Vea también

25.08.2025 09:12 AM

25.08.2025 09:12 AMBy the end of last Friday, US stock indices closed with a sharp rise. The S&P 500 gained 1.52%, while the Nasdaq 100 added 1.88%. The Dow Jones Industrial Average jumped by 1.89%.

Today, Asian indices followed Wall Street higher as traders increased their bets that the Federal Reserve would cut borrowing costs next month after dovish comments from Chairman Jerome Powell. The market interpreted Powell's remarks as a signal of the regulator's readiness to shift toward a more accommodative monetary policy in the near term. Investors, weary of high interest rates, saw in Powell's statements a hint of imminent relief from financial burdens, which sparked a wave of optimism and risk appetite. Traders now estimate the probability of a Fed rate cut next month at 84%.

The prospect of lower borrowing costs is having a tangible impact on different sectors of the economy. Stock markets stand to benefit the most, as rate cuts are traditionally viewed as a positive driver that boosts investment attractiveness and stimulates economic growth. In addition, lower rates may support the housing market by making mortgage loans more affordable and encouraging demand for residential property.

Asian indices rose by 1%, with Hong Kong's technology stock index jumping by 2.9%. The Shanghai Composite gained 0.8%, reaching its highest level in 10 years. US and European stock futures declined as investors reassessed Friday's optimism ahead of key economic events this week. Treasury bonds slipped slightly, giving back part of the gains achieved after Powell's speech, while the yield on two-year Treasuries rose by 1 basis point to 3.71%.

"Powell's wish-to-reality signal is set to serve as glue on the cracks beneath Asia's mildly shaking markets," Vantage Markets said. "For investors, this fresh dose of optimism is likely to keep risk appetite buoyant" through to the next Fed board meeting.

"It's clear that Fed is prioritizing the job weakness concern over inflation and that's their stance now," JPMorgan Asset Management stated.

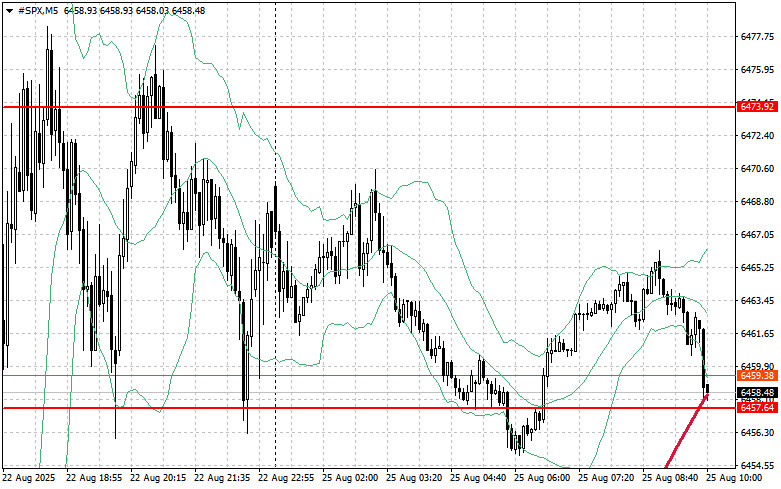

As for the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,473. This will help confirm growth and open the way toward the next level at $6,490. An equally important task for bulls will be holding control over $6,505, which would strengthen buyers' positions. In the event of a downward move driven by weaker risk appetite, buyers must assert themselves around $6,457. A breakout there would quickly push the instrument back to $6,441 and open the road toward $6,428.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.