Voir aussi

20.06.2025 08:53 AM

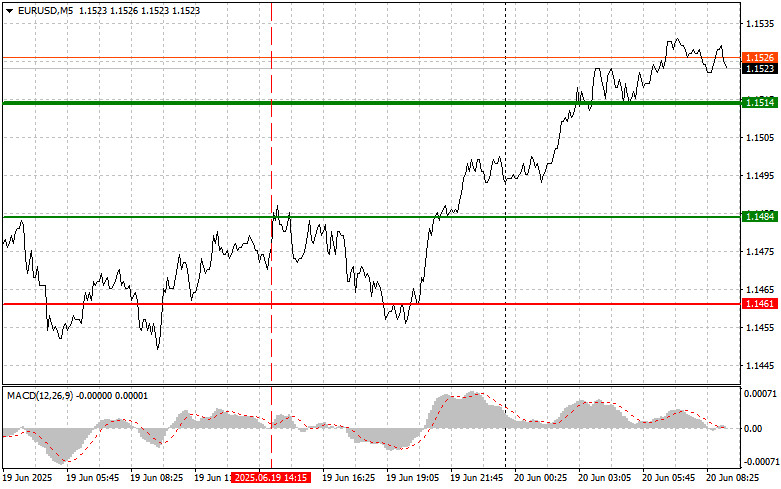

20.06.2025 08:53 AMThe price test at 1.1484 aligned with the MACD indicator beginning to rise from the zero mark, confirming a valid entry point for purchasing the euro. However, the pair did not rise afterward, resulting in a loss.

The euro strengthened against the US dollar, driven by the absence of economic data from the US and a holiday on several exchanges. Nevertheless, this should not be seen as a shift in the long-term trend. It's likely a short-term improvement due to the current market environment. Any geopolitical deterioration in the Middle East could quickly revive demand for the dollar, so expecting a sustained bullish trend for the euro is premature.

The spotlight will be on Germany's Producer Price Index (PPI), private sector lending dynamics in the eurozone, and data on consumer confidence in the region. Other less significant but still noteworthy releases include changes in the M3 money supply and the European Central Bank's economic bulletin. Special emphasis will be placed on consumer confidence—its decline may reflect household concerns about the economic outlook, potentially leading to reduced consumer spending and slower economic growth. Private sector lending trends will also be closely watched. Rising credit volumes may indicate positive business sentiment and a willingness to invest, a favorable economic signal. However, overly rapid credit expansion could overheat the economy and trigger asset bubbles.

Germany's PPI, a key inflation indicator, will shed light on the cost pressures businesses face and their ability to pass rising costs on to consumers. High readings may signal continued consumer inflation.

Lastly, the ECB's economic bulletin will provide a comprehensive analysis of the eurozone's economic situation and potentially reveal the central bank's future monetary policy direction.

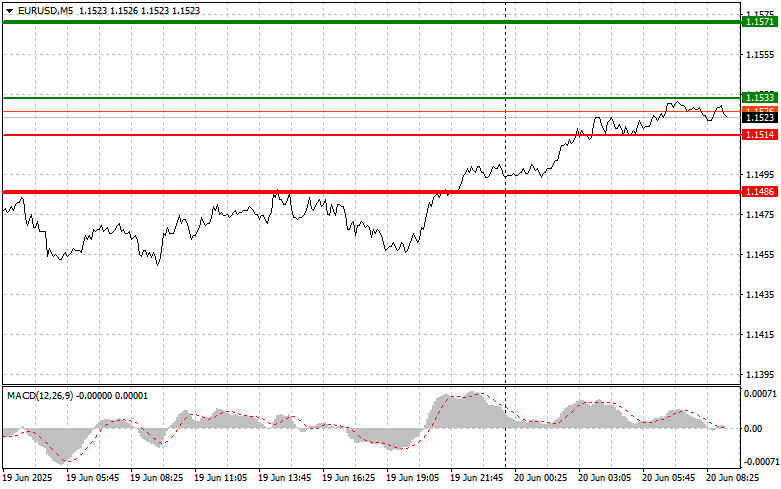

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Buy the euro today at 1.1533 (green line on the chart), aiming for growth toward 1.1571. At 1.1571, I plan to exit the market and open a sell position in the opposite direction, expecting a move of 30–35 pips from the entry point. Euro growth today would depend on strong data.

Important: Before buying, make sure the MACD indicator is above zero and just beginning to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.1514 twice a row while MACD is in the oversold zone. This would limit the pair's downside potential and trigger an upward market reversal. A rise toward 1.1533 and 1.1571 may follow.

Scenario #1: I plan to sell the euro after it reaches 1.1514 (red line on the chart), targeting 1.1486. I will exit and buy in the opposite direction (expecting a 20–25 pip rebound from the level). Selling pressure may return if the data is weak.

Important: Before selling, make sure the MACD is below zero and just beginning to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.1533 twice a row while the MACD is in the overbought zone. This would limit the pair's upside potential and trigger a downward reversal. A decline toward 1.1514 and 1.1486 may follow.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analyse et recommandations de trading pour le yen japonais Le test à 147.05 a eu lieu lorsque l'indicateur MACD venait à peine de commencer à descendre de la ligne zéro

Analyse et Recommandations de Trading pour la Livre Sterling Le test de 1.3554 a eu lieu lorsque l'indicateur MACD s'était déplacé bien au-dessus de la ligne zéro, ce qui limitait

Analyse du Commerce et Recommandations pour la Livre Sterling Le test du niveau de 1,3554 s'est produit lorsque l'indicateur MACD était déjà nettement au-dessus de la ligne zéro

La livre sterling, le dollar australien et le dollar canadien ont été échangés aujourd'hui en utilisant la stratégie de Réversion vers la Moyenne. Toutefois, pour être honnête, des replis

Le test du niveau de prix 146.84 a eu lieu lorsque l'indicateur MACD venait juste de commencer à monter à partir de la marque zéro, confirmant ainsi le bon point

Le test du niveau de prix de 1.35700 a eu lieu lorsque l'indicateur MACD avait déjà baissé significativement par rapport à la marque zéro, ce qui a limité le potentiel

L'euro et la livre sterling ont continué à se déprécier après la publication de solides données économiques américaines, ravivant l'espoir que la Réserve fédérale maintiendra une politique plus restrictive. L'augmentation

Examen du Commerce et Conseils de Trading pour le Yen Japonais Il y a eu un test du prix à 146.31 lorsque l'indicateur MACD avait déjà considérablement baissé sous

Analyse du Marché et Conseils de Trading pour la Livre Sterling Le test du prix de 1.3584 s'est produit lorsque l'indicateur MACD avait déjà considérablement dépassé la barre zéro, limitant

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.