Vea también

15.05.2025 07:49 PM

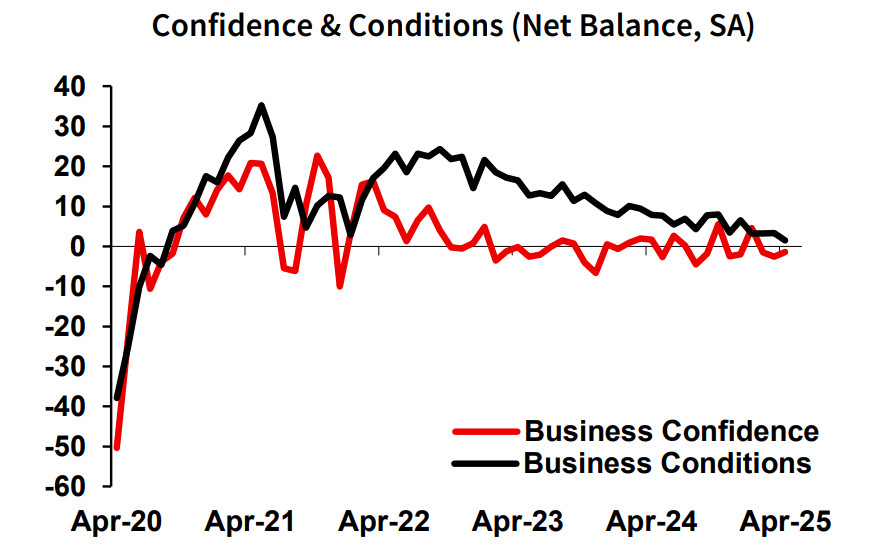

15.05.2025 07:49 PMThe monthly NAB Business Survey showed that the positive momentum which drove GDP growth of 1.3% y/y in Q1 is fading. Business confidence improved slightly but remains in negative territory and below its long-term average.

A sharp decline in capital expenditure was noted (now at the lowest level since June 2024), along with falling profitability and softer forward orders. The significant surge in capacity utilization recorded in March has also reversed; this metric fell to 81.4%, returning for the first time since mid-2021 to its long-term average. While labor cost growth remained steady this month, there was an increase in purchasing costs, as well as higher final product prices and retail price inflation.

Additionally, consumer spending growth in April slowed to just 0.1% after steady gains in previous months.

Although these incoming data alone are unlikely to change the Reserve Bank of Australia's (RBA) stance—focused on "gradual and cautious rate cuts"—they do suggest weaker market sentiment regarding future RBA policy moves. There are now more factors pointing toward a faster pace of rate reductions. So far, the RBA has made only one cut in February, and the current interest rate remains at 4.1%, while inflation has remained stable for two consecutive quarters at 2.4%—significantly below the RBA rate.

It has become evident that the economy cannot generate upward momentum at the current rate level, which is why a reassessment of the rate cut trajectory is likely to occur as soon as the upcoming RBA meeting on May 20. Expectations of a cut—and faster easing in the future—will put additional pressure on the Aussie and prevent it from sustaining a bullish momentum.

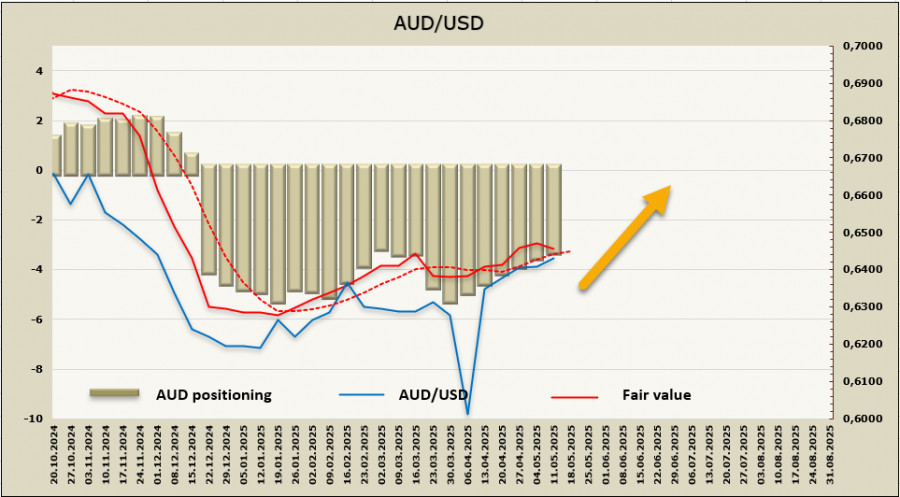

The net short position on AUD narrowed slightly during the reporting week by just $47 million, to -$3.14 billion. Positioning remains bearish, while the fair value estimate has lost upward momentum and is preparing to turn south, though it remains above the long-term average for now.

The AUD/USD pair failed to reach the resistance zone of 0.6540/50, and at this point, the odds of a resumed upward move have diminished. The nearest support zone lies at 0.6340/60; a test of this area will help determine whether there will be another attempt to move higher or whether, after a period of consolidation, a southward wave will develop. If the pair breaks below this support zone, the next target will be the technical level of 0.6287.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.