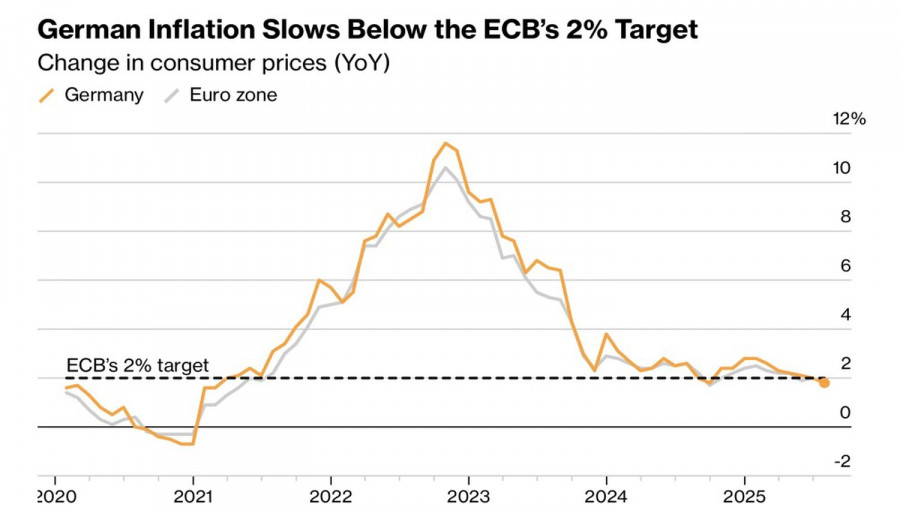

In contrast, German inflation fell below the European Central Bank's 2% target for the first time in ten months. In July, Germany's consumer price index slowed from 2% to 1.8% YoY. Nevertheless, the futures market does not anticipate a continuation of the ECB's monetary easing cycle this year. Most likely, investors are held back by the cautious rhetoric of Jerome Powell and Christine Lagarde.

Indeed, in July, two dissenters in the FOMC voted for a federal funds rate cut. It is quite possible that Christopher Waller and Michelle Bowman, both appointed by the current White House occupant, are acting on Donald Trump's instructions. However, decisions are made collectively by the seven governors of the Federal Open Market Committee and the five presidents of regional Federal Reserve Banks. Even if the U.S. president managed to dismiss the Fed Chair, it is unlikely to trigger a renewed cycle of monetary easing. That's all the better for the U.S. dollar.

Not all countries rushed to Washington to strike trade deals. Trump warned that he would send tariff letters ranging from 15% to 50%. However, agreements on investments and energy product purchases from the U.S. were reached with Japan, the European Union, and South Korea. Other countries refused. The president's dissatisfaction suggests that trade conflicts could escalate in early August.

If this happens, the likelihood of a correction in U.S. stock indexes will increase. The accompanying deterioration in global risk appetite will boost demand for the U.S. dollar as a safe-haven currency. The fact that the greenback has retained this status is confirmed by the inverse correlation between the S&P 500 and the USD Index.

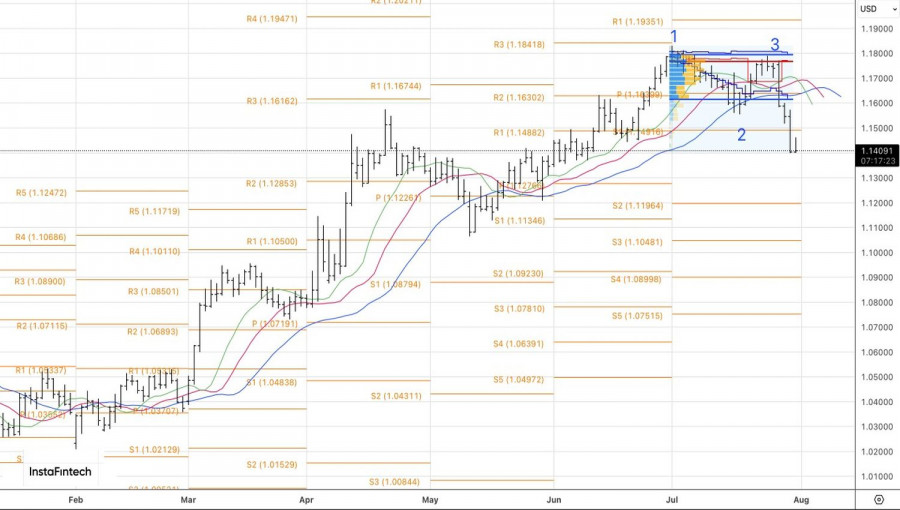

Technically, the daily EUR/USD chart shows a corrective move or possibly a reversal of the upward trend, as the 1-2-3 pattern unfolds. A drop in the pair below 1.140 would open the door to increased short positions. The target remains unchanged at 1.128.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.