یہ بھی دیکھیں

12.06.2025 12:35 AM

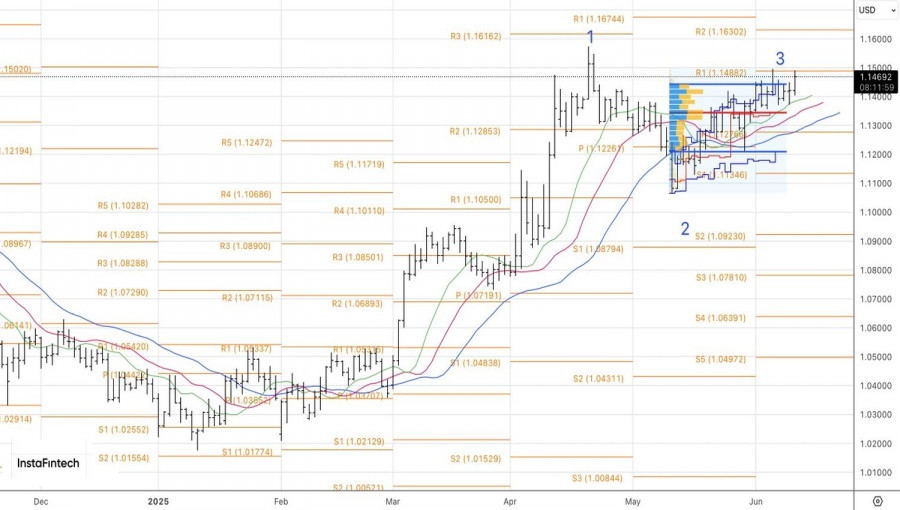

12.06.2025 12:35 AMTo make accurate predictions about the future, one must examine the past. The more than 10% rally in EUR/USD since the beginning of the year has been driven by four key factors: Germany's shift from fiscal restraint to spending in March, the April tariffs tied to America's Independence Day, capital outflows from the U.S. to Europe, and finally, a significant shift in speculative positioning—from excessively long on the dollar to short. All of these elements have already been priced into the major currency pair. So, is its current consolidation surprising?

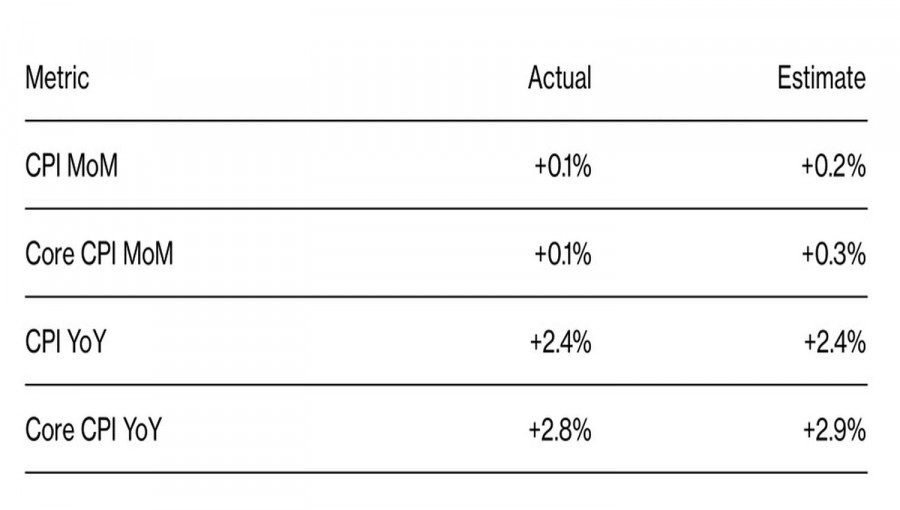

At first glance, EUR/USD appears likely to maintain the status quo. Following the European Central Bank's eighth deposit rate cut in June, the futures market believes the monetary easing cycle is either over or paused. The Federal Reserve's situation is similarly transparent. It's unlikely that below-forecast consumer prices and core inflation will prompt the Fed to leave its "pit stop." The central bank needs more data before deciding to cut rates.

European stock indices continue outperforming their U.S. counterparts, but the lead was primarily established in April–May. Capital inflows into Europe-focused ETFs are gradually slowing, which makes sense. A weakening U.S. dollar is likely to weigh on the corporate profits of Europe's export-oriented firms.

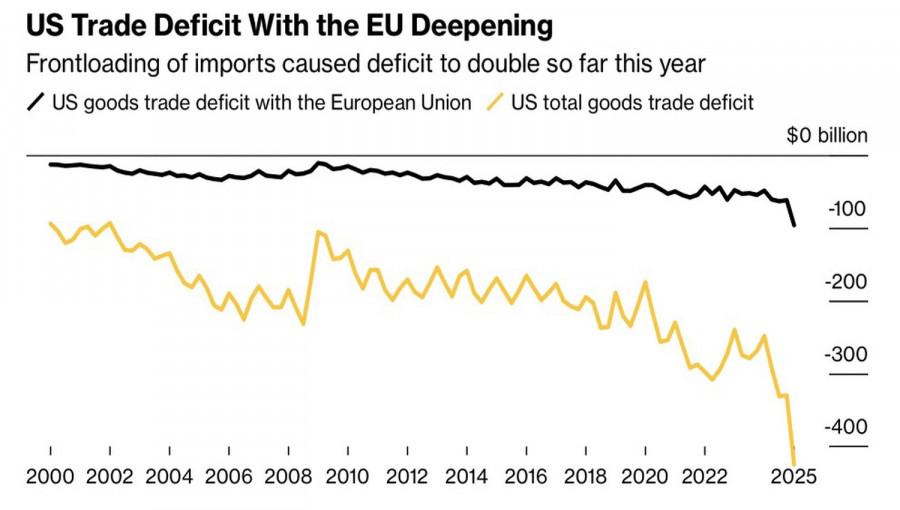

And don't forget the looming July 9 deadline—the end of the 90-day tariff reprieve. Donald Trump is threatening the EU with 50% tariffs. Currently, import duties cover about 70% of all shipments from the EU to the United States. Brussels values this trade at €380 billion and sincerely hopes negotiations will continue after the deadline.

The euro is not drawing support from economic fundamentals. In Q1, the accelerated GDP growth was driven by a front-loaded surge in U.S. imports ahead of major tariffs from the White House. At present, business activity and other leading indicators are at neutral levels. Given these conditions, it is difficult to anticipate an increase in GDP or the EUR/USD exchange rate.

Only a renewed escalation in trade tensions could add fuel to the rally. As the 90-day deadline approaches, tensions are likely to rise. Nerves may fail the "bulls" in U.S. equity markets, and a drop in the S&P 500 could trigger a new wave of EUR/USD buying under the banner of "ditch everything American."

Technically, on the daily chart of the main currency pair, there's a bullish attempt to restore the uptrend. Long positions initiated from 1.1445 should be held. A confident breakout above the 1.1495 resistance would offer an opportunity to add to these positions. In this scenario, the initial targets would be the 1.1600 and 1.2000 levels.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.