یہ بھی دیکھیں

22.05.2025 09:49 AM

22.05.2025 09:49 AMIf you harm your relationship with your neighbors, don't expect them to offer you help. Donald Trump's tariffs and subsequent coercive negotiations have diminished the willingness of other countries and foreign investors to purchase U.S. Treasury bonds. Yet Washington desperately needs to sell them amid a growing budget deficit. Fiscal issues have sparked fear in the U.S. stock market, pushing the S&P 500 lower.

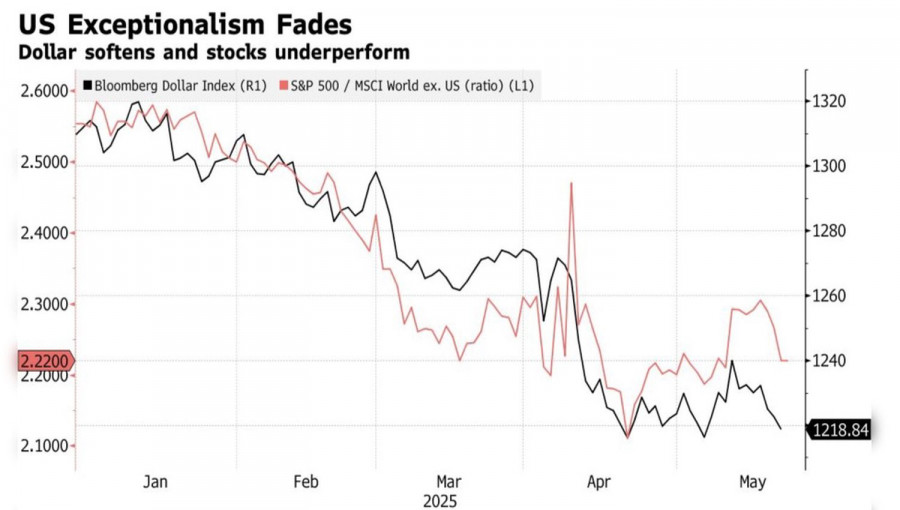

Whereas previously, Treasury yields rose in tandem with stock indexes thanks to a strong economy and reduced recession risks, the situation changed by the end of May. First came Moody's downgrade of the U.S. credit rating, followed by a weak 20-year Treasury bond auction—both forcing investors to acknowledge the presence of fiscal troubles. The slogan "sell America" reignited with new force, and the dollar's decline signals that non-residents are reluctant to acquire U.S. debt.

Even Americans are rethinking their stance due to Donald Trump's policies. According to UBS, in 2024, the wealthiest Americans directed about 84% of their multi-billion dollar investments into the U.S., compared to 74% in 2020. This year, the S&P 500 is underperforming compared to 22 major foreign stock indices due to slower corporate profit growth in the United States. By December, the performance gap with international peers stood at 13%, now narrowing to 9%. Against this backdrop, capital outflows from family offices to other countries are significantly likely.

Donald Trump is fully aware that tariffs will slow the U.S. economy. He plans to offset this with monetary and fiscal stimulus. That's why it's no surprise he's calling on the Federal Reserve to cut interest rates and urging Republicans to unite behind tax-cut legislation. Unfortunately, the central bank is independent, and there's no guarantee there aren't bad apples among the "elephants" (Republicans). The more hurdles the bill faces in Congress, the worse for the S&P 500.

On paper, its approval could add $280 billion in fiscal stimulus — or 0.9% of GDP — according to Congressional Budget Office research. This would help offset the negative impact of tariffs. However, it would also increase the issuance of U.S. Treasury bonds, leaving the Treasury Department scrambling to find buyers — who now seem nearly impossible to find.

The market had clearly gone too far and needed a correction. Why not let fiscal problems trigger it? These issues have replaced greed with fear.

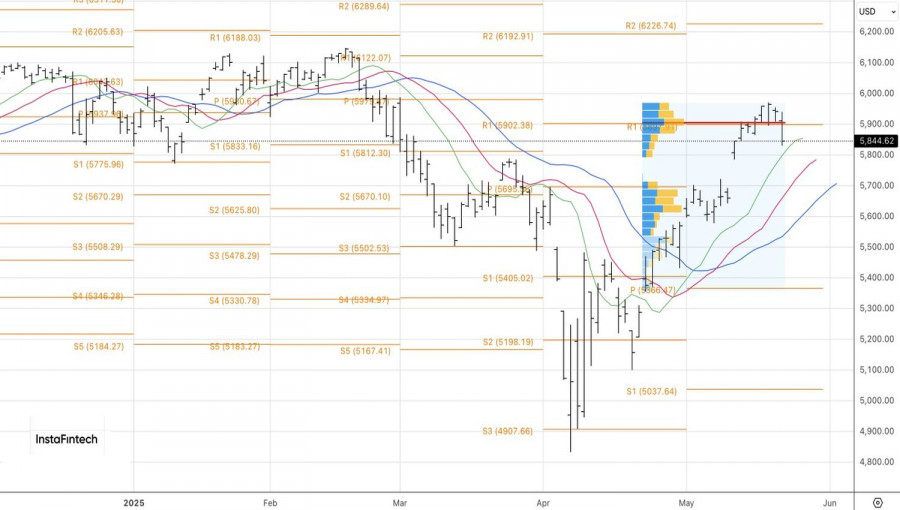

Technically, the daily S&P 500 chart played out an inside bar pattern. Short positions formed near the lower boundary of this bar, around 5910, should be maintained. Initial targets are pivot levels at 5770 and 5670.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.