Lihat juga

22.09.2025 12:05 PM

22.09.2025 12:05 PMOne step forward, two steps back. Bitcoin has tumbled from monthly highs as markets reassess the scope of potential Federal Reserve rate cuts and question whether demand for crypto remains strong enough. Even news of the SEC approving an ETF based on a basket of digital assets — rather than a single cryptocurrency — failed to support BTC. While US authorities are showing more openness toward the crypto industry than in the past, BTC/USD is increasingly behaving like an overbought asset.

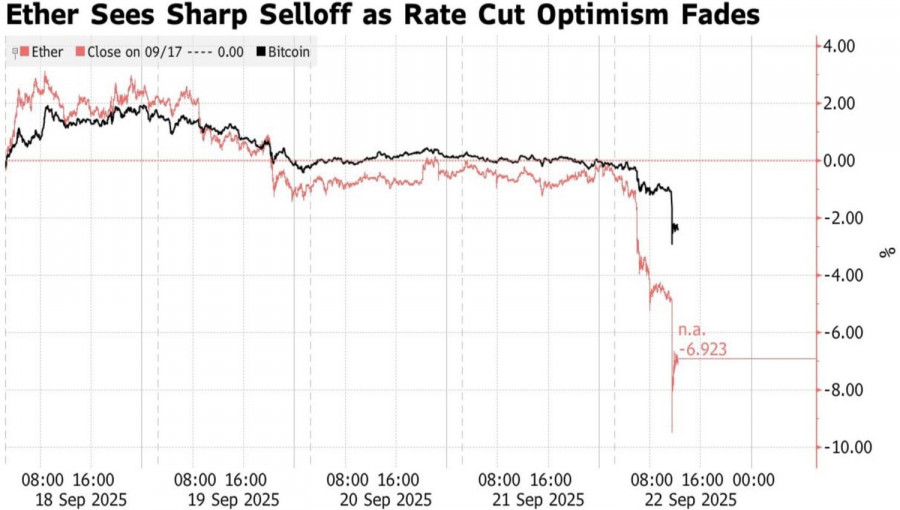

The futures market now expects the federal funds rate to fall from its current 4.25% to below 3%. However, the latest FOMC projections show a terminal rate of 3.4%. Investors had become overly complacent, betting on aggressive monetary easing from the Fed. The realization that the central bank may, in fact, act more cautiously has pushed the US dollar higher against major currencies — and sent both Bitcoin and Ethereum into retreat.

BTC and ETH sell-off dynamics

Bitcoin and Ethereum continue to dominate the crypto market, accounting for roughly 70% of total market capitalization. BTC/USD is increasingly seen as a portfolio diversification tool due to a drop in volatility — from 200% a decade ago to under 40% now — while ETH/USD remains largely a speculative asset.

According to Coinglass, $1.5 billion worth of bullish positions in digital assets were liquidated at the start of the final full week of autumn. Alongside the repricing of interest rate expectations, doubts about crypto demand have further strengthened the bearish case for BTC/USD.

Recently, crypto treasuries — firms that raise capital through stock or bond issuance and invest in digital assets — have gained immense popularity. Over 100 such companies have accumulated around $116 billion worth of Bitcoin. Their Ethereum-focused peers have raised $16 billion in 2025 alone. However, Nasdaq's new requirement that security issuances be approved by shareholders has raised market concerns. Will these firms be able to continue buying Bitcoin, Ethereum, and similar assets as aggressively as before? If not, a slowdown in demand could justify further BTC/USD selling.

Digital assets are also suffering from a breakdown in correlation with US stock indices. While American stocks are rallying thanks to AI-driven optimism, cryptocurrencies lack a comparable catalyst. Instead, they're forced to respond to shifting expectations for Fed policy and the strengthening US dollar.

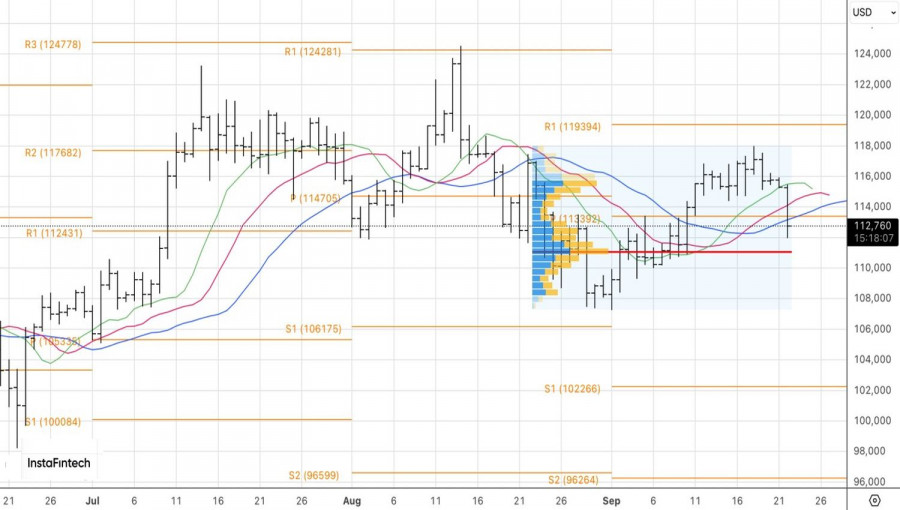

Technical picture: BTC/USD

On the daily chart, BTC/USD has broken through dynamic support levels — namely the moving averages — from above, signaling a return of bearish momentum. This opens the door for potential declines toward 111,000, 106,000, and 103,000. The key resistance level lies at 113,500. As long as Bitcoin remains below this mark, the focus stays on short positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.