یہ بھی دیکھیں

17.07.2025 12:45 AM

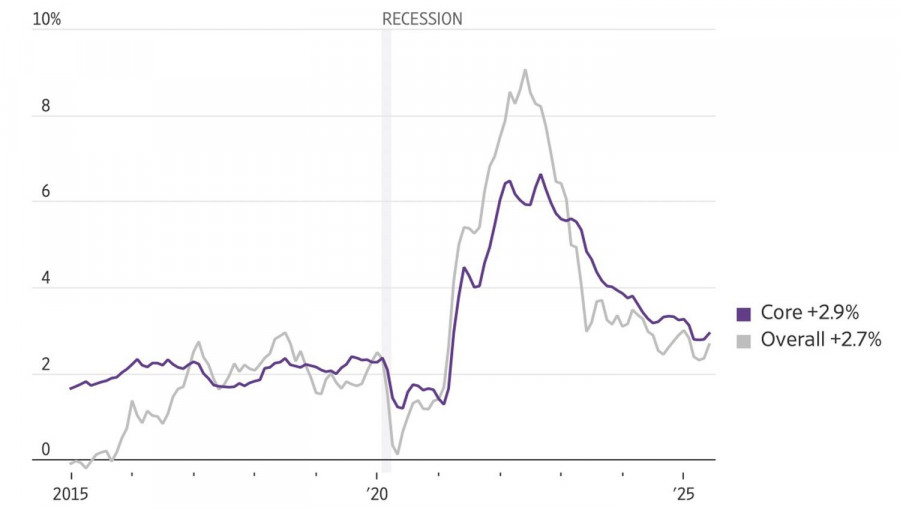

17.07.2025 12:45 AMIs gold overbought? Or just in a waiting mode? Investor opinions are divided. However, the negative reaction of XAU/USD to strong U.S. job growth and a surge in inflation to a five-month high signals that the precious metal remains highly sensitive to the Federal Reserve's monetary policy. The odds of a rate cut in September have fallen from 63% to 54%, dragging futures prices down with them.

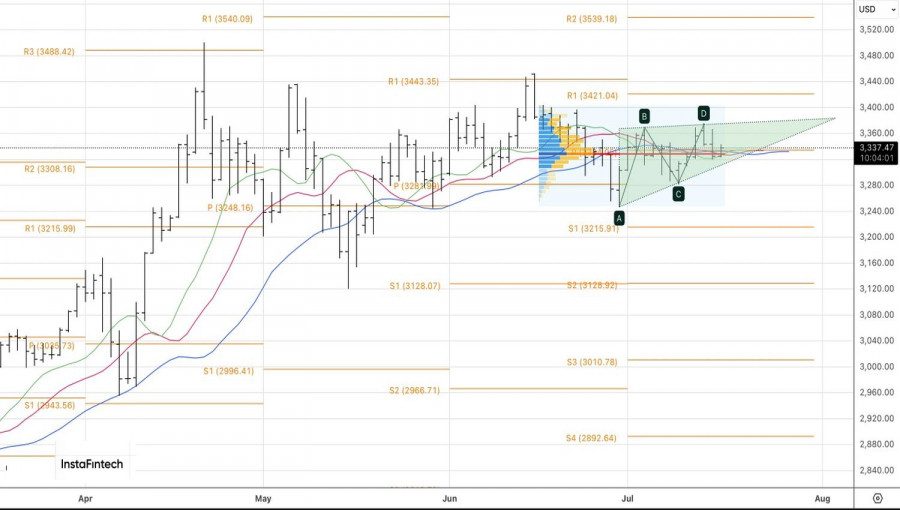

According to a survey of 175 investors managing $434 billion in assets, gold and the Magnificent Seven tech stocks are considered the most overbought assets. The most oversold asset is the U.S. dollar. Gold's inability to return to $3,400 per ounce reflects the weakness of the bulls. Sensing this weakness, investors are seeking alternatives — and finding them in silver, platinum, and palladium. Is it any wonder the XAUXAG ratio has peaked?

The capital shift into other precious metals hasn't yet triggered a broader correction. This gives gold enthusiasts room to remain optimistic about the metal's future. ANZ believes that the XAU/USD will continue to consolidate before rising toward year-end. City Index suggests the market is currently in wait-and-see mode, but the outlook remains bullish for gold.

According to the World Gold Council, if economic and financial conditions worsen, and stagflation or geopolitical tensions escalate, XAU/USD could surge by another 10–15%. Conversely, a broad resolution of conflicts could shave 12–17% off gold's gains in 2025.

In my opinion, the latest U.S. inflation data has set the direction for XAU/USD. Yes, as August 1 approaches, the rising risk of trade conflict escalation may provide temporary support for the bulls. But for now, investor focus is on the resilience of the U.S. economy amid the White House's protectionist policies. This resilience gives the Fed room to remain cautious, despite the intense pressure from Donald Trump on Jerome Powell.

The U.S. president intends to initiate the process of selecting a new chair of the Federal Reserve. His team's strategy involves appointing a shadow chair, who would influence markets and prepare them for rate cuts. In theory, this could pressure the U.S. dollar and support gold. However, for now, XAU/USD is seeing little benefit from the political maneuvering around Jerome Powell. The market still believes in the Fed's independence, which leads to a rebound in the USD Index and further declines in gold prices.

Technically, on the daily gold chart, a Falling Wedge pattern is forming. A break above its upper boundary near 3,365 dollars per ounce would increase the risk of an uptrend resumption and serve as a buy signal. Conversely, a decline below 3,315 would confirm a correction, opening the door for short positions.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.