Vea también

08.05.2025 09:17 AM

08.05.2025 09:17 AMGold experienced a slight uptick following the Federal Reserve's meeting, where interest rates were kept unchanged and Fed Chair Jerome Powell stated that the central bank is in no rush to cut them despite uncertainties stemming from the trade war. However, prices were soon hit by a significant sell-off—and here's why.

The modest increase in gold prices reflected the precious metal's traditional role as a "safe haven" during times of economic and geopolitical instability. Powell's comments about maintaining a cautious stance on rate cuts, despite the ongoing trade war, emphasized the Fed's commitment to controlling inflation and preserving economic stability. At the same time, his remarks heightened concerns about the outlook for economic growth in a climate of uncertainty. The Fed's decision to keep rates steady, combined with its reluctance to rush into easing, can be interpreted as a sign that the central bank sees risks associated both with rising inflation and a potential economic slowdown. In such an environment, investors often turn to gold to protect their assets.

However, it's crucial to understand that the impact of the trade war on the global economy remains a key factor influencing gold market sentiment. Escalating trade tensions can lead to slower economic growth, increased inflation, and greater uncertainty—all of which traditionally boost demand for gold as a defensive asset.

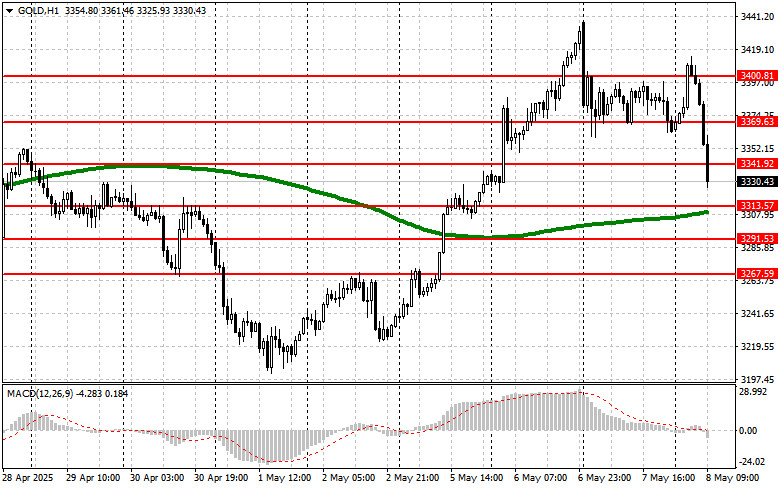

As noted earlier, during the Asian session, gold prices collapsed from a high of $3420 to around $3300 following news of upcoming US-China trade talks in Switzerland—seen as a critical stage in the prolonged trade dispute. This eased market tensions and prompted investors to unwind their gold positions in favor of riskier assets. The optimism surrounding the meeting is underpinned by both sides recognizing the need for compromise to stabilize global trade and prevent further negative consequences.

Investors will continue to closely monitor the latest trade moves from the White House. Yesterday, President Trump stated he does not intend to lower tariffs for China in advance of the key meeting in Switzerland. This comment introduced fresh uncertainty regarding the outlook for trade negotiations and further deepened concerns about a potential global economic slowdown.

In the near term, heightened volatility is expected in the gold market, as any outcomes from the upcoming talks could either renew demand for bullion or trigger a larger sell-off of the asset.

Technical Picture for Gold Buyers need to break through the nearest resistance at $3340 to aim for $3369, above which a breakout will be quite challenging. The ultimate target would be the $3400 level. In case of a decline, the bears will attempt to seize control around $3313. If successful, a break of this range would deal a serious blow to the bulls and push gold down to a low of $3291, with the potential to reach $3267.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.