Veja também

18.06.2025 11:53 AM

18.06.2025 11:53 AMAt the close of the most recent regular session, U.S. stock indices ended in decline. The S&P 500 fell by 0.84%, while the Nasdaq 100 dropped by 0.91%. The Dow Jones Industrial Average lost 0.74%.

Oil traded near a five-month high amid concerns that escalating tensions in the Middle East could lead to more direct U.S. involvement. West Texas Intermediate (WTI) crude stabilized during Asian trading after reaching its highest level in nearly five months on Tuesday. This happened after President Donald Trump demanded Iran's unconditional surrender and warned of a potential strike against the country's leadership.

Futures on U.S. equities remained largely unchanged after the S&P 500 dropped 0.8%. Treasury yields declined in Asia but still held on to most of their Tuesday gains, which were driven by geopolitical risks and disappointing U.S. data on retail sales, housing, and industrial production.

Iran and Israel have exchanged fire for the sixth consecutive day following Trump's meeting with his national security team to discuss the escalation. This has sparked new speculation that Washington is on the verge of joining the attacks. Tuesday's meeting in Washington, D.C. lasted over an hour but concluded without concrete results. Conflicts in the Middle East are increasing risk premiums, which is another reason global equity markets declined. However, unless the conflict escalates further, risk premiums and oil prices may return to lower levels.

U.S. data published on Tuesday showed retail sales fell for the second month in a row, indicating consumer concern over tariffs and financial conditions after a spending surge earlier in the year. Industrial production also declined, and homebuilder sentiment dropped to its lowest level since December 2022. Investors should continue to expect some volatility in economic data due to the lingering effects of trade policies, even as the broader economy and consumer activity remain resilient.

Today, Federal Reserve officials are set to announce their policy decision. Traders continue to bet that there will be only two quarter-point rate cuts this year—with the first one fully priced in for October. The Fed is expected to leave rates unchanged today and again in July, though it may communicate its intentions through revised economic and interest rate projections.

A fourth consecutive meeting without a rate cut could provoke another outburst from President Trump. However, policymakers have made it clear that they need the White House to resolve broader issues around tariffs, immigration, and taxes before they can act. Israel's strikes on Iranian nuclear facilities have also introduced another layer of uncertainty into the global economic outlook.

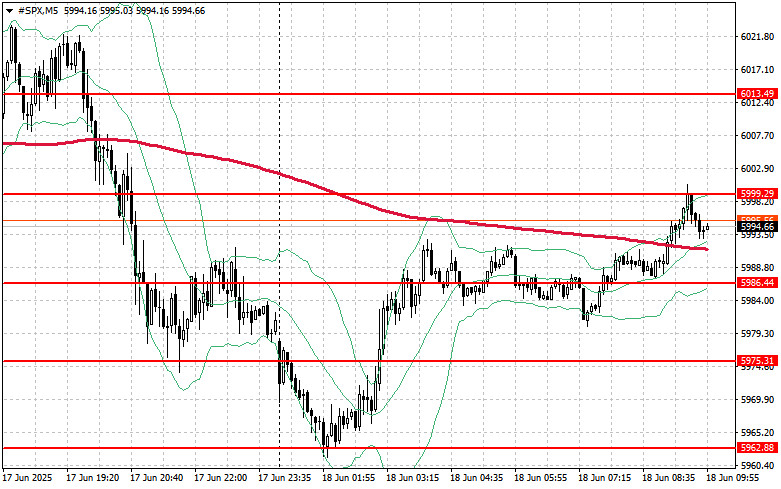

Today, the primary objective for buyers will be to break through the nearest resistance at $5999. This would support a continuation of the upward move and open the path toward $6013. Maintaining control over the $6030 level is also a priority, as it would further strengthen the bullish case. If the index moves lower due to waning risk appetite, buyers must step in around $5986. A break below this level could quickly push the price back down to $5975 and open the way toward $5962.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Os mercados de ações dos EUA continuam em alta. A euforia recente é impulsionada por diversos fatores simultâneos: resultados corporativos sólidos, notícias impressionantes da Apple e expectativas cada vez mais

Gráfico de Forex

Versão-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.