یہ بھی دیکھیں

26.09.2025 10:23 AM

26.09.2025 10:23 AMThe first significant sign that US inflation continues to rise proved to be a cold shower for market participants, causing a sharp rise in the dollar and a decline in demand for equities.

According to the latest data, in Q2 the Personal Consumption Expenditures (PCE) price index rose slightly more than expected, to 2.1% versus a forecast of 2.0%—still noticeably lower than the previous period's 3.7%. The core PCE also rose slightly to 2.6% from 2.5%, compared with the last 3.5%.

There was good news as well—a strong upward revision to Q2 GDP, which shot up to 3.8% from -0.5% with a forecast of 3.3%. In addition, durable goods orders rose sharply, up 2.9% in August versus a 2.7% decline in July (the forecast was for a slight decrease of 0.3%).

So why was there a wave of negativity in the markets on Thursday? The main reason was that market players are worried about the potential resumption of rising inflation. Yes, the quarterly PCE ticked up, but not critically. More concerning for investors is that today's fresh annual and monthly PCE readings may also show increases, which in turn could provide the Fed with justification to pause rate cuts this year.

According to forecasts, the overall annual and monthly PCE price index are expected to increase from 2.6% to 2.8% and from 0.2% to 0.3%, respectively, in August. The consensus is for 2.7% and 0.3%. The core figure month-on-month should remain at 0.3%, and year-on-year climb to 3.0% from 2.9%. There will also be data on US personal income and spending, which are expected to show a slowdown in growth.

How might markets react to the PCE report?

If the data comes in as expected or slightly below, it may lead to the closing of short positions on US equities and a softening of the dollar, with the DXY possibly dropping back to its starting point from yesterday, since the market has already priced in a potential rise to the forecast levels. This scenario wouldn't rule out further Fed rate cuts.

Overall, I see the market picture as moderately positive.

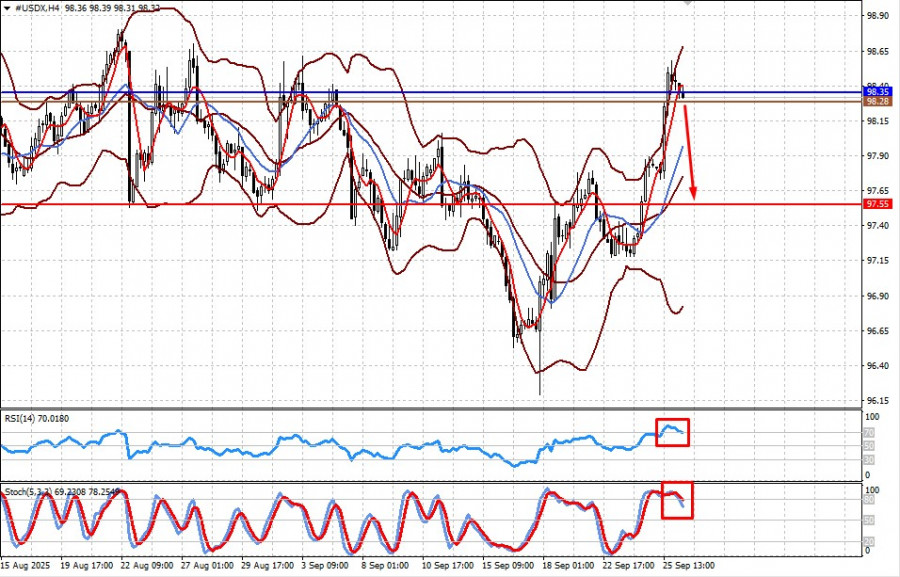

#USDX (Dollar Index):

The index is above 98.35. If the PCE index is reported as expected, it could put pressure on dollar demand and push the DXY down to 97.55. 98.28 is a level to watch for potential selling.

GBP/USD:

The pair is under pressure from UK economic woes. A PCE figure in line with expectations may keep the pair under pressure. A drop below 1.3335 will likely encourage a decline to 1.3260, followed by a further decline to 1.3160. 1.3319 is a level that can be used for potential selling.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.