Veja também

12.06.2025 01:31 PM

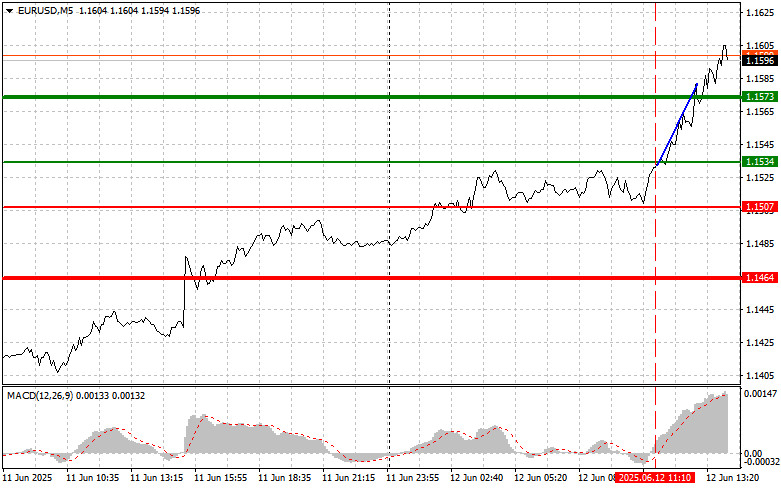

12.06.2025 01:31 PMThe test of the 1.1534 price level occurred when the MACD indicator had just started moving upward from the zero line, confirming the accuracy of the entry point for buying euros. As a result, the pair rose toward the target level of 1.1573.

Today, the U.S. will publish data on initial jobless claims and the Producer Price Index (PPI). These economic indicators will provide valuable insight into the state of the U.S. economy and may influence the Federal Reserve's policy decisions. The number of initial unemployment claims reflects the current labor market conditions. An increase in this figure may indicate a decline in job creation and a rise in layoffs, which could negatively affect consumer spending and overall economic growth.

The Producer Price Index is a leading indicator of inflation. A rise in PPI may signal upcoming increases in consumer prices, as companies typically pass their higher costs on to end consumers. Given Trump's trade policy, the Fed has to scrutinize the PPI to assess inflation risks and make appropriate decisions.

The market and traders will closely watch both figures—jobless claims and PPI—. If the data point to a slowdown in economic growth and rising inflationary pressures, expectations for future Fed policy may be adjusted, affecting overall market sentiment.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

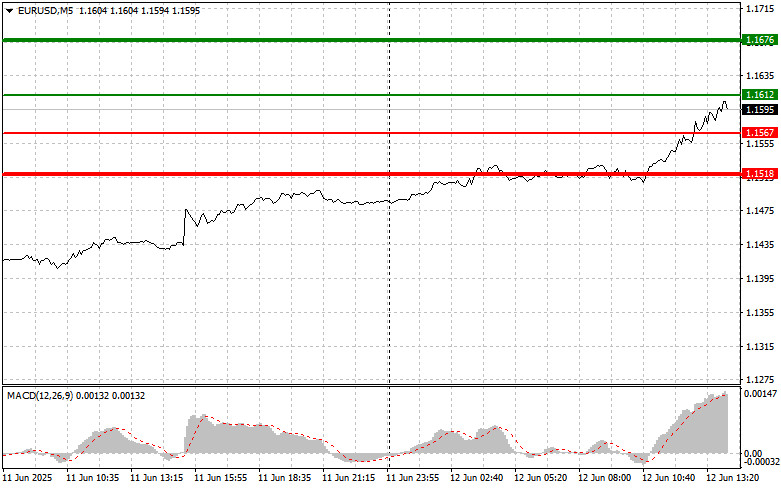

Scenario #1: I plan to buy euros today upon reaching the entry point around 1.1612 (green line on the chart), with a target of 1.1676. At 1.1676, I plan to exit the buy trade and sell in the opposite direction, expecting a 30–35 pip movement back. Buying the euro today is advisable only after weak U.S. data.

Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy euros today in the event of two consecutive tests of the 1.1567 level when the MACD indicator is in oversold territory. This will limit the pair's downside potential and may trigger an upward market reversal. A rise toward 1.1612 and 1.1676 can be expected.

Scenario #1: I plan to sell euros after the price reaches 1.1567 (red line on the chart), with a target of 1.1518, where I plan to exit the short and buy immediately in the opposite direction (expecting a 20–25 pip rebound). Selling pressure on the pair may return after strong data.

Important! Before selling, ensure that the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell euros today in the event of two consecutive tests of the 1.1612 level when the MACD indicator is in overbought territory. This would limit the upside potential of the pair and trigger a downward market reversal. A decline toward 1.1567 and 1.1518 may follow.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das negociações e dicas para negciar a libra esterlina Um teste de preço em 1,3608 na primeira metade do dia coincidiu com o indicador MACD já tendo se movido

Análise das operações e dicas para negociar o iene japonês Devido à baixa volatilidade, os níveis que indiquei não foram testados na primeira metade do dia. Dados os dados

Análise das operações e dicas para negociar a libra britância O teste do nível 1,3575 na primeira metade do dia ocorreu quando o indicador MACD já havia subido significativamente acima

Análise das operações e dicas para negociar o iene japonês Nenhum dos níveis que marquei foi testado na primeira metade do dia, portanto não fiz operações. Dado o breve momento

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.