Vea también

23.06.2025 10:36 AM

23.06.2025 10:36 AMHope for the best, prepare for the worst. Since the onset of the Israel-Iran conflict, the market seems to have largely ignored the severity of the situation. Investor reaction has been muted. The S&P 500 is trading only 3% below its all-time high. The US dollar has risen by 1% from its early June three-year low. And yet, what's at stake is the future of the global economy. Historically, a rapid doubling of oil prices over a short period often leads to a recession.

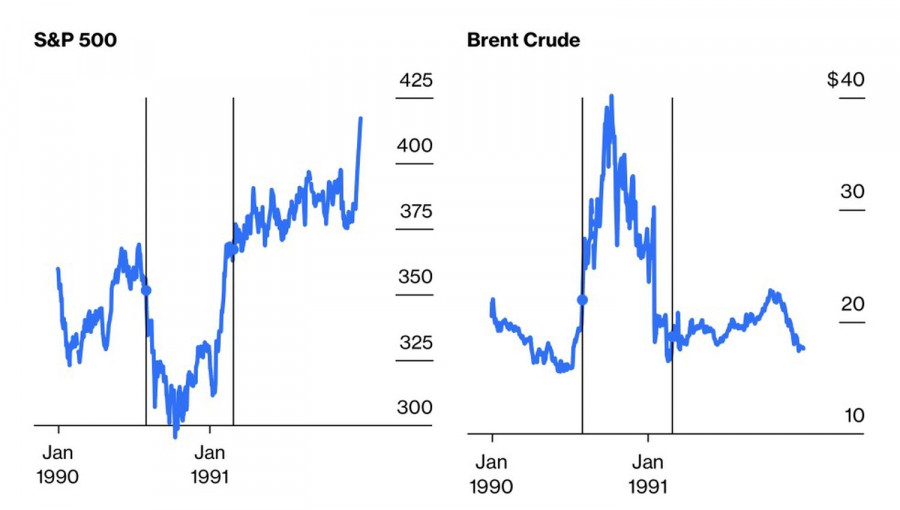

Both fundamental and technical analysts are looking for patterns to understand how events might unfold. A relevant historical example is the First Gulf War. Saddam Hussein invaded Kuwait, prompting US airstrikes on Iraq. After a sharp spike in oil prices and a plunge in the S&P 500, the market quickly rebounded.

Oil and S&P 500 reactions during the Iraq war

It's entirely possible that the current subdued market response to the Middle East conflict is simply a setup for "buying the dip." Retail investors have gotten used to this during the constant escalation and de-escalation of Donald Trump's trade wars. They've developed a feel for it. So why not try applying that experience to geopolitics?

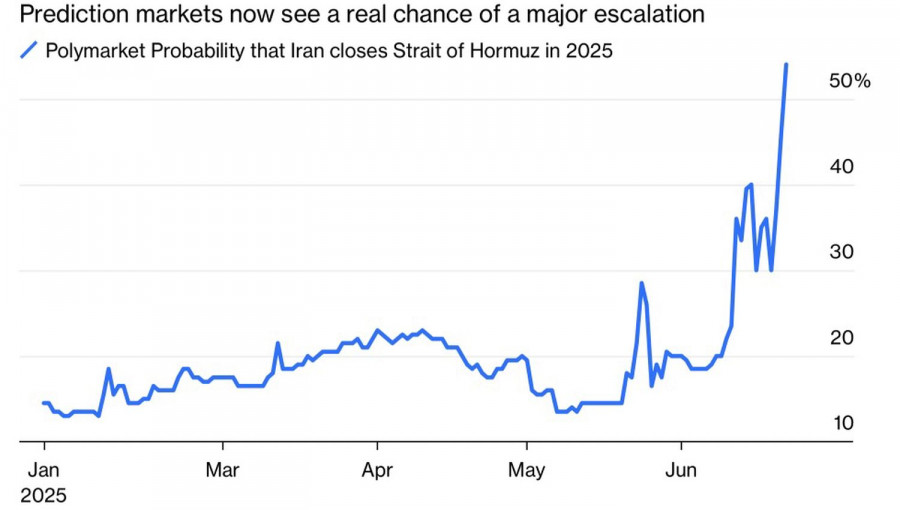

But this time, market movements depend not on the whims of one man, but on the trajectory of oil prices. According to Goldman Sachs, if the Strait of Hormuz loses half of its transit capacity due to Tehran's actions, Brent crude could surge to $120 per barrel. The Iranian parliament has already voted to block this vital artery of the global oil market, through which one-fifth of the world's oil supply flows.

The risk trajectory of closing the Strait of Hormuz

In a region where failure to retaliate is perceived as weakness, Iran is virtually compelled to respond to the United States. The question is whether its actions will be merely symbolic or whether they will deal a serious blow to the global economy. For equities to resume their climb, there must be a sense that the worst is over. That was the case with the trade wars. The more than 20% rally in the S&P 500 was driven by the belief that the peak of escalation had passed.

But market sentiment is one thing — reality is another. The Middle East conflict could divert investor attention from the White House's escalating tariff agenda. In early July, Donald Trump's 90-day tariff reprieve is set to expire. Apart from the UK and China, no major trade agreements are in sight. Can the broad stock market withstand a double blow — renewed trade wars and an Israel-Iran conflict?

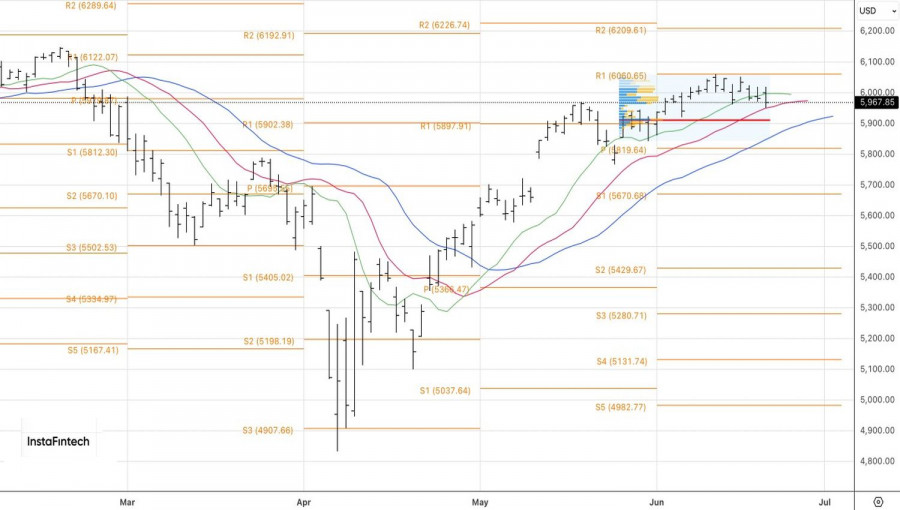

Technically, on the daily S&P 500 chart, bears are attempting a pullback toward the uptrend. Short positions opened near the 6,060 level should be held. Initial target zones include the fair value area around 5,900 and a key pivot level at 5,800.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.