See also

24.07.2025 12:53 AM

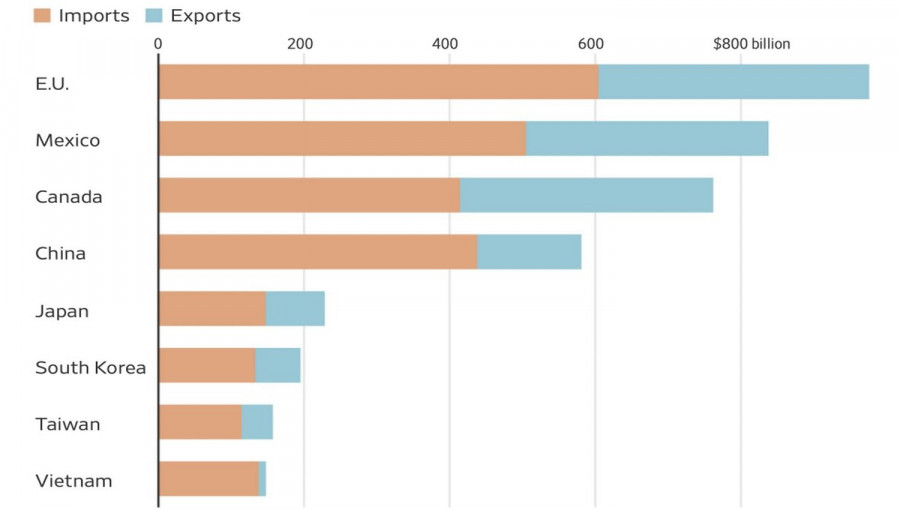

24.07.2025 12:53 AMPlan A: reach a tariff agreement with the U.S. at 10% or less by August 1. Plan B: activate the anti-coercion mechanism and impose import duties on the U.S. totaling around €100 billion. This would target one-third of American exports to Europe, valued at €335 billion in 2024. Given the White House's intent to raise tariffs to 15%, finding common ground is proving nearly impossible. Meanwhile, time is running out, preventing EUR/USD from moving upward.

The deal with Japan has granted the U.S. several advantages. The 15% tariff revenues will boost the American budget. The agreement signals a de-escalation of trade tensions, fueling global risk appetite and pushing stock indices higher. Finally, Washington may use this momentum to pressure Brussels. According to Treasury Secretary Scott Bessent, it is not guaranteed that the EU will receive the same terms as Tokyo. He noted that Japan had made a very compelling investment proposal: 550 billion dollars into the U.S. economy. Can the European Union offer anything comparable?

Unlikely. Even 10% tariffs would be disastrous for some EU members — let alone 15% or 30%. Everything points to a looming trade war, which, due to the EU's trade surplus, would likely end poorly for Europe. China's loss during the 2017–2019 trade standoff resulted in a sharp decline in the yuan's value. Why shouldn't the euro follow a similar path downward — especially with the Federal Reserve's passivity playing into the hands of the U.S. dollar? Despite Donald Trump's calls for a 300-basis-point rate cut, the central bank remains silent and inactive.

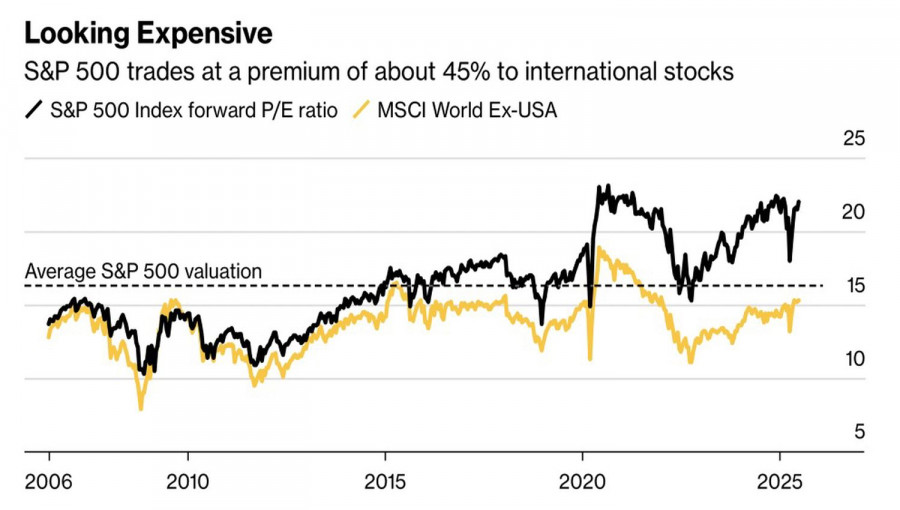

Add to that the excessively inflated speculative long positions in the euro, and the EUR/USD correction begins to take clear shape. If not for the bulls' strong cards. Capital flows from North America to Europe, driven by investment portfolio diversification into less expensive stocks and currency risk hedging by non-U.S. residents, are exerting significant pressure on the dollar.

Thus, the market has reached an impasse. On the bears' side for EUR/USD are the looming U.S.–EU trade war, the Fed's unwillingness to cut rates under Trump's pressure, and overblown speculative euro long positions. On the bulls' side are currency risk hedging and capital inflows from the US to the EU. It's no surprise that the main currency pair has been stuck in a consolidation range between 1.16 and 1.18 for weeks.

On the daily chart, EUR/USD bulls' inability to hold the pair above the 1.1715 support would signal weakness and justify short positions in the euro against the U.S. dollar. Conversely, a return above the local high at 1.176 would provide a reason to build long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.