See also

09.09.2025 12:55 AM

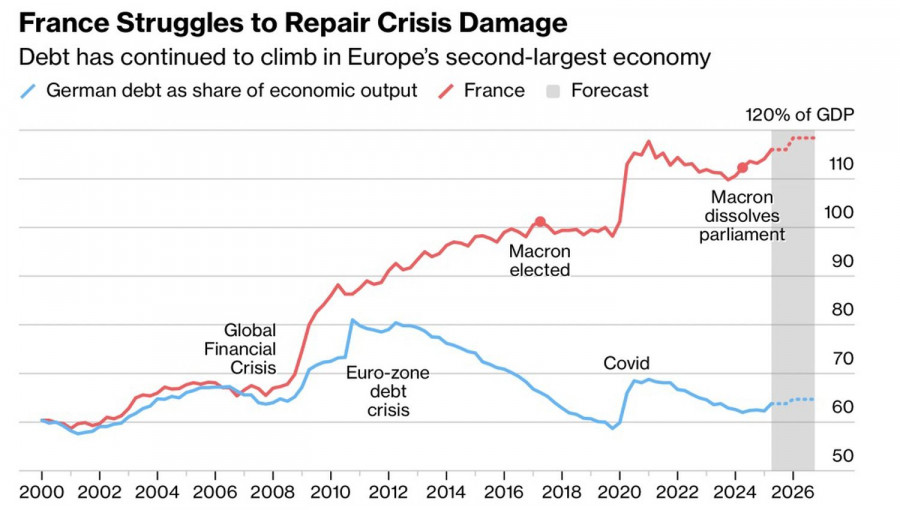

09.09.2025 12:55 AMThe closer the vote of no confidence, the higher the EUR/USD rises. Investors have stopped fearing the resignation of the Francois Barnier government. He made an act of self-immolation by demanding either to be dismissed or to accept a plan to reduce France's budget deficit from 5.4% to 4.6% of GDP. This involves raising taxes and cutting government spending. Neither the left nor the right parties want to go along with this. Yet the euro is rising, looking at Japan as an example.

While Barnier's resignation had been talked about for some time, the resignation of Japanese Prime Minister Shigeru Ishiba came as a surprise. The yen reacted with a drop but quickly recovered its losses. In the end, every currency pair always has two currencies. Whatever political difficulties the euro faces, a 150 basis point cut in the federal funds rate by September 2026 outweighs them all.

Indeed, divergence in monetary policy is a constant factor, while political and other crises occur from time to time. Experts at Bloomberg believe the ECB will conclude its cycle of monetary easing. The deposit rate will remain at 2% until the end of 2026—at the very least, it won't fall. There's even a chance it could rise if the eurozone economy delivers some pleasant surprises.

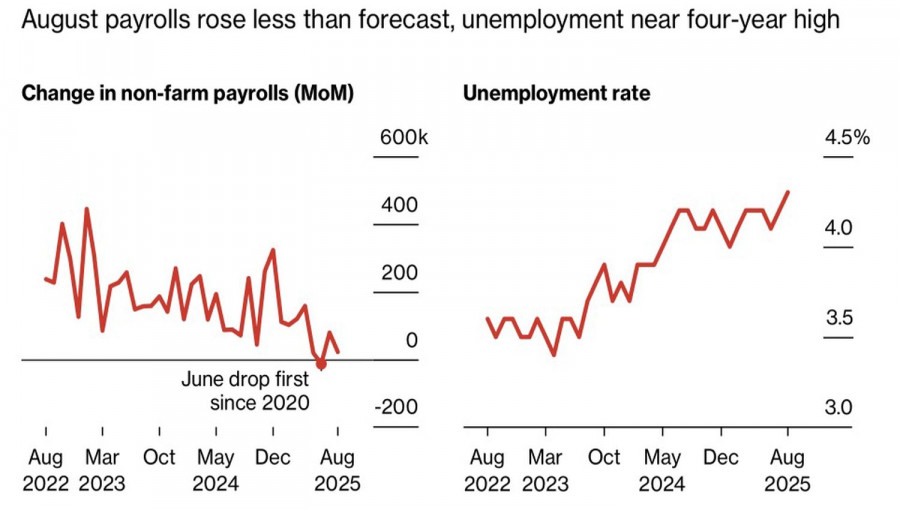

The US, on the other hand, is on the path to recession. The labor market is the first to cool. In August, employment grew by a paltry 22,000, and in June it actually declined. In addition, the BLS will soon release revised numbers for the past 12 months, including March. A reduction in non-farm payrolls of approximately 800,000 is expected, or about 67,000 per month. If that's the case, Donald Trump can rightly claim that the American economy started to seize up even before his genius tariff plan was implemented.

The futures market is now pricing in more than a 70% chance of three federal funds rate cuts in 2025—that is, at each of the three remaining FOMC meetings. Barclays agrees, although it previously predicted only two rate cuts this year. Bank of America, which didn't anticipate any cuts at all, now thinks the borrowing cost will fall twice—in September and December—and by the end of 2026, reach 3.25%.

And the worst may still be ahead. According to JP Morgan, around 150,000 laid-off US government employees are still counted as employed. Starting in October, they'll officially become unemployed. Watch out, labor market! Watch out, US dollar! History shows that when unemployment rises before a recession, it does so very quickly. The Fed will have to act aggressively—and that is a direct path to serious weakening of the American currency.

Technically, on the daily EUR/USD chart, quotes are consolidating above the upper boundary of the fair value range at 1.1600–1.1695. This indicates the strength of the "bulls" and allows for increasing long positions toward the previously mentioned targets at 1.1840 and 1.1950.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.