See also

11.06.2025 12:21 AM

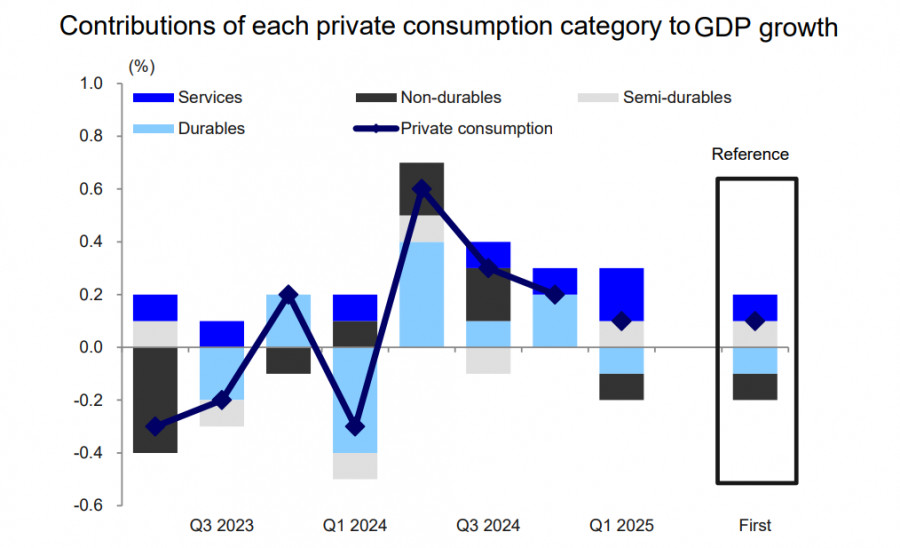

11.06.2025 12:21 AMThe revised estimate of Japan's Q1 GDP showed that the economy contracted less than previously estimated, with consumption figures also revised upward. GDP declined by 0.2% year-over-year instead of the earlier estimated 0.7%. At first glance, this appears to be a significant revision, but it's unlikely to change the general perception of Japan's economic condition. It's also worth noting that the deflator for final goods and services was revised from 3.2% to 3.3%, directly confirming persistent inflationary pressure.

Growth in consumer demand—another factor contributing to economic stability and inflationary pressure—supports the forecast that an interest rate hike is needed.

The main issue is that rising domestic demand's positive contribution to GDP is offset by falling exports and increasing imports. Tensions are escalating as July nears, when a 24% export tariff on goods to the U.S. will take effect if negotiations do not yield results. Japan is also trying to secure concessions on a 25% auto tariff since the automobile industry is Japan's largest sector, and a blow to it would immediately plunge the country into recession.

The Bank of Japan will hold its next policy meeting next week. The market unanimously expects that rates will not be raised at this meeting; a hike is anticipated at the following meeting in July. However, remarks from BoJ officials will be closely scrutinized. On Tuesday, BoJ Governor Kazuo Ueda reiterated that the Bank is ready to continue raising rates if inflation keeps rising. A rate hike likely would have happened in the spring, but the new U.S. tariff policy lowered the economic outlook, pushing any tightening back until more clarity about the future.

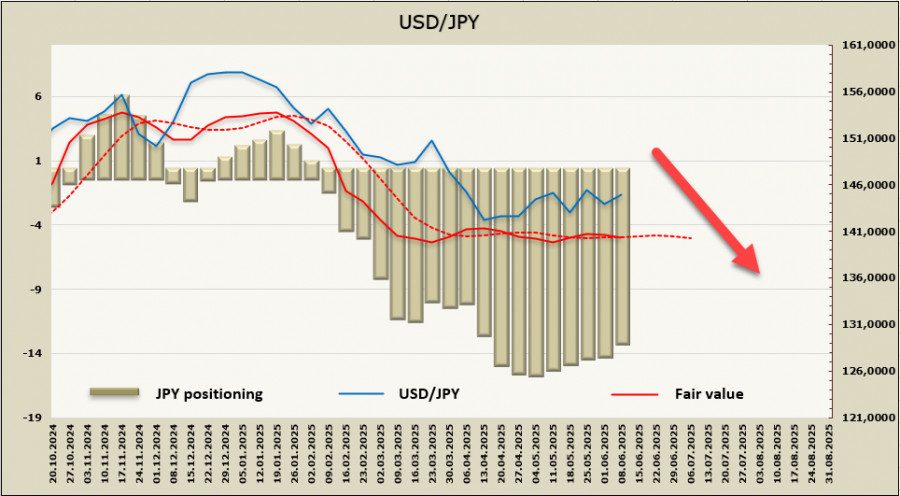

The net long position on the yen declined by $1.08 billion during the reporting week to $13.123 billion. This marks the fifth consecutive weekly drop, yet the bullish positioning remains strong. The estimated fair value has lost momentum, but from a long-term perspective, nothing has changed—the yen remains the favorite in the USD/JPY pair.

The resumption of U.S.–China trade talks and rising oil prices have once again pressured the yen, pushing it back to 145, but these are temporary factors that cannot sustain a long-term trend. Looking ahead, the outlook remains the same—the yen is inclined to strengthen, as inflationary pressure in Japan demands action, while the threat of a U.S. recession and global trade uncertainty increases tension and fuel demand for the yen as a key safe-haven currency. We expect the current consolidation to end with a downward breakout, with targets at the 139.49 support level and then the 127–129 range.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.