See also

03.06.2025 10:44 AM

03.06.2025 10:44 AMOver time, we get used to everything — the good and the bad. Investors have finally come to terms with the fact that they will have to build businesses under the constant uncertainty of White House policy for the next four years. Tariffs became increasingly predictable, as did Donald Trump's actions. He himself stated that he first hikes tariffs sky-high and then lowers them in exchange for concessions from other countries. Combined with the International Trade Court's ruling deeming the tariffs unlawful, this has allowed the S&P 500 to extend its climb.

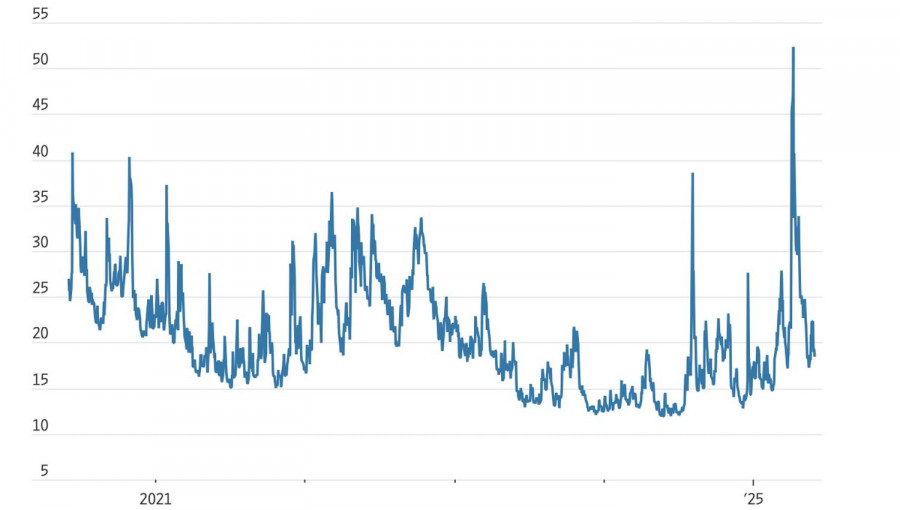

Getting used to this new reality is reflected in the decline of the VIX volatility index, which had recently surged to pandemic-era extremes during America's Liberation Day. Now, it has returned to historical averages. Hence, there's little fear in the market.

VIX fear index dynamics

The S&P 500 shrugged off the escalation in trade tensions. First, Trump accused China of violating the terms of a previous agreement. Then, Beijing accused the US of doing the same. Trump's decision to double tariffs on steel and aluminum imports from 25% to 50% prompted retaliation threats from the European Union. Yet the market reacted with eerie calm.

But perhaps it's only apparent calm. The S&P 500 remains overvalued by historical standards. Based on the P/E ratio, the Magnificent Seven stocks trade at 27 times forward earnings, while the remaining 493 companies in the broad index trade at 19 times. The 25-year average stands at 16.5. Earnings growth expectations fell from 10% in January to 8.4% in March, and now to just 4% in May.

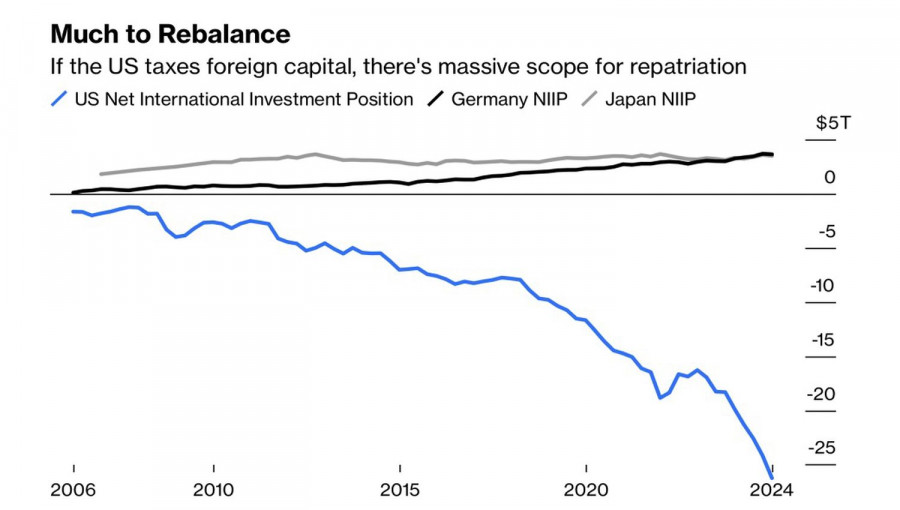

In April, a monster was awakened, the one the White House may find hard to rein in. The monster is the fear of the appalling national debt. The credit rating downgrade by Moody's, rising Treasury yields, and a proposed bill to tax non-resident investments in US securities have shaken the financial markets to their core.

Since 2008, net inflows into US stocks and bonds by foreigners have exceeded $26 trillion. American exceptionalism fueled both the S&P 500 rally and dollar strength. But Trump's protectionist policies are now triggering a reversal. Capital outflows could become a serious challenge for the broad equity index.

Net investment position of the US vs other countries

A rapid relocation of funds back to Europe and Asia appears likely if the Senate passes Trump's "big and beautiful" bill. This would put significant pressure on the S&P 500. That said, June might bring some calm. Over the past 50 years, the broad market index has risen by just 0.2% on average during the first month of summer — four times slower than in other months, where gains average 0.8%.

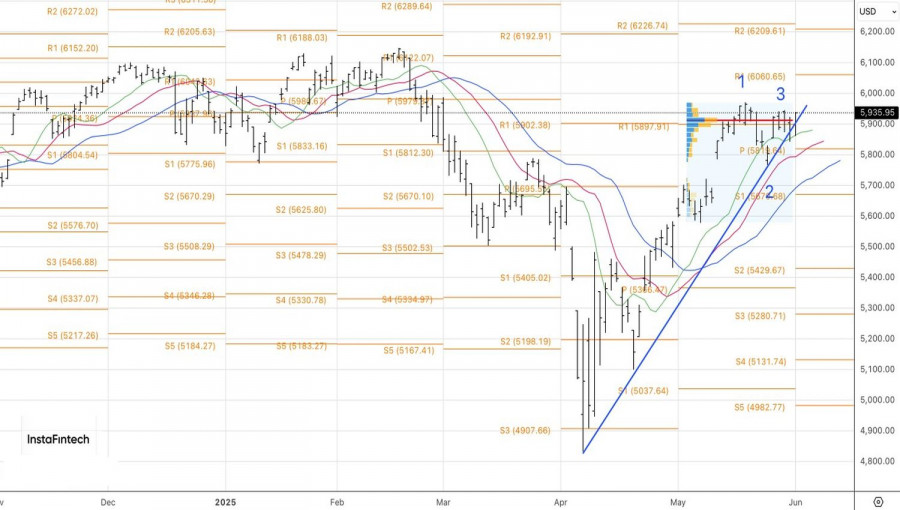

Technically, the S&P 500's daily chart shows an attempt to restore the uptrend. The current strategy remains relevant: buy from 5,945, sell from 5,840. The strategy is based on the 1-2-3 pattern and Splash formation.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.