Vea también

17.07.2025 12:45 AM

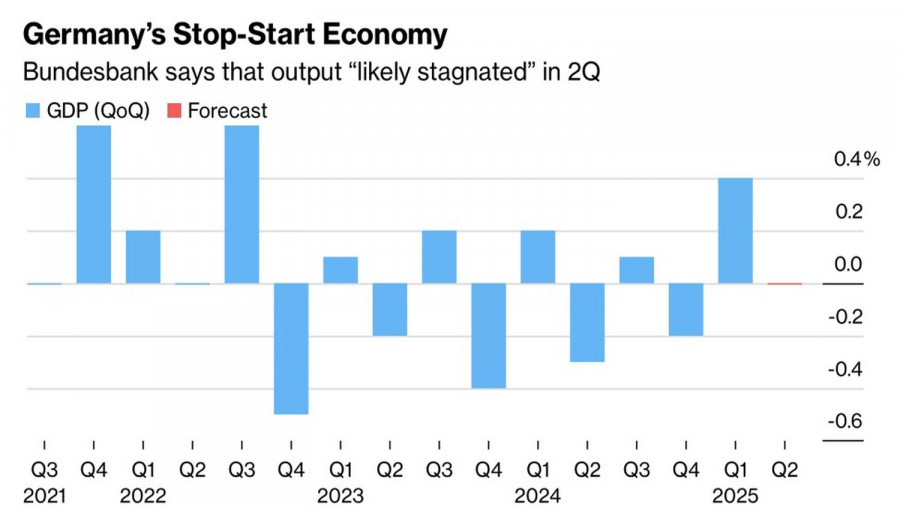

17.07.2025 12:45 AMIs the euro as strong as it may have seemed just a couple of weeks ago? According to the Bundesbank, Germany's economy is stagnating in the second quarter, and the U.S. decision to raise tariffs on EU imports to 30% will likely plunge it into recession. Europe is paying the price for supplying arms to Ukraine from the U.S. while also fighting battles on two fronts — against both America and China. China is actively redirecting its export flows, and many of those goods are ending up in the EU.

For the 27-member European Union, responding to U.S. tariffs is complicated. According to a Bloomberg insider, about half a dozen states, led by France, are not ready to compromise. They want to activate the so-called anti-coercion instrument if Washington and Brussels fail to reach a tariff-reduction deal by August 1.

This anti-coercion tool would grant the EU broad authority to retaliate, including new taxes on American tech giants, targeted restrictions on investment in the U.S., and limitations on U.S. access to EU markets. Counter-tariffs on €72 billion in U.S. goods as an initial EU response could be just the beginning.

Still, all decisions in the EU require consensus. Many member states prefer a cautious approach, and several have yet to take a public stance. This division plays into Donald Trump's hands. The U.S. president divides and conquers. If not for his push to weaken the dollar, the current EUR/USD correction might have turned into a full-blown trend reversal.

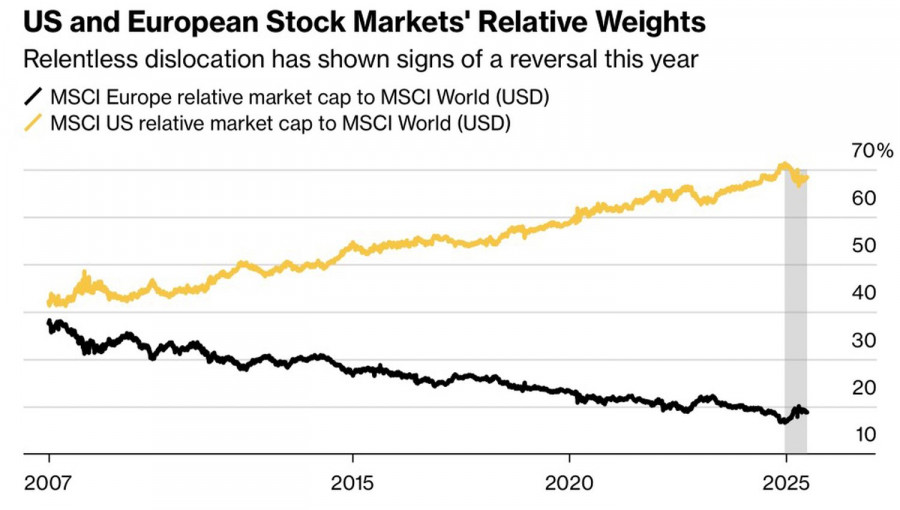

However, RBC believes that U.S. dollar weakness is structural. The trade-weighted dollar index has already declined 12% year-to-date. The bank views this as the early stage of a structural downturn. It expects hedge funds and asset managers to increase currency risk hedging for U.S.-denominated assets, further pressuring the USD index in 2025–2026.

RBC argues that capital flow shifts and portfolio diversification — in favor of reducing exposure to U.S. assets — will continue to support the EUR/USD uptrend. The bank recommends buying on pullbacks.

So, while the euro has its vulnerabilities, Trump's firm intention to weaken the U.S. dollar, along with capital flow dynamics and the rising demand for FX risk hedging, supports the case for a bullish trend in the main currency pair.

Technically, on the daily EUR/USD chart, we are seeing a pullback within the uptrend. A break below fair value increases the risk of a decline toward the lower end of the range at 1.1525–1.1815. After hitting the first short target at 1.1615, positions should be held in anticipation of the second target at 1.1530.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.