یہ بھی دیکھیں

15.08.2025 12:44 AM

15.08.2025 12:44 AMThe release of the U.S. Producer Price Index (PPI) for July came as a cold shower for EUR/USD bulls. The index rose by 0.9% month-on-month—the fastest pace since June 2022. Service prices jumped by 1.1%, a surge not seen since March 2022. The report showed that companies are adjusting prices to offset higher costs, which are linked to White House tariffs. The chances of a federal funds rate cut in September fell from 99% to 92%, reviving the U.S. dollar.

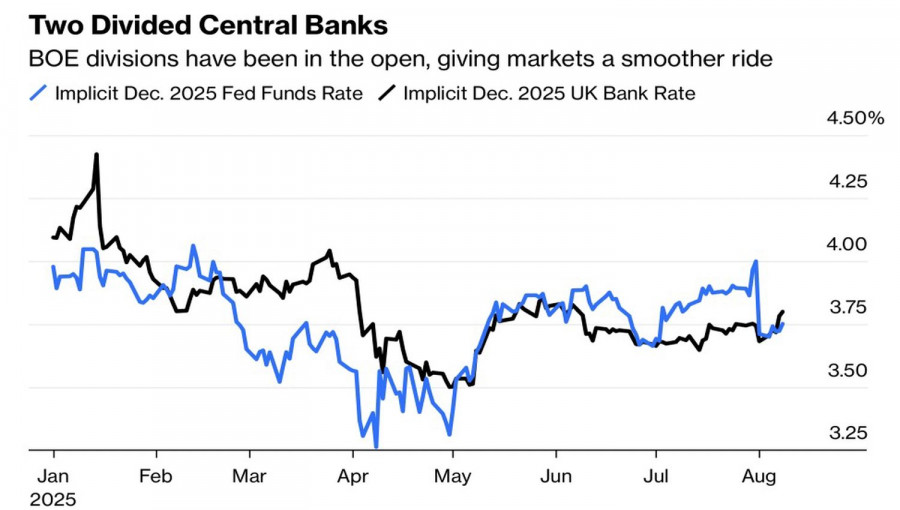

Alongside consumer price data, producer price data are used to gauge the Personal Consumption Expenditures (PCE) index—the Federal Reserve's preferred inflation measure. Before the PPI release, the futures market expected the Fed to deliver three monetary easing moves by the end of the year, pressuring the U.S. dollar against major global currencies—for example, against the pound, as no rate cuts are expected in the UK in 2025.

The July spike in U.S. producer prices raised doubts that the Fed would loosen monetary policy at each of the three remaining FOMC meetings in 2025. This allowed EUR/USD bears to counterattack.

Moreover, Scott Bessent stated that he did not give the Fed any recommendations on what it should do. He merely noted that economic models suggest the federal funds rate should be 150–175 basis points lower than it is now. However, markets took this as a call to action. In fact, the head of the Treasury should not comment on such matters, as investors could interpret this as a form of pressure on the central bank.

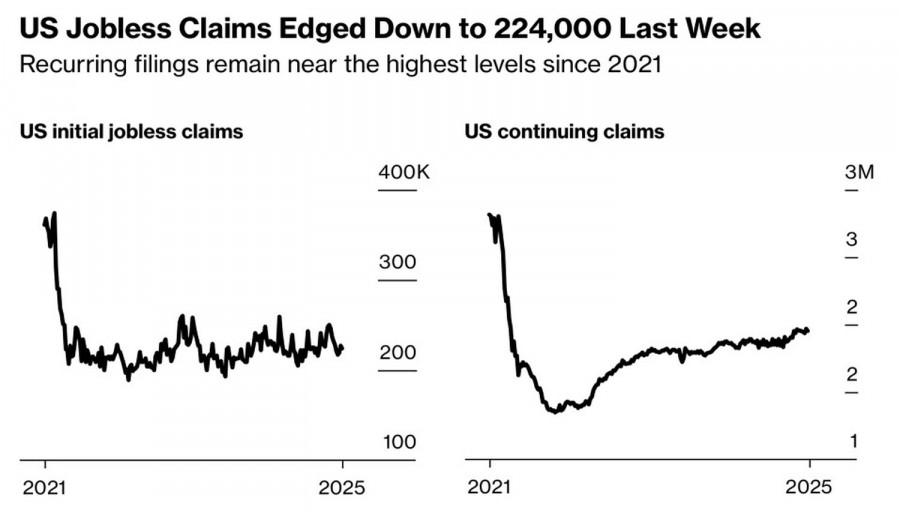

A decline in jobless claims also supported the U.S. dollar. Although continuing claims remain elevated, it is possible that the U.S. labor market is not as weak as the May–July NonFarm Payrolls reports suggested. If so, FOMC hawks could sway the Federal Open Market Committee to keep the federal funds rate at 4.5% in September.

In my opinion, it is premature to draw conclusions based on a single producer price report. The market had been confident in the Fed resuming its monetary easing cycle and is now slightly disappointed. But that does not mean a September rate cut is off the table. EUR/USD bulls are likely to recover soon, although rising doubts have become a serious obstacle to restoring the uptrend in the main currency pair.

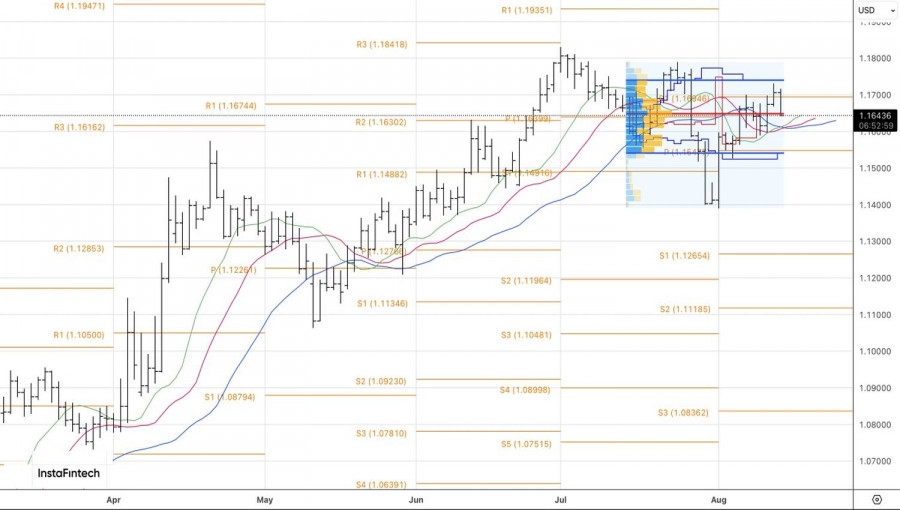

Technically, on the daily chart, EUR/USD is testing key support in the form of fair value at 1.165. If this level is broken, the risk of a decline toward the lower boundary of the 1.154–1.174 trading range will increase. Conversely, a rebound would allow for adding long positions in anticipation of the pair returning to challenge resistance at 1.170.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.