یہ بھی دیکھیں

26.08.2025 12:48 AM

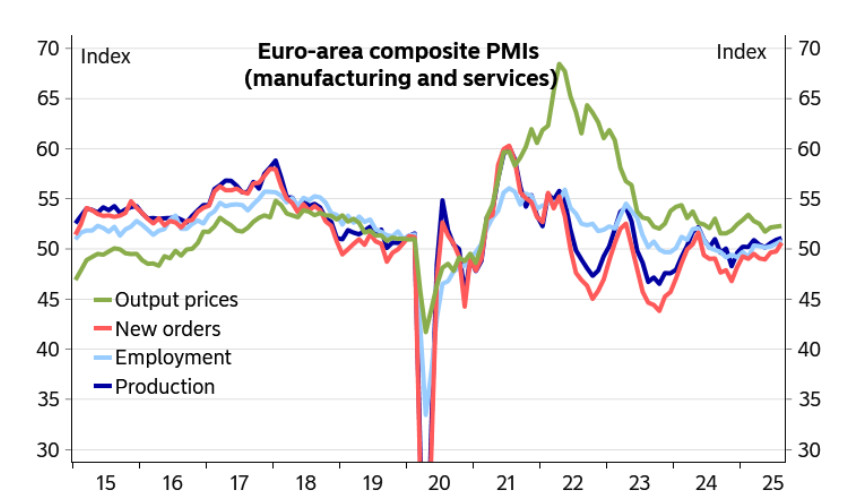

26.08.2025 12:48 AMBusiness activity indices in the euro area continue to look positive. The composite index rose in August from 50.9 to 51.1, despite a slight decline in the services sector, thanks to an unexpected recovery in manufacturing sector. This marks the highest level in more than a year, with the economic rebound supported in part by employment growth. Manufacturing recorded growth for the first time since June 2022.

Positive economic data reduces the likelihood of further European Central Bank rate cuts, as the economy now appears relatively stable. At its July meeting, the ECB left rates unchanged and made it clear that conditions for another cut would need to be much stronger. At this point, the 2% rate is viewed by markets as neutral. Since the Federal Reserve outlook is currently dovish, conditions for a decline in EUR/USD have not formed yet, but there is no basis for strong growth either.

The current week is not particularly interesting in terms of macroeconomic data, and the euro will likely fail to find an internal driver for a significant move. The main source of news will be the United States: on Tuesday, the durable goods orders report will be released; on Thursday, quarterly data on the dynamics of the personal consumption expenditure (PCE) price index will be published; and on Friday, equivalent data for July will follow. While the market is still digesting Powell's speech — trying to find in it what was not said, namely, a promise to cut rates — the yield on 5-year TIPS rose by Friday's close. This indicates that businesses responded to Powell's remarks with higher inflation expectations. Such a reaction is more meaningful than the short-term rise in EUR/USD, since consumer inflation expectations or the market's quick response to rhetoric can often be misleading, whereas higher TIPS yields signal that businesses see the risk not of a Fed rate cut, but of a potential hike.

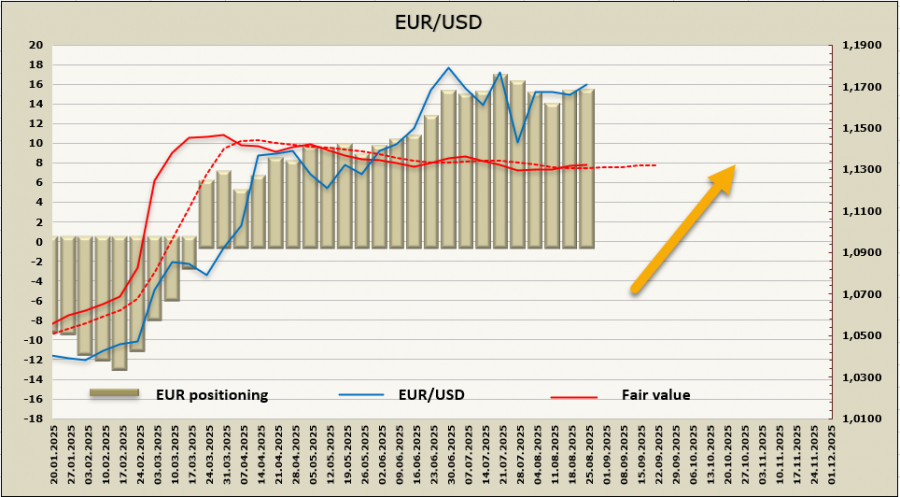

The net long position on the euro grew by 0.5 billion during the reporting week, reaching 17.3 billion, reflecting confident bullish speculative positioning. At the same time, the fair value shows no momentum.

Powell's speech, interpreted by markets as dovish, did push EUR/USD higher, but the pair failed to reach the 1.1790/1.1830 resistance zone. Another upward attempt cannot be ruled out, but neither can a decline toward support at 1.1580/90. At present, the probability of movement in either direction is roughly equal. From a technical perspective, the pair remains in consolidation mode, forming something resembling a "flag" pattern, with no clear conditions yet for a decisive move. We assume markets will reassess Fed rate projections in favor of a slower pace of cuts, pushing the pair lower, but additional factors will be needed to realize this scenario.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.