Vea también

07.05.2025 09:56 AM

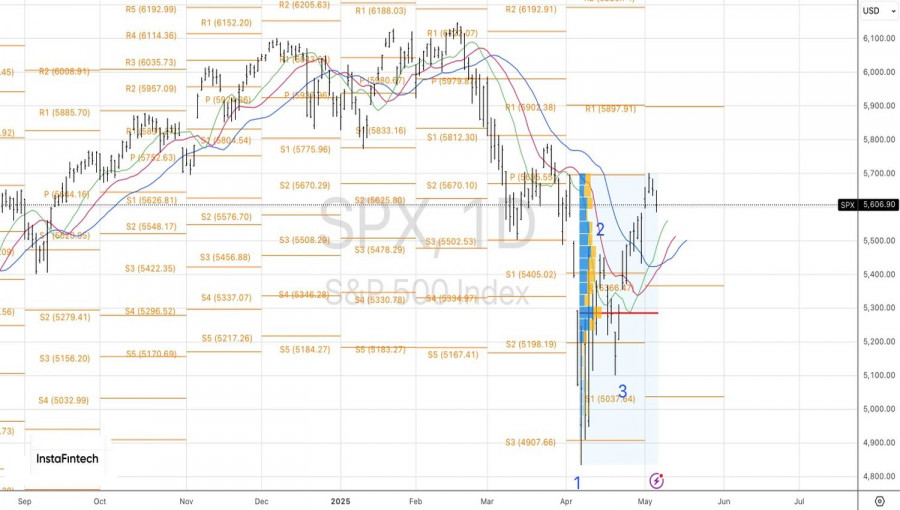

07.05.2025 09:56 AMThe market's eyes have finally opened. Donald Trump is not the kind of president who would lower tariffs in response to reciprocal reductions from other countries. The occupant of the White House intends to dictate the terms of negotiations. Either meet his demands or leave the American market. The S&P 500 has realized that the U.S. president can change his approach at any moment, and negotiations are taking place under the threat of force. What are the odds of success under such conditions? The decline of the broad stock index for a second consecutive trading session reflects significant doubt.

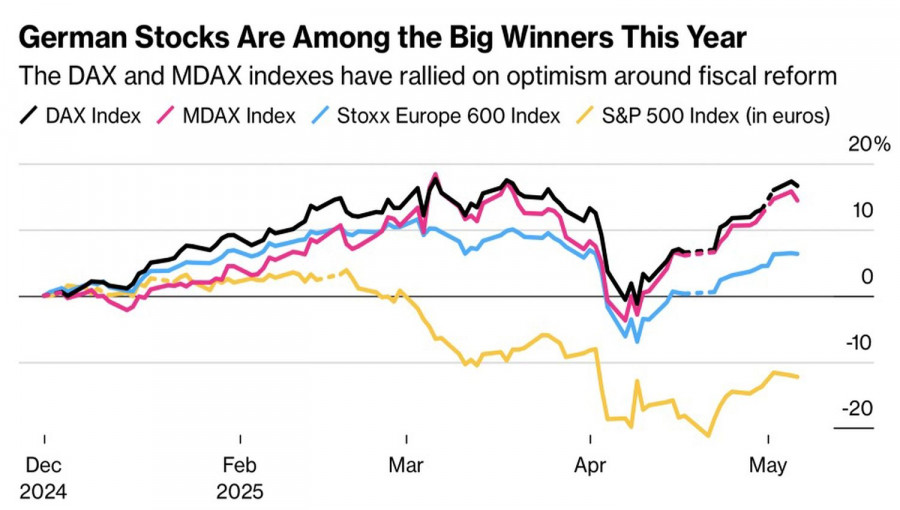

Goldman Sachs believes current valuations of U.S. equities leave little room for an extended S&P 500 rally. JP Morgan argues that U.S.-issued assets are not a safe haven amid market shocks. HSBC urges caution, citing dire fundamental conditions. Despite the longest winning streak since 2024, the broad stock index is still underperforming its European counterparts. However, the political crisis in Germany could shift the balance of power.

Friedrich Merz became a star in the financial markets by proposing an adjustment to Germany's debt brake rule. But as the saying goes, there's a thin line between greatness and ridicule. He failed to gain Bundestag approval for the chancellorship despite having sufficient coalition support on paper. Et tu, Brute? Someone from within his own Christian Democratic Union betrayed him. So far, this hasn't rattled the DAX 40 much, but if new parliamentary elections are called, things could quickly spiral out of control.

Capital outflows from the U.S. to Europe, driven by the loss of American exceptionalism, have been one of the reasons behind the S&P 500's slide toward its April lows. Should capital reverse course and return to the U.S., the broad index could pleasantly surprise its supporters.

Still, a slowing global economy and looming U.S. recession are not ideal for buying stocks. Trump attempts to overhaul the international trade system, but such a transformation requires financing. According to the IMF, banks provide trade financing worth $10 trillion. Disruptions in supply chains could reduce lending volumes and tighten financial conditions. Can the U.S. and other countries withstand that? I doubt it.

The president's determination to dictate terms—negotiating with a proverbial gun to the other party's head—frightens the S&P 500 more than the potential political crisis in Germany or the upcoming U.S.-China trade talks set to begin in Switzerland. And let's not forget the Federal Reserve, which, despite Trump's pressure, plans to keep the federal funds rate unchanged at least until July. That's bad news for the stock market.

The S&P 500 is pulling back toward its moving averages on the daily chart. A bounce near the pivot level at 5510 may prompt traders to reassess short positions opened from 5695. Until then, holding those positions remains the advisable course.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los mercados mundiales siguen bajo la fuerte influencia de los acontecimientos que ocurren en Estados Unidos, que tanto en el ámbito político como en el económico se comportan como

El par de divisas el par GBP/USD el jueves se consolidó por debajo de la línea media móvil, mientras que el dólar creció durante tres días consecutivos. Sin embargo, todo

El par de divisas EUR/USD reanudó su movimiento alcista durante la sesión del lunes desde la apertura del mercado. Otra caída del dólar estadounidense la semana pasada fue provocada

Los mercados continúan actuando a ciegas en medio de las acciones caóticas de D. Trump, quien intenta sacar a EE.UU. de la más profunda crisis integral como el barón

El par de divisas GBP/USD continuó su movimiento hacia el norte el miércoles, aunque a primera vista no había razones claras para ello. Sí, el nivel de inflación (el único

El par de divisas EUR/USD continuó su movimiento ascendente durante el miércoles. El dólar estadounidense lleva cayendo sin pausa por más de una semana, algo que no sucedía en todo

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.