Lihat juga

18.07.2025 12:25 AM

18.07.2025 12:25 AMWhat if the idea of the Federal Reserve's independence is just a myth? JPMorgan believes exactly that. The firm argues that the central bank has always interacted with the White House. At times, their paths diverge—as they do now—but the executive branch and the Fed are expected to coordinate policy. Cases like the one in 2025 are rare, and they understandably spark strong market reactions. It's no surprise that EUR/USD experienced a rollercoaster ride due to rumors about Jerome Powell's potential dismissal.

The primary task of any central bank is to bring inflation to its target. For the Fed, that typically means 2%. If the central bank perceives a risk of accelerating consumer prices, it will maintain the federal funds rate at a higher level. However, that's bad news for the government—servicing public debt becomes more expensive. And when Congress passes Donald Trump's ambitious $3.4 trillion tax cut plan, those costs increase even further.

This conflict of interest between the executive branch and the central bank underscores the necessity of the latter's independence. When a president dictates what the Fed chair should do, negative consequences are inevitable. One need look no further than Recep Tayyip Erdogan, who recently pressured Turkey's central bank to cut rates under the pretense of fighting usury. In reality, it led to runaway inflation, a collapse of the lira, and a full-blown currency crisis.

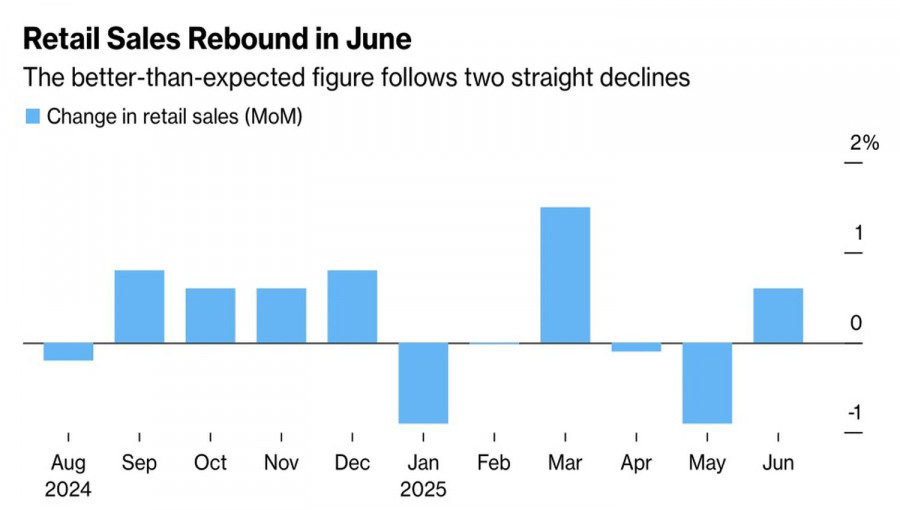

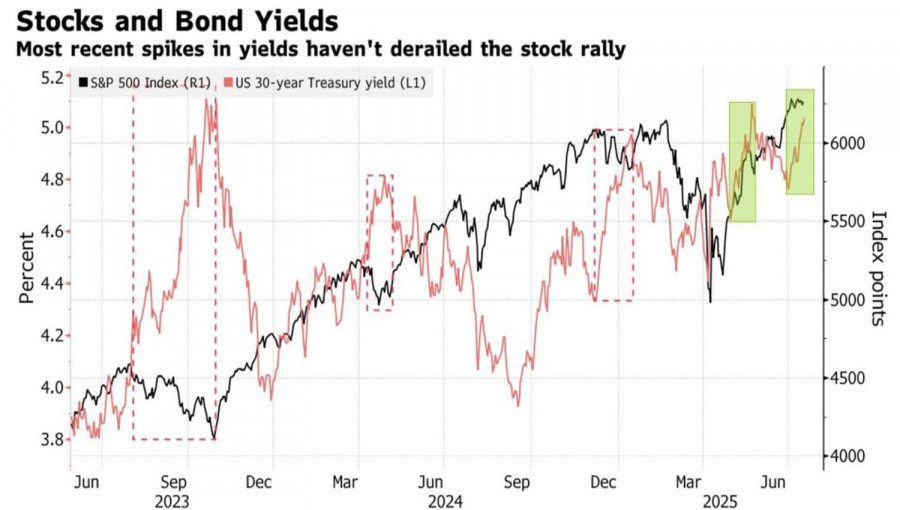

A weaker dollar benefits Trump. It boosts the competitiveness of American companies, helps narrow the trade deficit, and increases corporate profits. This ultimately lifts the S&P 500. However, the Fed has no intention of cutting rates. A fifth straight week of declining jobless claims and an unexpected spike in retail sales in June point to a solid, resilient economy—one that can withstand high borrowing costs.

For now, at least. In the future, tariffs may cool GDP growth and restart a cycle of monetary easing. From the outside, it may look as though the Fed is dancing to the White House's tune. Could it be that the Fed's independence really is a myth, as JPMorgan claims? The bank is convinced—and recommends buying U.S. equities for as long as possible.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.