See also

25.08.2025 09:17 AM

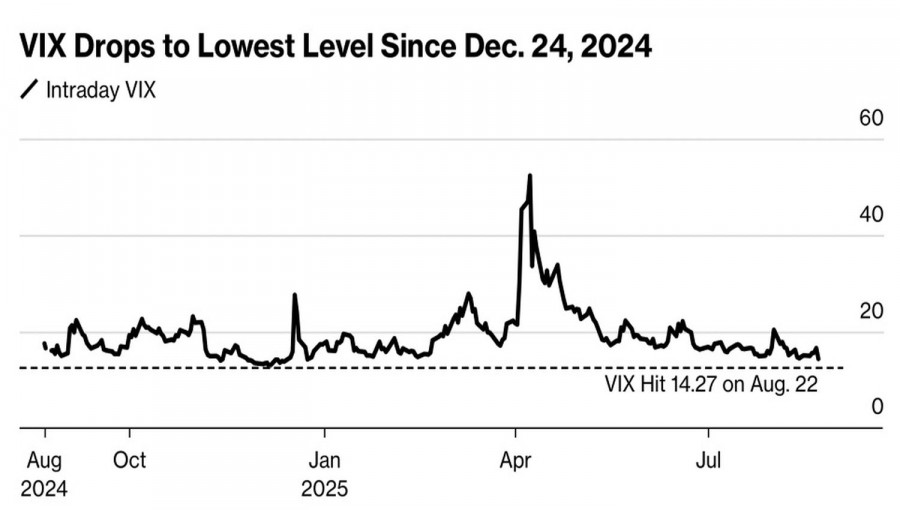

25.08.2025 09:17 AMHope for the best, prepare for the worst. Markets were seriously worried about hawkish rhetoric from Jerome Powell in Jackson Hole, while secretly hoping for signals of a rate cut in September. The outcome turned out far better than investors expected. The Dow Jones posted its first record of 2025, and volatility fell to its lowest level since the start of the year.

Fear vanished from the market almost as soon as it appeared. Powell outlined a new concept: deterioration in the labor market will undermine domestic demand and slow inflation. This process will help offset the risks of rising consumer prices driven by Donald Trump's tariffs. The Federal Reserve can afford to cut rates — not just in September. The renewed cycle of monetary easing will look less like a sprint and more like a marathon, a prolonged process dependent on data.

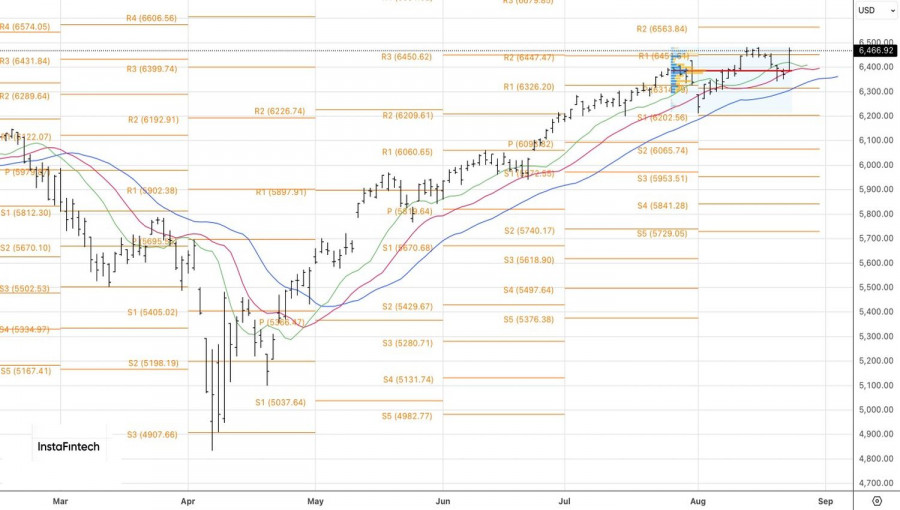

The S&P 500 received more than it hoped for. The probability of monetary easing at the upcoming FOMC meeting jumped from under 70% to 83%. The dollar weakened, and Treasury yields tumbled. It's the perfect backdrop for the broad index rally to continue. Investors had anticipated a rebound, but this is more than just a rebound.

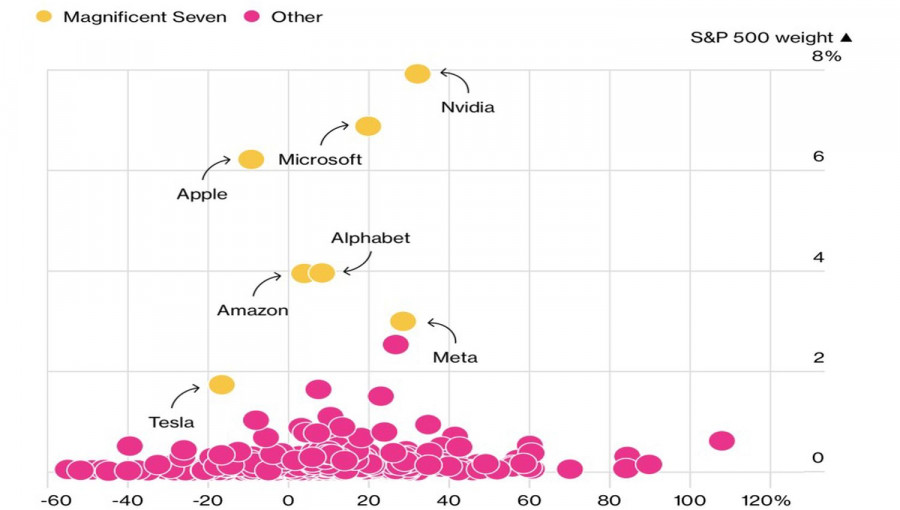

The Dow Jones' success shows that the rally in U.S. equities is about more than artificial intelligence technologies. Industry, transportation, and consumer sectors all stand to benefit from greater clarity on tax and tariff policy as well as expectations of monetary stimulus.

The next big test for the market after Jackson Hole will be the middle of the last week of summer. On August 27, NVIDIA will release its Q2 earnings report. The tech giant holds the largest share in the S&P 500 — about 8%. The figures will show whether the AI factor has been priced in already, or if there's still fuel left for the rally.

Before Jackson Hole, the broad U.S. equity index had fallen for five consecutive days on fears that the boost from new technologies was already priced into S&P 500 valuations. NVIDIA's earnings report — particularly spending on AI and revenue outlook — could ignite a stock market rally no less than Powell's dovish speech. Conversely, investor disappointment could trigger a wave of equity sell-offs.

Despite growing confidence in a Fed rate cut, the Personal Consumption Expenditures (PCE) price index could still challenge that expectation and force the broad index to retreat, although the likelihood is small.

Technically, on the daily chart, the S&P 500 bounced from fair value and then surged sharply. The market is ready to resume its uptrend. Long positions entered from 6393 and 6407 should be held and periodically increased. Targets are set at 6565 and 6700.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.