Vea también

26.08.2025 12:48 AM

26.08.2025 12:48 AMThe U.S. dollar has moved past the "sell everything American" era but is now under pressure from monetary policy. At Jackson Hole, Jerome Powell made it clear that the Federal Reserve intends to cut rates. Other central banks are planning to raise them or keep them unchanged. This divergence in monetary policy is shaping the fate of EUR/USD. The main currency pair has strong chances of resuming its upward trend.

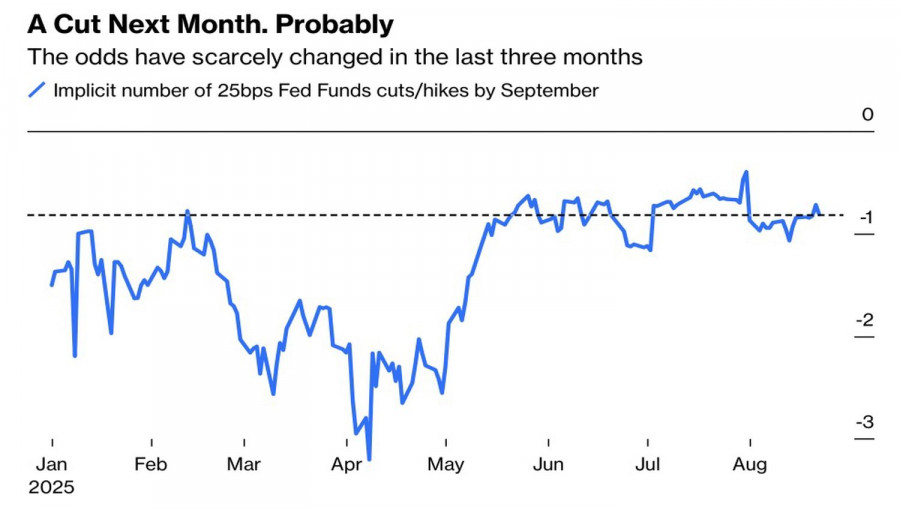

From January through April, the dollar fell alongside U.S. stock indices amid the prevailing "sell America" narrative in financial markets. However, in May, the inverse correlation between the USD index and the S&P 500 was restored. Powell's Jackson Hole speech boosted the odds of a September federal funds rate cut from under 70% to over 80%, triggering a stock market rally. This dealt a serious blow to the greenback.

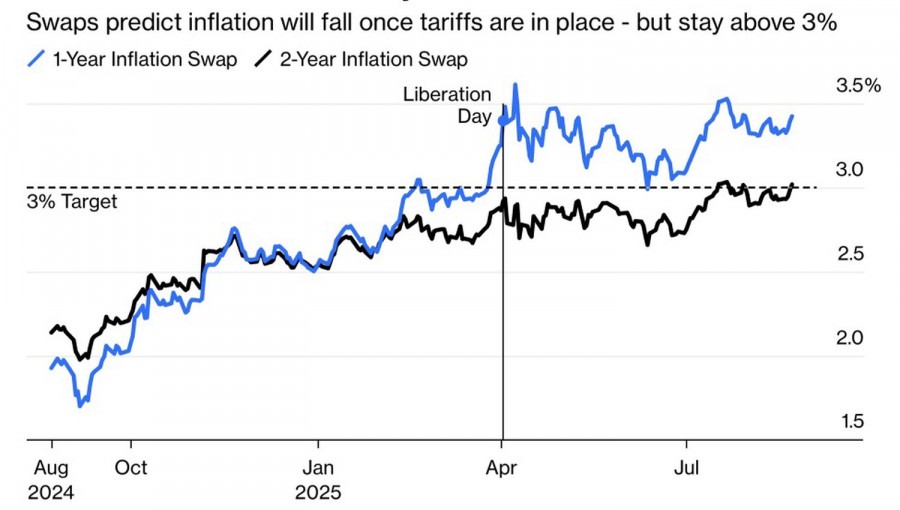

The Fed chair laid it out clearly. Under normal circumstances, tariffs drive prices higher and allow workers to demand higher wages. But when the labor market is weak, they won't — not at the risk of losing their jobs. As a result, the cooling of employment offsets the inflationary effect of import tariffs. This gives the Fed room to throw the economy a lifeline without worrying about a prolonged rise in PCE.

Rate cuts are coming — and the White House couldn't be happier. Had Powell's Jackson Hole speech failed to satisfy Donald Trump, investors would have seen a fresh wave of presidential criticism toward the Fed chief. That did not happen. On the contrary, National Economic Council Director Kevin Hassett said the Fed chair's remarks were justified. The Fed is lagging, as the annual inflation rate has fallen below 2% over the past six months.

Since America's "liberation" in April, inflation expectations have risen somewhat, but have since stabilized. If the Fed does not believe tariffs can drive them significantly higher for long, the central bank will almost certainly resume its monetary easing cycle. That is bad news for the U.S. dollar.

Additional pressure on the euro came from Friedrich Merz. The German chancellor stated that the German economy is in worse shape than he expected and has virtually lost competitiveness. I do not think such an acknowledgment is bad for EUR/USD. Merz knows how to tackle these issues, and his remarks may pave the way for new fiscal stimulus, which would benefit the main currency pair.

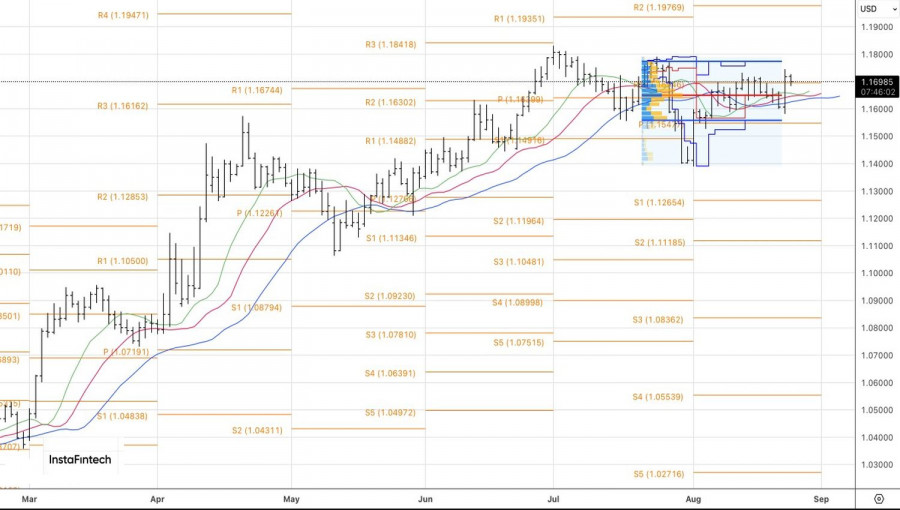

From a technical standpoint, EUR/USD on the daily chart has seen several failed tests of dynamic support in the form of moving averages, followed by a return above fair value. Bears are weak, and the initiative lies with the bulls. Buying remains relevant toward the pivot levels of 1.20 and 1.22.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.